| Title | : | Minimum RRIF Withdrawals u0026 The Pension Income Tax Credit Explained |

| Lasting | : | 7.59 |

| Date of publication | : | |

| Views | : | 62 rb |

|

|

Hello, if you have a rrif of $100,000 at 65 you must take out 4 therefore $4000 are you taxed fully on $2000, and a tax credit of $2000 is the tax credit the full $2000 that you pay no tax Comment from : @ronchenier6496 |

|

|

You should be able to leave your money in your rrsp and withdraw it as needed not as mandated whether you need it or not That seems fair to me Comment from : @joebender3662 |

|

|

Hi Adam, Pension Income tax Credit ($2,000) Question - If I am 65 and drawing from a RIF Account and 2 LIF Accounts’s, do I get the $2000 Pension Income tax Credit from each account ? If not, can you elaborate on how it would work ? Comment from : @rickstanhope7154 |

|

|

Can I share my RRIF with my wife who has no income? Comment from : @newton227 |

|

|

What happens if some of your RRSPS are in mutual funds Comment from : @ludwigboyadjian2252 |

|

|

Thank you for your advice, very informative I appreciate your videos Comment from : @ludwigboyadjian2252 |

|

|

I always go back to this video when i forget You help me more than my advisor Comment from : @killersparklesj6150 |

|

|

Do you offer on line consulting service ? If so how to contact you Comment from : @suramson6436 |

|

|

Do you have your financial planner in Ontario Burlington Comment from : @dalmavi1379 |

|

|

What is the process for withdrawing min RRIF $ from investments in stocks, bonds, ETF, etc Is it advisable to have the min amounts in cash in those investment accounts at your designated RRIF withdrawal date Seems obvious that you must sell a certain portion of your portfolio to accommodate the min Withdrawal $ Are there certain required dates for these sells? Comment from : @davecallas5275 |

|

|

I tried looking up o line but I can't find anything If you retire early (before age 55 for example) can you convert RRSP to a RRIF? And if so, what's the you need to withdraw from your RRIF that year? (Let's say age 45 for example)??? Comment from : @HDCanadianTrainVideos |

|

|

My income is 2488800 do I qualify for GIS Comment from : @ernafuchs6999 |

|

|

Your videos are really informative! Thank-youbrbrIs this rule about withdrawing from each RRIF account still true in 2023? So if I have a CAD RRIF and a USD RRIF I would need to make the minimum annual withdrawal from each of them?brbr"You are allowed to have multiple RRIFs, but it's important to know that the minimum needs to be redeemed from each account; you can't redeem your 'total minimum' from just one account" Comment from : @petert834 |

|

|

Another question, if you don't mind if I have my own company pension and also my RRIF withdrawals, do I get a $2000 tax credit for my pension payments and another $2000 for my RRIF withdrawals Or only for one of them? Which one? Thank you Comment from : @Alex-ed8vj |

|

|

Can you talk about company pension federal Comment from : @josephinekumar9335 |

|

|

My question is if I have 6,000 rrsp in a bank and I have other rrsp in another institution as I am 64 now, I am allowed to turn that 6,000into rif this year? And leave the rest as is(rrsp)thanks for the advice Comment from : @deliagabaon5962 |

|

|

Great info Thanks I am 68 and receiving pension for the previous 3 years I had no idea of the pension Income Tax credit and as such I didn't claim them Is there any way I can claim those in my next year return? Comment from : @guachamaron123 |

|

|

Great info, however can't see the info re: what qualifies for the tax credit 2kthank you Comment from : @Chap17 |

|

|

Is opening a RRIF account as easy as simple as opening a RRSP or TFSA? I won’t be opening (or converting my RRSP) until Year end of my 71st birthday I have a self-directed RRSP, and financial institution (mutual fund) RRSP account So in self-directed, I see they have the RRIF accounts, will I simply transfer over my Stocks, ETFS, and everything stays the same? Mutual funds at bank, they’ll do it for me (convert) it to RRIF? Comment from : @missygilly9917 |

