| Title | : | What income will I get from a £100K PENSION POT? - Retirement income explained (is £100,000 enough?) |

| Lasting | : | 12.39 |

| Date of publication | : | |

| Views | : | 29 rb |

|

|

Nonsense! So long as use guard rails can take over 5 per annum Comment from : @JohnDoe-wu4tt |

|

|

£10,000 for low risk and £20,000 for medium risk and £40,000 for high risk at the moment 21/2/25 Or £20,000, £30,000 and £50,000 for drawdown Comment from : @shaungregory1789 |

|

|

I suffer from Crohns disease as well, am 63 retired from working and live off savings Curious about starting drawdown or an annuity, I completed the moneyhelper enhanced annuity checker based on LIFETIME gauranteed income (no set period) All quotes came back marked as 10 yearly Does that mean only gauranteed for 10 years as they only expect me to live that long? Confused, as the amount after 10 years is significantly less than pension pot used to buy the annuity Comment from : @DavidWilliams-y2i |

|

|

In August 2008 I had a pension pot of £248k In October 2008 I had a pot of £172k The September crash taught me about life! Comment from : @michaelbelcher3936 |

|

|

Well all being well I shall be getting two state pensions when I retire uk and usa Comment from : @markhosbrough9180 |

|

|

The idea that I would want the same income at 67 as I would at 87 is rubbish Comment from : @peterloftus6259 |

|

|

In an isa 5 £5,000 a year plus still have 100,000 left and no tax to pay Comment from : @johnfitton3716 |

|

|

Worth pointing out that 25 of pensioners rent their homes Comment from : @ukulelalienation |

|

|

Hang on so if you have high blood pressure or cholesterol you get less annuity than someone with no health issues ?? 😂 wtf bullshit is that Comment from : @SteveTurnbull666 |

|

|

Pay nothing and you will get everything Same care home same doctors same if not more extras from the state Comment from : @horkstowarms |

|

|

Great video, but disappointed to see that you don’t give the equivalent figures for annuities for women Comment from : @jencarter6785 |

|

|

it doesnt make sense to me to take a level annuity so even the lowest joint rising at 3 (489) is higher than the 4 rule for drawdown and if the market crashes you shouldnt even take that So your saying its a no brainer, unless you want to leave an inheritance Comment from : @evokestudiosbrighton |

|

|

Is this video about starmer asking me how much he will get from my 100k pension?brMy answer :brAll of it starmer, you'll take it anyway, or at least, Rachel from accounts will Comment from : @leehowson440 |

|

|

Less tax Comment from : @christopher554 |

|

|

8:35 DON'T DEFER YOUR STATE PENSION!! It takes 17 years for you to breakeven from deferring and that's including the extra tax you'd need to pay because you are still working Not saying you shouldn't consider it but can you be sure you'll make it to 80? Comment from : @Pegaroo_ |

|

|

Agree Bitcoin for the win Comment from : @mikesweeney651 |

|

|

I have a full state pension, 2 private pensions 1 of which I’ve not drawn on yet and I’m still contributing to I’m also still in full time employment I am, as you can imagine, being crucified by the taxman brbrIve been actively seeking appropriate financial advice It appears to me, that independent advisors either want to sell my entire pot and take 10-20 commissions, or, enter me into some type of investment plan for the privilege of so doing, they’d charge me a rate not dissimilar to what the taxman is currently getting It’s a ‘win win’ scenario, for the taxman or financial advisor, but not for me Comment from : @howardskeivys4184 |

|

|

Something to keep in mind, the average healthy life expectancy in the UK is age 63 Do you want to retire after your health is starting to deteriorate? Comment from : @OneAndOnlyMe |

|

|

Why doesn't everyone just say that they're a smoker, and get more money for life? Comment from : @andrewball2662 |

|

|

If you reach state pension age, take it you don't know how long you have got Comment from : @kinggeoffrey3801 |

|

|

Surely it depends on your retirement age !! If you are 62 a 6 drawdown might workbrbrIf you are just 58 I think a 4 drawdown rate is the maximum you could plan on Comment from : @maxflight777 |

