| Title | : | What is the Earned Income Tax Credit? | Do You Qualify For It? |

| Lasting | : | 14.13 |

| Date of publication | : | |

| Views | : | 14 rb |

|

|

This office are all over here! Comment from : @fernandosandoval9306 |

|

|

They don't tell this in tax office! Comment from : @fernandosandoval9306 |

|

|

Wholly shit! Never knew or heard of this! 🤔🤨🤨 Comment from : @fernandosandoval9306 |

|

|

I never heard of it! But know what it means! 🤨 Comment from : @fernandosandoval9306 |

|

|

I don’t know if my tax preparer gave me this credit, how can I check? Comment from : @carmengonzalezgarcia5006 |

|

|

I never claimed a eitc Comment from : @melvinallen6938 |

|

|

My daughter was born in early June 2021 would she qualify for the credit? I already filed and got my return when I filed early 2022 Comment from : @bernardomacedo2961 |

|

|

Still confused about one thing: My 2019 Earned income is higher than my 2021 earned income BUT my 2021 Adjust Gross Income is higher than my 2019 Adjusted Gross Income because of unemployment Does that mean I qualify for it still? Thanks! Comment from : @maliabella |

|

|

Thank you This was quite helpful and you were very clear Comment from : @hy9093 |

|

|

I got this form from irs but we have already filed or tax so what should be our next step Comment from : @Syamuelgaha |

|

|

so what happens if you thought you qualified and actually didn't? I'm new to this and only filed for it because it was suggested or something while i was filing my taxes this year i'm only 22 and still dumb when it comes to this stuff so i've been stressed out over if It is considered fraud if I genuinely thought I qualified but didn't I still do not know if I actually qualified but It would at least be nice to know what happens if I get an email (or if they even email you) at all to inform you of the mistake or if they just punish you for it in some other kind of way without contacting you about it or something Comment from : @TheSpaceyCat |

|

|

How much money do I have to make to earn eitc? Comment from : @kainoamahoe253 |

|

|

What if my ex gf claimed the EITC and I'm trying to claim my daughter as a dependent? Does that mean I won't qualify for that tax break now? I guess she didn't claim our daughter as a dependent Just claimed the EITC This tax stuff is kinda confusing lol Comment from : @joshuasmith9587 |

|

|

Looks like it does not apply to married but filling separate Comment from : @abigailpacheco2711 |

|

|

Can u claim ur son that's 25 and lives with u Comment from : @angiefairfieldtrinkle1994 |

|

|

I'm on SSA Disability per monthAnd I'm working as a caregiver for my brother my income per month is $3800 per month do I Qualify for earn income credit caring for my brother? Comment from : @timgrahn3624 |

|

|

Under age of 17 by 12/31/20 ? Comment from : @causeeffect7624 |

|

|

Sorry, a bit confused I'm single with 0 kids and I make more than $16K, this means I cant file for the EITC correct? Comment from : @clintbeastwood2903 |

|

|

Like we immigrated to US in July 2020, do we qualify? Comment from : @SaadAli-os7cj |

|

|

What if my child lived with me outside of USA 7 months? Comment from : @SaadAli-os7cj |

|

|

How about the $2,000 per kids credit is that different? From this EIC ? Comment from : @mariloucruz4695 |

|

|

i did my taxes, because i have an LLC it was applied but not given i already did my taxes didn't make any money last year because of the pandemic my wife also i a contractor but made less than 15k so the credit though applied it was us actually having to pay ny state 957 and getting $1,876 from federal so my questions arebr1 is this going to be added and us not getting it!? or 2 do we just close shop get regular jobs so that we CAN get something back this is the first year that we are actually getting something back Comment from : @darbyalvarado30 |

|

|

Good infowell explain Comment from : @avenpineda8052 |

|

|

AT Can one report to irs social security benefits Comment from : @awashteklehaimanot7754 |

|

|

What does line 5 mean about if the child was disabled so if they are not u can’t claim it? Comment from : @hr6144 |