|

|

Can you transfer a RIFF from one institution to a bank without paying tax? Comment from : @jaredvaughan1665 |

|

|

Can I buy a condo from Riif and live in it Sell my house and get benefit of gain on the primary house will it work Comment from : @moerelan1 |

|

|

Hi Adam Great information! My question is what happens with a locked in gic within an rrif I believe banks have to allow you to withdraw the government stipulated minimum each year but what happens if you want to withdraw more than that? Comment from : @petervol5069 |

|

|

I love your sessions Can you maybe do a session on what affect the possible China invasion of Taiwan will have on our retirement investments? Thank you! Comment from : @kentucker6298 |

|

|

You have the best videos Comment from : @janeto100 |

|

|

Are you using the 2022 rate of the minimum amount to be withdrawal as in 2020 the amount was reduced by 25? Comment from : @bookbinding-sewingtextbook7911 |

|

|

Pension income tax credit - you mentioned withdrawals from your RRIF qualify, the first $2000 and that the credit is about 15 It seems numerous comments are under the impression that the credit is $2000 Please clarify Thank you Comment from : @kathymooney1047 |

|

|

Adam, is my wife able to roll her rrsp and spousal rrsp into one rrif? And further to that could I add that to my rrsp turned to rrif so we just have one? Thanks Jeff Comment from : @goodygoody5760 |

|

|

Hi Adam, thank you for your videos Are there strategies to avoid RIFF withdrawal fees ie fewer withdrawals or not changing the withdrawal amounts To be clear, I am not referring to taxes but fees to be paid Could this be something that you could provide a video on Thank you for making these informative videos Comment from : @mayfieldmanor5344 |

|

|

Very pleased there is a host can keeps up & explains details as an assistantbrSave lot of time to searchbrBut need to slow down a bit to absorb Comment from : @kwanchitse25 |

|

|

so a high valued rrif has to take out a lot of money especially later in life? what happens to that money that you dont actually need ? put it back into a private fund? Comment from : @cd_8773 |

|

|

Hi Adam,brI am about to initiate an RRSP melt down (I am 58 will be 59 in April); and I am wondering if I have to withdraw money from my RRSPs in $5K increments with 1 or 2 weeks apart to save on income tax or can I withdraw $24K all at once? Thank you! Comment from : @connielapierre1892 |

|

|

Why does the governments tax , something that we saved for , at the time we want to take out our own money , saved in a RRSP or a RRIF ? When we take money out of a regular bank account , the governments , don't tax us for that ?Is it because we saved money , when we received a reduction in our fiscal taxes at the end of the year ? Comment from : @gerardvinet8448 |

|

|

The more I watch these videos, the more I realize how much I don’t know…brCan’t thank you enough for this I’ll be your future client 😀 Comment from : @evadeanu1 |

|

|

Hi Adam very informative videos for Canadians There is a lot I learned from your videos What happens to the investment in stocks and ETF as we start withdrawing from RRIF as the non invested amount slowly drains out, do we have to liquidate all the assets Is there any other provision for the invest asset Thanks in advance Comment from : @Archie2060 |

|

|

Do you have a video on the upper and lower withdraws for a locked in RRIF? Comment from : @gerardbarry9276 |

|

|

I am 62 and I have to retire now Converting part of an RRSP to a RRIF will help Can I income split with my wife before I am 65 Comment from : @gerardbarry9276 |

|

|

If I make four withdraws per year from my RRIF can I take the minimum out four times without tax? Example withdraw 16,000 out of a 100,000 RRIF without holding tax Or is the minimum only once a year and the other withdraws have tax withheld? Comment from : @gerardbarry9276 |

|

|

Hi Adam If you are only pulling income from your RRIF based on the dividends generated each month as your income stream at age 65 ( no other income) would I be correct that based on a 4K monthly withdrawal that the withholding tax would be 30 of 4K for each monthly withdrawal? Comment from : @leemehlhorn |

