| Title | : | Using Rental Income to Qualify for A Mortgage [Mortgage Qualification] | #LoanwithJen #rentalincome |

| Lasting | : | 6.53 |

| Date of publication | : | |

| Views | : | 19 rb |

|

|

Amazing video Thankyou! Comment from : @JesusGonzalez-ug6xq |

|

|

Great video ty Comment from : @drobgyn5615 |

|

|

Rock solid information Thanks Comment from : @subwaydepot8326 |

|

|

Advice for rich people to make even more money off poor people Comment from : @marsbearmcw3050 |

|

|

What about va home loan Comment from : @ahkeemcooper31 |

|

|

What is FHA? Comment from : @stanmclean6218 |

|

|

2 questions to the lender br1 What is the reason you are not using the 75 of my rental income toward my dti?br2When can you use the 75 of my rental income toward my dti? Comment from : @GELATINOUSORBZ |

|

|

Hi, I have a rental property that i short term rent I have one year tax return on it I am being told i cant use the rental income on to lower dti I didnt show any profit to pay taxes on the return Why isnt the rent that was paid which paid my expenses on it not being calculated towards my dti? Comment from : @GELATINOUSORBZ |

|

|

Excellent 🎉 Comment from : @muhammaddaniyalisrar3879 |

|

|

Thanks a lot Very important information I just subscribed! Comment from : @luisrivera5314 |

|

|

This is EXACTLY why I was confused about Thank you so much!!! Your a very good teacher Comment from : @Thejasonrogers |

|

|

Omg thank you for this info! I’ve been researching and this is what I needed! Comment from : @felicia_kaye |

|

|

Quick, concise, and easy to understand Thanks! Comment from : @thoyo |

|

|

If I have a current home that I pay 1300$ payment including taxes, insurance, hoa etc And I want to buy a new primary residence, allowing me to rent my current come for say 2,000$ a month do I have to provide a lease or something for it to count as my income? I currently get 650$ every month from my brother who lives with me but he pays me cash or send me the money through zelle by chase bankbrbrSecond question is, the house I want to buy has 3 rooms I plan on renting One to my brother and 2 others to tenants I plan on charging each of them 700$ making that 2100$ a month from renting rooms at the new home Can I use this projected income aswell ? brbrRight now most lenders haven't approved me for more than a 300k loan since I have a 800$ payment on a truck but I've never missed a payment and even have a 60k downpayment for the new home I make 60k annually if that matters brbrI'm just unsure if I'm not explaining my situation correctly to the lenders Comment from : @ISILENTNINJAI |

|

|

Hello Jen, I'm 63 years old and I'm planning (thinking) to buy a multi-family property (3-4 units) in Pennsylvania My monthly social security is about $1,500 dollars a month I have close to $30,000 for the down payment and closing expenses My question is when can I apply for a mortgage? Do I have to find the property first with rented units? or can I apply now The property will be my primary residence Thank You in advance for your response Comment from : @diose0078 |

|

|

Does VA loan buying a triplexbrQualify for 75 rule? Comment from : @davidpham9353 |

|

|

Will the lender follow up to confirm rental income on your previous primary after closing a new primary? Comment from : @yume816 |

|

|

Similarly, if you rent the rooms in your primary, can you and how to exclude that mortgage for a new mortgage/purchase? Is this exclusion method better or basically same as converting your primary to rental AFTER new primary purchase? Which method will qualify for best loan? Comment from : @yume816 |

|

|

The average of 2 years of rental income? Is that with both Fannie and Freddie Mac? Comment from : @The1SimLash |

|

|

Thank you!! Comment from : @rubenchavez1747 |

|

|

Can I use the income of rents of a building I want to rent as income to qualify? Comment from : @yeetstreetbuilt |

|

|

Hi, i have some questions? Do i need a consultation with you? If so, how can i reach you? Comment from : @spazysmalls |

|

|

Thank you for the information Comment from : @emawussi |

|

|

What about scenario 3; You have no properties and want to buy a duplex/Tri-Plex with a owner occupied FHA loan, would you, the loan originator, still use 75 of the markets rental income as a qualifier for said loan? Comment from : @420blazinOG |

|

|

What about income from short term rentals with no lease? How can you use that income to qualify for a new primary residence on conventional loan? Do you have to wait until you have 2 years of that income on a tax return? Comment from : @WillEstateGuru |

|

|

Do the rental payments offset your dti to qualify for a second fha? Comment from : @baldwincobb |

|

|

Pure gold at 3:55 TY for the info! Comment from : @jamesvelvet3612 |

|

|

Do you have a video for using income from house flipping to qualify for a mortgage? Comment from : @sterl1616 |

