| Title | : | HOW much you need to save to RETIRE COMFORTABLY - Episode 3 Pension Income Planning |

| Lasting | : | 10.41 |

| Date of publication | : | |

| Views | : | 70 rb |

|

|

So is that just for rent 😂😂😂 what world do you live in Comment from : @russellhowson730 |

|

|

Why would you give up £260k for 10k a year? Madness? Comment from : @andrewwilson919 |

|

|

Why do not even get back what you put in? Also your funds stay invested, doesn't make any sense Comment from : @SuperTreemendus |

|

|

I started my pension journey 42 years ago but unfortunately Labour got into power half way through and took half of my pension savings over 24 hours by taxing Equity savings and by doing so ruined millions of peoples pensions in the process not to mention future investment confidence It looks like they are going to do it again Comment from : @keithrobinson3023 |

|

|

If think you need to refresh the series in light of the cost of living crisis and inflation ❤ Comment from : @welshhibby |

|

|

Do you think with £1m pension and say 100k in cash a couple, it is possible to retire at 58yo on 50k a year, when wife will draw say 8k pension 2 year later, and full state pension kicking in at 67x2? Not sure whether I’ll have enough to retire at 58 and get my goal of 50k (no way will I draw more and pay 40 tax, I’m sick of paying 45 now)? Comment from : @wakeywarrior |

|

|

The predicted income needs seem to assume that you own a property How much income would you need if you were renting? Comment from : @alexwade9921 |

|

|

The FAs i have met want to charge me 1 for the pleasure of transferring my hard earned into their platform, 1-2 thousand pounds for setup fees and 1 to 15 per year incl fund costs for the pleasure of putting my money in tracker funds Thanks but no thanks! Comment from : @petersmith6520 |

|

|

In the UK u will always pay tax even when you’re dead Comment from : @Senna-xi1gr |

|

|

It seems pointless building up a fund of 900k over 20years only to sustain an 11k moderate income Surely a more dynamic withdrawal rate would be better especially in the good years and slightly less in the bad years Comment from : @nigelbyde5039 |

|

|

It is funny that people have been warned about the risks of not having a good retirement plan and still fall into these issues despite being warned I made my first million trading stocks with professional help from mrs Emily Lois Parker who is popular in the US as you can look her up Comment from : @JosephineGaule |

|

|

Many folks struggling to cover basic expenses often face this challenge because they didn't save enough during their working years The choices made in preparing for retirement have significant impacts, as seen in my own family Different investment strategies led to different outcomes With guidance from a financial advisor, I'm now enjoying my retirement Comment from : @Casey-summer |

|

|

I just sold a property in Portland and I'm thinking to put the cash in stocks, I know everyone is saying its ripe enough, but Is this a good time to buy stocks? How long until a full recovery? How are other people in the same market raking in over $450k gains with months, I'm really just confused at this point Comment from : @GudrunScharrer |

|

|

Thank you for sharing this information as most important Can I check did your drawdown fund calculations assume income return from the moderate investment? Comment from : @brianturvey1726 |

|

|

I live in America I am a dual citizen at the moment I am nine years short of a full pension due to opt out brSo if state pension is still around when I retire I would get state pension from two countries unless they take money off you for qualifying in another country Comment from : @markhosbrough9180 |

|

|

How much money will you be spending when you're 80? Comment from : @stumac869 |

|

|

Looks like Which have their categorisations correct unlike PLSA 🤨 Comment from : @Umski |

|

|

Iam a pensioner had a letter this week to say I got too start paying tax on a small pension pot thanks too this government not raising the tax threshold,what a joke they our Comment from : @christopher554 |

|

|

What a difference a year makes Now we have 10 inflation and it will be a while before that falls, really you need to add something in for inflation Comment from : @MrGman2804 |

|

|

Hi Helen, what has happened- are you not making any more videos? I did learn some things ffrom them Whatever, thanks for what you did do far Comment from : @mauroaurelio6534 |

|

|

I make huge profits on my investment since i started trading with a professional broker Mrs Millian Kelvin, her trading strategy are top notch coupled with the little commission she charges on her trade, thanks so much♥ Comment from : @richardcrown9764 |

|

|

Just to confirm all these incomes are before uk tax Is it possible to become say a Dubai Citizen and have my state pension payed off shore Comment from : @156dave |