|

|

How would one do a minimum withdrawal from a RRIF GIC, when the GIC is non-redeemable ? Comment from : @astalavistababy-g5o |

|

|

i am 67 already but started receiving my CPP when I turned 62, got a survivors income and when i turned 65 I quit my part time income with still a full time income yet and planning to quit when i turned 70 I have an RRSP and still contributing from work when can i get my RRSP or can I covert it to the RRIF what are the consequences of taking out money if converted to RRIF Comment from : @rlenv |

|

|

Hi Adam, Understood that your RRSP has to be transferred to RRIF at the age of 71 Does the Spousal RRSP have to be transferred to RRIF at the same time or transferred when your spouse turns 71 Comment from : @tapansen4913 |

|

|

My wife has a government pension and I have no pension If she has me claim up to 50 of her pension cheque does that amount let me claim the $2000 pension credit amount ? - Thanks Comment from : @123scanman |

|

|

Your video's regarding RRIF and this can start as early as 55yrs, is really helping with the planning of what is coming Looks like lower income will be at 65 yrs of ageso hold off on OAS and CPP and dip into the RRSP until 71this clarity is wonderful to haveso thank you so much I shared one of your vids with two other people who are in their early 60'sto help them think carefully 🇨🇦 💯 Comment from : @MegsCarpentry-lovedogs |

|

|

Hi Adam brI have locked in RRSP from my old employer I quit back in 2003 I was told by Canada Life that it has to be converted to a locked LIF and from there I can unlock up to 50 and transfer it to RRSP at another financial institution and from this account I can withdraw any amount any time The other half is supposed to be set up the way you are saying So confusing I would appreciate your input Love your videos, very helpful Comment from : @Andrew21882 |

|

|

Hi, My RRSP are all Stocks Investments so when I turn 71 yrs will these same stock just transfer to RIF Stocks Thks, Comment from : @joanner2644 |

|

|

I have only spousal RRSP because I never workedbrCan you talk something about spousal RRSP when converting to RIFF?brI am 68 now, my husband is still working, 80k income for the year Am I qualified for GIS?brThank you very much I will check for your reply when I watch this video again Comment from : @lucylucy9311 |

|

|

Hi Adam, is there any advantage to converting a portion of RRSPs to a RRIF before 65? I realize there’s no withholding tax on the minimum required withdrawal, but I don’t see this as a benefit I’d rather pay a withholding tax and potentially see some or all of it back later Thanks! Comment from : @richm4402 |

|

|

If you are getting income from a RRIF and you are not 65 yrs old, can you still get the Pension income tax credit? Comment from : @sylviebarabe-chin4801 |

|

|

Hello Adam Saw your video on pension income tax credit I have a maxed tfsa, maxed rrsp, and non registered accounts Turning 65 next may, I have had little or no income for the past 10 years Is there a way for me to benefit from the pension tax credit? Comment from : @hildabaumhard9c438 |

|

|

Does Parallel Wealth have financial planners in Quebec? Comment from : @mariegeaston2233 |

|

|

Hi Adam,brI love your videos about RRSP to RIF and i am reaching 65 next yearbrMy question to is while i was watching your video about RRSP withdrawal i heard you were saying that if i withdraw money from my RRSP i have to pay withholding tax which i know but i want to ask what will happen if i withdraw $5000 in installment say every month 5000 and how do i have to pay withholding taxbrbrDo have to pay only 10 every time or max 30brbrThanks Comment from : @humayunkhan7585 |

|

|

This is what I did to save some tax $ is instead of receiving a monthly income from my RIF's, I withdraw the required minimum in one lump sum in December Any income earned is tax protected for almost a year Comment from : @terrygorsuch4898 |

|

|

Can we both , my wife and I , claim 2000 each Income tax credit?brThank you Comment from : @bobabobic4314 |

|

|

super great tip thanks Comment from : @normjones6916 |

|

|

what if I forget to take out the min required RIF in one year, what will happen? Comment from : @ybc8495 |

