| Title | : | Retirement u0026 Pension: A Guide to Planning with Guaranteed Income |

| Lasting | : | 8.32 |

| Date of publication | : | |

| Views | : | 104 rb |

|

|

Nice video ❤🎉🎉 Comment from : @parshurammmore5341 |

|

|

My pension is allowing me to allocate a percentage of my saving to growth stocks These have significantly outperformed my indexed funds and we can delay my social set until age 70 Comment from : @dunesmom7990 |

|

|

I’ve been hearing a lot about plans with guaranteed income lately It sounds like a great way to ensure financial stability, especially as we get older Does anyone have experience with something like this? Comment from : @RomanFranklin-lr3ri |

|

|

I work for a company that pays a pension, and I plan to retire soon I understand from others that already retired that the company has started purchasing annuities in lieu of pension obligations Is there anything I need to be aware of? Comment from : @GAP_933 |

|

|

I've been stressing about retirement lately I spent years working hard without really planning for a guaranteed income later on, and now I worry I might end up without the security I need Comment from : @Kseniaramesh |

|

|

Healthcare expenses, inflation, and longer lifespans mean that the cost of retirement is increasing Relying solely on pensions or government benefits may not be enough By building a retirement fund, you gain financial independence and ensure you can maintain your desired lifestyle in retirement Comment from : @GabrielMartins-j8k |

|

|

Be frugal anyway and save These pensions accrue over years, if you don't get to the full accrual (laid off or something) you're going to come up short Comment from : @callmeishmaelk767 |

|

|

I 63 and have two pensions, but still saved for retirement We don’t need the savings or SS at this time so waiting to draw SS until I’m 70 The savings will be to either help my spouse if I die first or for an inheritance Waiting to 70 will increase the survivor benefit also Comment from : @abnmp7865 |

|

|

Enjoy the video, most you find out there are about 401k, Roths, n SSA only!!!! At 59 was forced to retire with SSDI due to my military injuries which I am 100 P/T with VA! I am almost 62 now, wife is 64 and started drawing SSA at 62! We live rural, cheap, n comfortably! brbrSadly the push on 401Ks in the 90s initiated many companies to dump their pension plans and offer 401Ks only!!! Why so many retiree eligible people are hurting now! Not like my parents who both retired in 91 with pensions n SSA!!! Comment from : @lucken13 |

|

|

you should be criticizing Trump and Elon's play to eradicate the SS benefit Comment from : @davedeboy5726 |

|

|

Hi ErinbrLove your videos I have a defined benefit pension but there is an option to take lump sum at retirement instead My financial planner wanted me to take the lump sum so he could invest it, yielding a higher payout than the traditional pension What factors go into making this decision of a defined monthly pension vs a lump sum payout Thanks, brTony Comment from : @anthonygreco7071 |

|

|

People sometimes forget that a 40K yearly pension really equates to a $1M Portfolio with far less risk assuming the pension is funded and managed correctly My wife will be collecting a small state pension assuming she gets in another 20 years That should help with SS Comment from : @erichaban1264 |

|

|

My wife and I are 29 We’ve got over $130k in our Roth IRA’s plus I’m giving to a Roth 457 I’m also going to get a pension at 54 covering 60 of my top three years of pay Really hoping for a great retirement! Comment from : @zackfrancisco5202 |

|

|

5:50 the classic time value of money formula I use to estimate the current value of my wife’s pension plan I do modify it with the funded variable Based on the last decades worth statements, the plan is 75 funded So for our net work tracking, I only assume 75 of the calculated value I also do the calculation assuming she stopped working Jan 1 of the current year Comment from : @clsanchez77 |

|

|

Let’s say some orange traitor becomes President and crashes the economy for a second time This time being way worse than the first time he did it What kind of cat food will I be able to feed myself on my firefighter pension? Comment from : @moose6954 |

|

|

My wife will have a pretty good pension when she retires We still save quite a bit… plan is to be able to retire at 60/61 and be able to be flexible in our withdrawal strategy based on market conditions Comment from : @rodrigok1220 |

|

|

Hi Erin, I'm a little late to your video but thoroughly enjoyed it I will retire from the military in 17 days I'm 55 yrs old with a 31 yr pension (34 yrs of service but only 31 yrs count for retirement) I have been looking for videos that show how to incorporate a pension into my net worth but most content creators ignore it, thank you for helping me to think through this part of my financial picture I'll forego the particulars but my wife and I are retiring with no debt and plan to pursue our own interests now thanks to my pension We also have a TSP, 2x IRA's, and a brokerage account at fidelity, but did not really concentrate those pieces until very late in my career Keep up the good work, you're on point with so much of your videos Comment from : @briandoerr9305 |

|

|

Yes pensions are a blessing to include social security I will have 2 pensions (army reserves and federal) I should get about $12000 a month in pensions and social security Comment from : @Dennisoh999 |