|

|

My understanding from other pension experts on Twitter is the PLSA retirement income standards are income levels after tax What this video shows in income before tax is deducted So unless I have missed a step, the income from the drawdown calculator needs to be reduced by basic rate tax Comment from : @SimonApperley |

|

|

I am lucky to have a good final salary pension but still have a pot of £200 K to manage as well Comment from : @156dave |

|

|

Is this before tax? Comment from : @156dave |

|

|

Invest in Bitcoin as a hedge against inflation This required £30k for a comfortable living for a couple will only go up Bitcoin is deflationary and can earn you 10 back (staking rewards) just for holding it Comment from : @Stubbo1950 |

|

|

how come we pay tax are pensions wen we payed tax on it wen was at work we are being robbed Comment from : @georgeriggs7651 |

|

|

These are very useful videos I’m going to binge watch the pension onesWhat I’ve never understood is…If I drawdown less than the personal allowance every year do I have to pay any tax at all? Comment from : @a40a40 |

|

|

Good video As for me i have made huge profits on my investment since i started trading with Mrs Christi Lily, her trading strategies are top notch Comment from : @martinluah5740 |

|

|

I'm 54 and have a healthy pot of £415k and a small frozen index linked final salary pension that will pay (in today's money) £10k at age 65 So I'm probably better off than most, but my cash savings are modest and I have a mortgage that won't be paid until shortly before my 65th birthday My wife is 51, has a modest pot of around £170k but is an only child with an 80something mum (dad already passed away) and she stands to inherit a £700k house even after the potential £86k nursing home costs as her mum has £200k in cash savings and investments On the other hand, my parents were skint and I only ended up inheriting a third of their meagre £120k estate back in 2005, my brothers taking the rest Any suggestions on what we should do? Our current mortgage payments amount to £740 a month, plus £2,100 a year council tax Comment from : @tancreddehauteville764 |

|

|

I retired at 55 due to health issues, with a 134k pot and 2 rentals Took 25 to buy the 2nd rental I take 12k drawdown and receive @13k gross rent As my main income as defined by HMRC is the drawdown i only pay tax on the rental profit in arrears Even with the new rules on rental income Im comfortable with income equating to a taxed salary from a 30k salarynot much less than I earned My Royal London pot has had 195 growth since Aug 2020 so despite taking 41k so far its still at 116ka bumper year maybe and some of that is from the covid nosedive but its never been as low as 5 in recent years Forecast is I will have 30k left when state pension kicks in I also pay into a Pru Isa which will have a similar amount at age 67unless we spend it Wife loves work for the NHS and doesnt want to retire, earns 35k with shifts and overtime She has a similar drawdown pot and Isa and a BTL of 7k a year and an NHS pension when she calls time Wel be best to get it all spent before we need care and govt takes it Anyone who can afford it - retire and enjoy it Like she says you cant take it with you Comment from : @davymc6764 |

|

|

Loved your video information what about if you emigrated and your pension is stuck in the uk Comment from : @markhosbrough9180 |

|

|

are these people living in cuckooland Comment from : @terrybrookes8292 |

|

|

Very informative Helen Are there no decent bonds or similar lower risk investments that would generate income without the crazy risk of equities? Comment from : @Victor_GouldianPro |

|

|

If you considered property investing you’d need only £60k I know, because I did it brbrI get the ‘Financial Advisor’ schtick It’s what they sell It’s inside the box It’s a scheme for people who want to work 50 years and retire on half pay I just think we deserve more Comment from : @StupidIsTheNorm |

|

|

I have an investment portfolio in investment ISA's combined with a final salary pension which I am already drawing on My investment manager believes 5 is a reasonable figure to draw down from the ISA's which I thought was frugal until I watched this I would like to run the investment pot down to zero but given nobody knows when they will die, it's not likely to happen Comment from : @markwilliams4312 |

|

|

I'm just amazed at how much is considered a 'normal' spend even on the lower budgets? Do people really chuck so much money away?? £10 a week on taxis for example? I haven't spent that much on taxis in a year! Comment from : @Hide_and_silk |

|

|

Your insane ! we havent spent that amount EVER Comment from : @gowdsake7103 |

|

|

Don,t believe it all the GOVERNMENT expect you to live on 114 pounds and 10 pence per week for a couple if you are an ex tax payer that has been made disabled and can no longer work so these amounts of money are not achievable for people like me but THANKS for the look at what i will be missing out on as i can not get a workplace pension on disability allowance Comment from : @williamsmith1671 |