|

|

Single Can claim eic? Comment from : @vanhuynh9440 |

|

|

My friend already file Tax return for me 2020I got credit for my two kidshow do I know I can eligible for Eitcor my I already got itI don’t know the difference between File tax return & file EITC Thank you Comment from : @Rickychicago |

|

|

Help, I cannot wrap my head around using 2019 Earned income instead of 2020 So If I use 2019 (because I earned MORE income) I probably earned too much, and won't be eligible for this credit So, I guess I do not understand the benefit of using 2019 earned income Don't you get more credit if you made less money? Please help, I keep looking into this, but I don't understand it Comment from : @BrandySimonton |

|

|

Hi, I filed my taxes already What should I do? Comment from : @GoldenGlobalTrading |

|

|

Can I claim my EITC next year 2022 ? Comment from : @milagrosbrajas3092 |

|

|

I filed my 2020 taxes already I put my 9 month old grandson as my dependent My tax refund is a lot less than $5,584 Is it because i only worked 3 months of 2020? i received unemployment the rest of year but i had taxes withheld Comment from : @XCLASSYDACX |

|

|

Of I already filed my taxes Will get any more money back if the new bill passes Comment from : @juanbrown9648 |

|

|

If this plan passes, does it replace the current 2,000/child or is it in addition to the current child tax credit? Comment from : @actionjackson4587 |

|

|

Hi Questionif I made $65000 last year and I have a qualify depend I can get refund or not?? Comment from : @Tourfigueroa5357 |

|

|

do you offer any discounts for anytax preparer sofware? Comment from : @elizabethhuerta4555 |

|

|

Thank you very much for providing very interesting information Comment from : @s_f_u4787 |

|

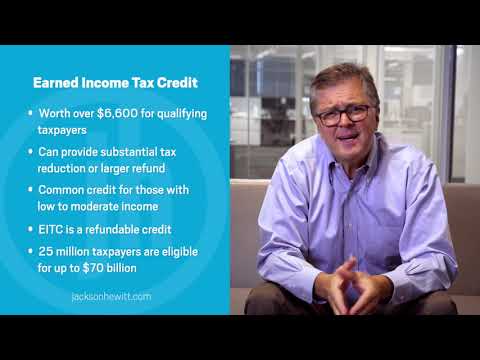

What is the Earned Income Tax Credit and Do You Qualify For It? РѕС‚ : Jackson Hewitt Download Full Episodes | The Most Watched videos of all time |

|

INCREASE EITC CREDIT FOR THE 2025 TAX FILING SEASON-Earned Income Tax Credit 2025 РѕС‚ : Simplistic Motivation Download Full Episodes | The Most Watched videos of all time |

|

Tax On Gift Income 2024 | Income Tax On Gifts Received | Taxation Of Gifts Under Income Tax Act РѕС‚ : Banking Baba Download Full Episodes | The Most Watched videos of all time |

|

Earned Income Tax Credit Explained - Everything You NEED To Know! РѕС‚ : On Cash Flow Download Full Episodes | The Most Watched videos of all time |

|

Expert Gives Advice on Child Tax and Earned Income Tax Credits РѕС‚ : theGrio Politics Download Full Episodes | The Most Watched videos of all time |

|

Income Tax on Stock Market Earnings | Tax on Share Market Income | Tax on Fu0026O Trading in Budget 2025 РѕС‚ : MyOnlineCA Download Full Episodes | The Most Watched videos of all time |

|

Earned Income Tax Credit (EITC) Explained РѕС‚ : Tax Teach Download Full Episodes | The Most Watched videos of all time |

|

Earned Income Tax Credit (EITC) Explained РѕС‚ : Jackson Hewitt Download Full Episodes | The Most Watched videos of all time |

|

TUTORIAL- How To Locate The Maximum Earned Income Tax Credit For 2024 РѕС‚ : Simplistic Motivation Download Full Episodes | The Most Watched videos of all time |

|

How to Increase Your Earned Income Tax Credit РѕС‚ : WCS Money Tutorials Download Full Episodes | The Most Watched videos of all time |