|

|

Going to retire in 2 years with 100 VA and a P/F pension also with my wife getting a small pension from her job If i can make it until 62, two years after i retire i should be go to go with another 5k a month net income We both have 401k's that we should not have to touch Comment from : @MetalRipper67 |

|

|

Your Welcome! I found your YouTube Channel serendipitously So Happy that I did!💜 Comment from : @KISSGreatestFan |

|

|

Hi Erin! Thank you for making the video Your video made me realize how grateful I am to have a State Government Pension Please keep making your videos! Thank you!😃 Comment from : @KISSGreatestFan |

|

|

Thanks! Comment from : @KISSGreatestFan |

|

|

It's not guaranteed It's the company's assett My company just changed the requirements for their pension without warning (being eligible after 15 years instead of 5 now) I will be retired before I reach 15 years of service here They screwed me Comment from : @myscorebig |

|

|

4:45 Iowa's IPERS plan offers a few different options like this, but it is good to remember when choosing that if this is needed, the money will only be supporting the spouse, so 50 or 75 is about like having 100 to the employee before death Comment from : @ron9665 |

|

|

0:48 457b would be in here too? Comment from : @ron9665 |

|

|

Retiring next week at age 63, pension will be 3k per month Going to hold off on SS for awhile as I have plenty of savings as well as a nice portfolio Also a well funded HSA Comment from : @suespony |

|

|

What is the difference between VTI JPI? Is one better? Comment from : @FranklinCampbellJones |

|

|

Amazing video, A friend of mine referred me to a financial adviser sometime ago and we got to talking about investment and money I started investing below the $100k mark and in the first 2 months, my portfolio was reading $234,800 Crazy right!, I decided to reinvest a huge percentage of my profit and it got more interesting! For over a year we have been working together making consistent profit just bought my second home at the beginning of summer Comment from : @Pelham04 |

|

|

I am really looking forward to retiring in a couple of years as my monthly income will be around $5500 a month and is indexed to rise with inflation My monthly expenses are about $4200 a month so I hope this will last my entire lifetime? Comment from : @flybirds2024 |

|

|

I am looking at retiring in four years I have a pension and 401K with my job The pension should give me about half of what I need to retire and, once I start Social Security that should be the other half needed for my retirement, My 401K and investments should just be extra income when needed Comment from : @MrMaxamillion67 |

|

|

Im 58 with 950k in 401k Plan on retiring in 35 years at the age of 62 With my pension, SS, and VA disability i should be bringing in close to 10k a month Didn't start my 401k til i was 37 years old Comment from : @bluray4687 |

|

|

Here's a topic for you to tackle I am a retired police officer from Pennsylvania and expect to receive REDUCED SS benefits when I choose to apply How do i plan for those SS numbers? Love your channel and am a new subscriber Thank You Comment from : @tomjones407 |

|

|

Thank you for this video, Erin I am a teacher I plan to retire at 60 Collect my pension at 62 My pension has a cola It will be around $3600 a month How do I figure out the best time to take SS? If I wait until 70, I am afraid I will get nailed with taxes If I take at 62, less taxes, but IF I live past 80, will I miss out on too much $? I live in MN Both are taxed at the state level 🤷🏼♂️ Comment from : @kdkragt |

|

|

She is Captain Obvious with this video And Erin, most Americans were never covered by a defined benefit pension plan Never!!! At their peak in the mid 1970’s they covered about 20 of employees And Erin, at best 5 of defined benefit pensions include inflation adjustments And to get that feature, the retiree took a significant reduction in their current benefit Comment from : @DavidDarakjy |

|

|

Every working man and woman needs a pension… Comment from : @enigmathegrayman2953 |

|

|

@ErinTalksMoney Can you comment on Taking A Lump Sum pension vs annuity form payouts?brWe have both options at employer but moving a lump sum out can also have risksbrThanks for all of your videos! Comment from : @johnnysfunzone743 |

|

|

Govt already gaming blaming to the pensioners in India We all know about this Comment from : @manyamrs6633 |

|

|

My pension was frozen after 39 yrs of service Have pension, 401k, a small business, plus a few other investments I'm getting close to the finish line I'll be 62 in a few months Nice to see light @ the end of the tunnel & it's not a freight train Comment from : @HopkinsCoinLaundrySupercenterI |

|

|

Great video, Erin! Im still 22 years away from retirement but looking forward to the pension still being around I work for a city agency Comment from : @jon34153 |

|

|

Recent new subscriber I enjoy your presentations and information you provide Comment from : @Andy28-m6e |

|

|

Thank you! Comment from : @Gojiradajedi |

|

|

I am 62 and retired from the military with a pension After taxes my pension is $98k a year I also have investments which I plan to use until I reach a desired SSAN amount The pension is nice, however being a senior military officer really took its toll on my mental health I wonder if taking less responsibility but focusing on investments would have been a better plan for life Comment from : @johngrubb5486 |