|

|

Thanks for explanation Comment from : @mirzauamerici2286 |

|

|

Hello! I'm new to your channel, thanks for sharing So my other half and I are wanting to buy a beach house (or maybe a cabin in the mountains) to rent out- like on Airbnb etc Stay there a week or two on vacation and rent it out the rest of the time So they can use 75 of market value rent to help qualify to buy the home- correct? If we decided to build a house instead of buying one already built would they be able to still use the 75 of rent or would it be different? We have around $40-60k to use to make it happen It is from an inheritance and it's probably the only chunk of money we will have to better ourself, so we want to use it in a way that will bring more and more money with time Keep on investing it into other properties to hopefully become wealthy, at least very comfortable We have had the money for almost 2 years now trying to decide how to best use it to make the most out of it but it's time to put that money to good use I feel like the longer we hold on to it the less it will be able to do for us I would love to be able to talk to someone, even pay someone to help show us what we should do to make the most out of it Like a game plan Comment from : @homoerotic85 |

|

|

thank you Comment from : @armengharibian8606 |

|

|

I have one case were subject is Conv Purchase of Investment, borr currently residing on rent and own one REO property since Apr 29, 2021 So can I use the rental income from existing REO?brI knw from subject Invest I can only use rental income to offset the subject PITIAbrPlease advise Comment from : @afshankhan3157 |

|

|

Do you do DSCR loans? Comment from : @favored4life |

|

|

I have a questionI have 2 properties(I have a 3 year rental history with tax returns on 1 property I just converted property 2 into a rental)total cash flow is 1,300 per monthbetween the 2 homes mortage payment on 1 home is $1000 and rent is $1600 home number # 2 the mortgage payment is $1,000 and the rent is $1700 can i use these to help qualify me for a new primary home purchase? My income from my job is $6,000 per month Is the total rent i collect also seen as income? What is my total income when i include my rental homes? Do the rentals help me qualify for more home? Comment from : @1snakemanvrod |

|

|

Can I count the rental income on rooms I rent out of the house I propose to purchase? ANYONE KNOW? And WHAT IF you buy a duplex as your “residence?” Doesn’t 75 of the rent income from the unit you rent count as your income even if an FHA loan?!?!? Comment from : @billygraham5589 |

|

|

Great video and information, why most of investors can get lots of properties in conventional loan with in a year even have no 2 years history for their properties ? Comment from : @daveandaya4626 |

|

|

Thanks for clarify these requirements Jennifer 🤠👍 Comment from : @harryherber2971 |

|

|

What about if after purchasing a property you want to buy another one in between filing your next tax return for the first purchase, in that case would you still be able to use the 75? Comment from : @joshengen4480 |

|

First Time Buyer Mortgage 5.5x income (22% more!) Help to Buy Alternative // Helping Hand Mortgage РѕС‚ : Alex Kerr - Mortgage Chain Ltd Download Full Episodes | The Most Watched videos of all time |

|

What is the Earned Income Tax Credit? | Do You Qualify For It? РѕС‚ : The Locum CPA Download Full Episodes | The Most Watched videos of all time |

|

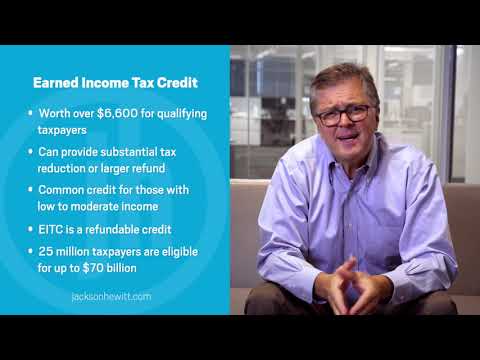

What is the Earned Income Tax Credit and Do You Qualify For It? РѕС‚ : Jackson Hewitt Download Full Episodes | The Most Watched videos of all time |

|

How Much Mortgage Can I Afford UK? | Mortgage Matters #13 РѕС‚ : Location Location East Download Full Episodes | The Most Watched videos of all time |

|

Before Taking a Mortgage, WATCH THIS! … #Centonomy101 #Mortgage РѕС‚ : Centonomy Download Full Episodes | The Most Watched videos of all time |

|

Mortgage Down Payment Gift Letter Overview | Brian Martucci Mortgage Lender РѕС‚ : Brian Martucci, Mortgage Lender Download Full Episodes | The Most Watched videos of all time |

|

Should You Get A Mortgage From A Bank Or A Mortgage Broker? РѕС‚ : The Ramsey Show Highlights Download Full Episodes | The Most Watched videos of all time |

|

NO-DOWN PAYMENT Home Loans First-Time Buyer | No PMI Mortgage | First Time Homebuyers Mortgage РѕС‚ : Shaheedah Hill Download Full Episodes | The Most Watched videos of all time |

|

Paying for care with rental income from your home РѕС‚ : The Retirement Café with Justin King Download Full Episodes | The Most Watched videos of all time |

|

Tax On Gift Income 2024 | Income Tax On Gifts Received | Taxation Of Gifts Under Income Tax Act РѕС‚ : Banking Baba Download Full Episodes | The Most Watched videos of all time |