|

|

£100k per year, for one year Comment from : @t28mcd |

|

|

Why piss around like this, get into xrp Comment from : @timsmith1292 |

|

|

I think in these times 1 Bitcoin will pay off better Comment from : @trevormillington813 |

|

|

IIRC the age at which youj can start withdrawing from a DC pension or SIPP is now 56, and will rise to 57 when the SSP qualifying age increases Comment from : @stephen2203 |

|

|

This is great advice Thanks for sharing it Comment from : @leewellstead2305 |

|

|

So does that 43k include tax, state pension and assume you pay no mortgage? What is it really for a single person? Comment from : @onekindthing1327 |

|

|

Are you still entitled to whatever amount of state pension you have built up if you move abroad when you retire/stop working (for example to another European country) and become tax resident there? Comment from : @jayplays568 |

|

|

Given the current situation, probably best not to expect a state pension if you have a reasonable private pension or own your home Comment from : @voodoomotion5855 |

|

|

The pot averages mean very little, many people will have pots scattered across different providers from a range of jobs across their career Most people don't take any interest in their pension nor know what its invested in nor its value so realistically they are highly unlikely to have combined all their pots into a single pot Comment from : @BaileyMxX |

|

|

Those living standard figures are a joke I've always lived a comfortable type lifestyle on a lot less than £43k That's equivalent to needing a £1m pension pot using the 4 rule Comment from : @johnristheanswer |

|

|

Those retirement living "standards" are not relevant for most retirees Their methodology is somwhat questionable and the values shot up way over 10-11 in the ladt updatebrThey were useful in the past Now, at best, a pessimistic upper bound Comment from : @BeeblebroxTheThird |

|

How MUCH will my pension pot give me? £500K/£250K/£100K РѕС‚ : Principles Personal Finance Download Full Episodes | The Most Watched videos of all time |

|

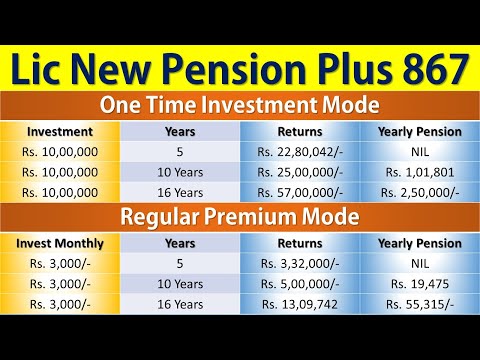

Lic New Pension Plan 867 | Lic Pension Plan 2022 | Lic New Pension Plus Plan | नई पेंशन प्लस योजना РѕС‚ : Insurance Clinic Download Full Episodes | The Most Watched videos of all time |

|

How $1,000,000 Can Be Enough For Retirement РѕС‚ : The Ramsey Show Highlights Download Full Episodes | The Most Watched videos of all time |

|

Retirement u0026 Pension: A Guide to Planning with Guaranteed Income РѕС‚ : Erin Talks Money Download Full Episodes | The Most Watched videos of all time |

|

These 3 Retirement Tax Credits Equal Up To $50,000 Per Year In Retirement Income РѕС‚ : PlanEasy Download Full Episodes | The Most Watched videos of all time |

|

How much should you have in your pension? - Average UK pension pots by age РѕС‚ : Money to the Masses Download Full Episodes | The Most Watched videos of all time |

|

Minimum RRIF Withdrawals u0026 The Pension Income Tax Credit Explained РѕС‚ : Parallel Wealth Download Full Episodes | The Most Watched videos of all time |

|

Accessing Retirement Accounts Early | Roth IRA Conversion Ladder Explained | Early Retirement Hack РѕС‚ : Our Rich Journey Download Full Episodes | The Most Watched videos of all time |

|

For many American seniors, their retirement savings are not enough РѕС‚ : CBS Evening News Download Full Episodes | The Most Watched videos of all time |

|

Do you have enough saved for retirement? | Amyr Rocha Lima | TEDxKingstonUponThames РѕС‚ : TEDx Talks Download Full Episodes | The Most Watched videos of all time |