|

|

I am 50 retired with a 153 k pension for life expecting to live to 90 so my pension is worth? 612 mill ??? Comment from : @nywaves |

|

|

Hi Erin, can you show a step by step of the calculations of the formula you used? I am getting a different amount for the example you provided in the video Thanks! Great video! Comment from : @drmommybudgets3127 |

|

|

I worked for a company for 9 years We were vested after 5 years of service in a defined benefit plan Now I’m over 62 and they say they cannot find my records I would have my tax forms from the 80s What can I do? Comment from : @wilma6235 |

|

|

Can someone walk me through that math? How are you coming up with 16351 for the 2 discount rate (I can’t figure out that formula) Comment from : @JohnBrennan-x3j |

|

|

I do hope the people who are or will be receiving a pension - but not yet drawing SS if they are eligible, understand the impact that SS's Windfall Elimination Provision (WEP) will likely have on their eventual SS payout It is NOT going to be the figure on those statements you get prior to reaching retirement age Comment from : @suemurphy1730 |

|

|

Defined benefit(pension) and 401K will be mine 24yrs at a FL electric utility that’s been in business for 125yrs The pension is not as good as the “old” plan the folks before me got, but it’s still for as long as I live with an option of 50, 75, or 100 for surviving spouse Planning on another 10-12 years until retirement Comment from : @Mike-mc8tj |

|

|

Defined pensions and social security are our primary incomes We have a substantial amount of money in moderate index funds as our backup Both kids are successful professionals so aside from gifts, they have launched We are very lucky Comment from : @bobdrago6965 |

|

|

I am paying 300 a month into the SBP and have VGLI, so that gives piece of mind to my family Comment from : @fortgrove3166 |

|

|

For pensioners I would argue taking out a term life insurance policy is a better option than taking a reduced benefit to support a surviving spouse if you pass away early In Erin's example the pension benefit was reduced permanently by $300 per month to cover the surviving spouse Instead of taking the $300 per month hit, shop around for a 20-year term life insurance rate? Comment from : @casa87blue |

|

|

Why not apply your annual pension total worth using the 4 rule? Just divide it by 4 Comment from : @JD-ir2sb |

|

|

Just retired with a pension It’s very comforting to know the first of every month 3,23000 is deposited into my checking account It allows me to delay SS until my FRA and to be more aggressive with my IRA Comment from : @thomasmoshier3920 |

|

|

Saving money to give to grandchildren was a waste of your time! Comment from : @Bryan-e2n |

|

|

Is there a calculator out there to plug the formula into? Comment from : @dan7102 |

|

|

I am 44yrs work for the federal govt and will be eligible for full retirement benefits at 57, but will stay until I’m 62yrs old (we recieve a life time bonus of 10 if we have 20 yrs or more of service and retire at age 62)brbrI will have a full pension, I max out our version of the 401-k, and I have a personal IRA( maxed out) as well as a brokerage accountbrbrThe key to retirement is NO DEBT and invest, invest, and invest some more! Comment from : @cameroncunningham204 |

|

|

I retired from the US Army in 2016, after 20 years of service During that 20 years, I saved and invested like crazy, sometimes putting close to half of my pay into index funds In the 8 years since I retired, I still haven't made any withdrawals from my investments, and my net worth is increasing at a rate much faster than when I was working! (I also have the benefit of living (as a full-time caregiver) with my dad in his house, which I will inherit) I'm 55 years old with a net worth of about $2M, almost all in index funds My pension lets me be aggressive with my investments Even if the market crashes, my pension lets me stay cool and wait for the recovery Comment from : @mikeg9b |

|

|

Took my pension as a lump sum and reinvested it myself Making a lot more money that what the annuity payout! Comment from : @frankanddanasnyder3272 |

|

|

Retirement is 160k a year with a 3-5 yearly raise depending on CPI Retired at 48, after 25 years Got bored, moved to another state and working on 2nd pension Just passed my 6th year with my 2nd pension Comment from : @Krabbiepattie |

|

|

Think of Roth conversion, no taxes and no required RMDs in your lifetime Comment from : @cecilemuggill9444 |

|

|

I’m approaching this pension subject with a lot of apprehension I’ve earned a defined pension but haven’t started it yet trying to get as much knowledge as I can Thank you for this video You have made it a little clearer for me Comment from : @BlueLineGroovy |

|

|

My jobs have both DB and DC plans🎉 Comment from : @BARUCHIAN99 |

|

|

Why is it always someone that looks 10 so called pension experts in these Utube videos Comment from : @deloresredman4792 |