|

|

I’m 56 with 1100000 in LRSP and plan on retiring at 63 Should I start taking out now since my income will be higher when I retire ?brThx Comment from : @lancewindsor-brown3367 |

|

|

Can you transfer your investments (in kind ) from your RRSP to a RIFF when you are required to transfer funds at 71? Comment from : @nowcjm |

|

|

Hi, Adam What do you think of RRIFs invested in high yield covered call etfs & income funds Since minimum withdrawals are way lower I believe in the first 10 - 15 years compared to yield, you get to maintain your principalYour input would be greatly appreciated Thanks! Comment from : @bongkitopascual7655 |

|

|

How much do I draw out from RRSP into rrif to withdraw a minimum $2000 from rrif to benefit from pension tax credit of $2000 if I'm 57 years old and on the way to retire Comment from : @Udjeox |

|

|

I am retiring in about a month and have a defined benefit pension, cpp and oas, along with about 100k in an rrsp What would you suggest l do with the rrsp Should l convert it to an RRIF or just draw out a certain amount from my RRSP I really don't need the extra money so should l just leave it till 71? Comment from : @JoeS1956 |

|

|

Very interestingbrLove your videos!! brNice to see your channel growing 🌼 Comment from : @Booo858 |

|

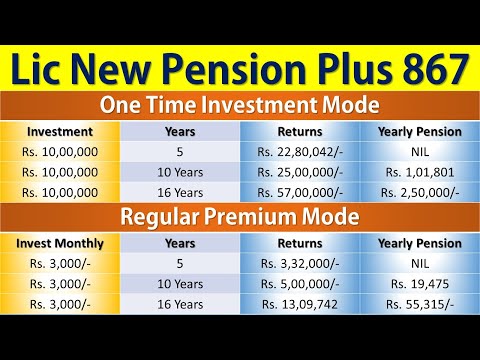

Lic New Pension Plan 867 | Lic Pension Plan 2022 | Lic New Pension Plus Plan | नई पेंशन प्लस योजना РѕС‚ : Insurance Clinic Download Full Episodes | The Most Watched videos of all time |

|

Tax On Gift Income 2024 | Income Tax On Gifts Received | Taxation Of Gifts Under Income Tax Act РѕС‚ : Banking Baba Download Full Episodes | The Most Watched videos of all time |

|

UK Income Tax Explained (UK Tax Bands u0026 Calculating Tax) РѕС‚ : That Finance Show Download Full Episodes | The Most Watched videos of all time |

|

Income Tax on Stock Market Earnings | Tax on Share Market Income | Tax on Fu0026O Trading in Budget 2025 РѕС‚ : MyOnlineCA Download Full Episodes | The Most Watched videos of all time |

|

What income will I get from a £100K PENSION POT? - Retirement income explained (is £100,000 enough?) РѕС‚ : Money to the Masses Download Full Episodes | The Most Watched videos of all time |

|

Income Tax on Foreign Income | Income Tax on Foreign Remittance | TCS on Foreign Remittance РѕС‚ : MyOnlineCA Download Full Episodes | The Most Watched videos of all time |

|

INCREASE EITC CREDIT FOR THE 2025 TAX FILING SEASON-Earned Income Tax Credit 2025 РѕС‚ : Simplistic Motivation Download Full Episodes | The Most Watched videos of all time |

|

How much should you have in your pension? - Average UK pension pots by age РѕС‚ : Money to the Masses Download Full Episodes | The Most Watched videos of all time |

|

Are Pensions Still Tax Efficient? The 2027 Tax Changes You Need to Know. #pension #inheritancetax РѕС‚ : Xenia Download Full Episodes | The Most Watched videos of all time |

|

NEW Income Tax Calculation 2025-26 | Tax Slab Rates for Old u0026 New Tax Regime (Examples) РѕС‚ : FinCalC TV Download Full Episodes | The Most Watched videos of all time |