|

|

The state pension will means tested in the near future, I wouldn’t count on it Comment from : @welshhibby |

|

|

Does anyone even consider an annuity these days? Carefully managed drawdown has to be the better option for almost everyone Comment from : @PDCRed |

|

|

Any defined benefit pensions you have are like gold, no matter how modest Comment from : @Charonupthekuiper |

|

|

what is this a john lewis crimbo ad ? turn the twinkly lights off Comment from : @chrishawkins1922 |

|

|

250k pot drawing down 10k per year for 20 years and you've run out of money??? Comment from : @mickhep |

|

|

Great video Honest, to the point and easy to understand Comment from : @Manc-fh5we |

|

|

Very good content Well presented thanks Comment from : @mal3519 |

|

|

My standards of living:brMinimum I can have the heating on in the eveningbrModerate My house is warm when i want it to bebrComfortable Greetings from sunny Barbados! Comment from : @demos113 |

|

|

As always, thank you for watching and as always, you are so gorgeous, MARRY ME! X Comment from : @fp2165 |

|

|

Missed out 200k, was looking forward to that one Comment from : @lessharkboy |

|

|

Another awesome video! ❤️❤️ Am investing my time and money in crypto now, this new price is a clear sign for new investors to come in ✅✅ Comment from : @alanfoss8990 |

|

|

Very helpful Thank you for this mini series Comment from : @davidplanet3919 |

|

|

Are these figures used as retirement goals gross or net? 🤓 Comment from : @aficio698 |

|

|

Always useful content, thanks Helena Great trilogy by the way! Or will it be a quadrilogy? 😁 Comment from : @robbloom272 |

|

|

Thank you Helena Good information and some excellent links, which I am now going to explore In my experience its easier than expected to build up a decent sized pot as you effectively have 4 contributors - Yourself, taxman, employer and growth Comment from : @petermorris3665 |

|

|

In episode 3 we look at what kind of income you can expect in retirement with around £300K in your pension savings Comment from : @BouncingBack |

|

How Much Do You Need To Retire Comfortably In the UK - And Are You On Track To Retire in 2025? РѕС‚ : The Money Board Download Full Episodes | The Most Watched videos of all time |

|

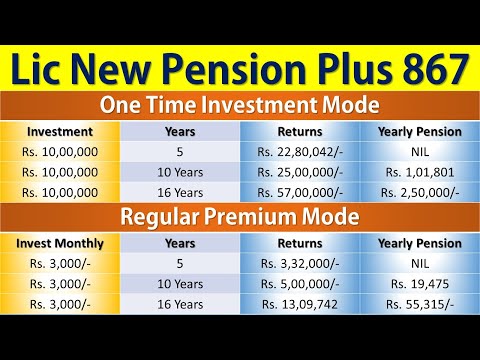

Lic New Pension Plan 867 | Lic Pension Plan 2022 | Lic New Pension Plus Plan | नई पेंशन प्लस योजना РѕС‚ : Insurance Clinic Download Full Episodes | The Most Watched videos of all time |

|

How Much Money Do You Need to Retire Comfortably? РѕС‚ : Safe Harbor Retirement Group Download Full Episodes | The Most Watched videos of all time |

|

"How Much Money Do You Need to Retire Comfortably? РѕС‚ : AI Money Vault Download Full Episodes | The Most Watched videos of all time |

|

How MUCH do I need to RETIRE COMFORTABLY? РѕС‚ : Principles Personal Finance Download Full Episodes | The Most Watched videos of all time |

|

How Much Money Do I Need To Retire Comfortably? РѕС‚ : Rob Tetrault Download Full Episodes | The Most Watched videos of all time |

|

How Much Do I Need To Retire Comfortably РѕС‚ : Tiffany Thomas, Your Wealth Mentor Download Full Episodes | The Most Watched videos of all time |

|

Can I Retire at 55? How Much Do I Need To Save To Retire at 55? РѕС‚ : Drew Blackston, CRC® Download Full Episodes | The Most Watched videos of all time |

|

How much should you have in your pension? - Average UK pension pots by age РѕС‚ : Money to the Masses Download Full Episodes | The Most Watched videos of all time |

|

Retire at 55 ? || How Much You Need To Retire Early at 55! РѕС‚ : Drew Blackston, CRC® Download Full Episodes | The Most Watched videos of all time |