|

|

I’m retiring next year at age 59 with two pensions worth a combined $8K a month $1000 is a private company and the rest is from a government job The larger one has 1/2 COLA for the first $30K I also managed to save $530K in a 403b which has a 7 fixed Option for life and $200K in a standard 401K Owe $60K on my $300K Condo and my medical is being picked up by the government with my cost being $1500 a year including meds The pension(which I paid 3 salary into for my first my first 10 years) is one of the greatest retirement plans one could have My smaller pension cost me a total of $3600 over 10 years to buy into It’s sad that so few jobs offer pensions anymore It really allows people to retire with dignity Comment from : @DWilliam1 |

|

|

Thanks for the great information I am fortunate enough to have a great pension from a municipal career when I retire But I also started an IRA years ago along with contributing 10 to my deferred compensation plan at work brAnd she will receive 50 of my pension should I pass first brI had my wife start an IRA years ago as well and she adds to a 403b with 4 matching contribution by her employer brHopefully my wife and I will be sitting pretty when we retire and can share with our kids and grandkidsbrAlways force yourself to save extra for retirement …because you never knowbrThanks again 😊 Comment from : @theladder06 |

|

|

I love brains and beauty Comment from : @terryneal5569 |

|

|

Great explanation of pensions and retirement planning, Erin! Understanding the difference between defined benefit and defined contribution plans is so important for financial security in retirement The insights on how pensions can ease financial pressures and offer peace of mind are incredibly valuable Thanks for breaking it down so clearly! Comment from : @BalancedRetirementPlanning |

|

|

I know this can be a personal decision, but would be curious if there are any guidelines of taking the lump sum versus monthly payments, if offered Lump sum seems to take the guess work out of survivor benefits, and should allow more flexibility to modify income year to year if needed Comment from : @richardvetter8170 |

|

|

We need a Mandatory National Pension Act for workers Companies are throwing workers in the streets for profit and calling it "layoffs" Comment from : @jaygold4467 |

|

|

Impressive video Erin! I don't think many working people understand the guaranteed income/peace of mind relationship I'm amazed it isn't mentioned more often in the "when to take Social Security" videos I'm a big advocate of delaying Social Security, if you can afford to and have longevity in your genes I had a pension but took the lump sum because I retired early and needed more up front than the pension paid After all debt was paid off, I need much less and am delaying Social Security for that peace of mind factor Comment from : @hogroamer260 |

|

|

Pension or no, max out any potential retirement investment Comment from : @densnow4816 |

|

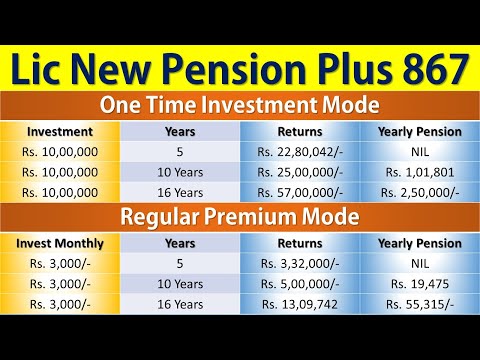

Lic New Pension Plan 867 | Lic Pension Plan 2022 | Lic New Pension Plus Plan | नई पेंशन प्लस योजना РѕС‚ : Insurance Clinic Download Full Episodes | The Most Watched videos of all time |

|

What income will I get from a £100K PENSION POT? - Retirement income explained (is £100,000 enough?) РѕС‚ : Money to the Masses Download Full Episodes | The Most Watched videos of all time |

|

HOW much you need to save to RETIRE COMFORTABLY - Episode 3 Pension Income Planning РѕС‚ : Bouncing Back Download Full Episodes | The Most Watched videos of all time |

|

Best Retirement Calculator Excel for Retirement Planning | Easy Spreadsheet to get your number fast! РѕС‚ : Melisa Ford - Damsel of Success Download Full Episodes | The Most Watched videos of all time |

|

How much should you have in your pension? - Average UK pension pots by age РѕС‚ : Money to the Masses Download Full Episodes | The Most Watched videos of all time |

|

These 3 Retirement Tax Credits Equal Up To $50,000 Per Year In Retirement Income РѕС‚ : PlanEasy Download Full Episodes | The Most Watched videos of all time |

|

Moving to Spain 2026 living off 1 state pension from Yorkshire #retiredlife #retirement РѕС‚ : Retiring to Spain Download Full Episodes | The Most Watched videos of all time |

|

How Much Will I Pay in Taxes in Retirement? Complete Guide to Retirement Taxes РѕС‚ : James Conole, CFP® Download Full Episodes | The Most Watched videos of all time |

|

Expert Guide to Early Retirement Planning in Canada | Tips and Strategies РѕС‚ : Money Mastery Download Full Episodes | The Most Watched videos of all time |

|

Minimum RRIF Withdrawals u0026 The Pension Income Tax Credit Explained РѕС‚ : Parallel Wealth Download Full Episodes | The Most Watched videos of all time |