| Title | : | Pensions Explained UK | Pension Basics for everyone |

| Lasting | : | 12.03 |

| Date of publication | : | |

| Views | : | 521 rb |

|

|

Well done on expluaing UK pensions in just over 10 minutes Comment from : @mikeroyce8926 |

|

|

Should I merge my pensions, or leave them separate? Comment from : @luke-pt9pe |

|

|

Give this guy an OBE! Simple, Clear, Informative! Comment from : @Blox363 |

|

|

Work all your life pay tax and NI and when you retire they give u a pittanceand for the fue remaining years of your life u struggle Comment from : @peterdavidsadd1034 |

|

|

amazing! I'm releasing a similar video soon but with a different angle Comment from : @HackWealth |

|

|

They want 14000 to buy credits it will give my wife 700 a month at age 66 Do you think it will be bankrupt or should I buy the credits? Thanks Comment from : @billyflanagan9657 |

|

|

Awesome video I’m 21 and I was confused with how the pension works with all articles online being so confusing You laid everything out perfectly! Thank you! I will definitely be paying the max amount for my DC plan Comment from : @levelitup_uk |

|

|

very helpful Comment from : @lynxlinus4355 |

|

|

I’ve paid tax on £5,000 of my income in each of the last 3 years (salary £17,700pa), totalling £3,000 in tax paid Can I pay £15k into my pension this year and claim this tax back? Comment from : @connorduffy6307 |

|

|

fancy words for government desiring early deaths Comment from : @user-ht9fr6eh9u |

|

|

It's hopeless You'll never outrun inflation Your 100k today will be worth 20k in 2050 You'll spend your life in misery, slaving away like a dog and it will all be for nothing Might as well just spend it while you've got it and when you retire just unalive yourself Comment from : @EnglandVersus |

|

|

The State Pension is a complete Socialist concept as EVERYONE gets it even if they haven't worked just look at the fat and lazy boomers who have bankrupted the country doing it Comment from : @IggyGoesPop666 |

|

|

Avoid a personal pension, my advice! 4 years away from mine and the GOV move the age limit up a coup[le of years, my money! who's to say as I approach the new age limit they decide to move it again! BTW any lawyers out there? can I sue the gov/pension company? I mean I stated at the beginning I want to draw at 55 years, surely under contract law NO body should be able to change this against my will? Comment from : @waynecunning5733 |

|

|

yupyop Comment from : @DJLOUIS247 |

|

|

Wow! Comment from : @projectgenes1s |

|

|

Who do you suggest i open my pension with? Is Legal and General a good place to start? I want to transfer my old workplace pensions into one place too Comment from : @thejournalnook |

|

|

I only recently discovered I had a pension from years ago that I totally forgot all about It started in 2001, I only put into it for 2-3yrs and it’s now at a certain amount I’m 47, haven’t worked in 15yrs and can’t work due to ill health however I get zero gvnmnt handouts right now I looked into it (Scottish widows) and it says u can take money before 55 if you’re unable to work My question is how to go about that? Do they require proof from the allopathic medical corporation that I do not wish to be a part of? Or is the fact I’ve not worked in 15yrs enough? Comment from : @EricPollarrd |

|

|

Amazing Comment from : @MartinLewisFinancialAdvisorand |

|

|

The only question I have What do you have / do for a pension? I'll copy that Comment from : @will2574 |

|

|

My mam only gets £114 a week She is 76, worked less than 35yrs And married Is she entitled to more ? Many thanks Comment from : @anyone173 |

|

|

The UK State pension is pathetic 🤮🤮🤮 Comment from : @soyboymotivation |

|

|

From what I read a works pension you pay into go straight out to the people that are retired there's no pot with your name on and the same happens to you when you retired 😮 Comment from : @robertnorman4306 |

|

|

When you run out of Pension fund invested does the pension just stop? For example if you take £20k out each year and you have a Pension pot of £200k In 20 years does it mean you get nothing? So basically at 87 you only have state pension Obviously Tax will reduce the £20k, but in theory and I assume Tax is the same for retired people as working people Comment from : @Scrumpys |

|

|

We want rp kooty 10000 penshan money in the my game thankyou congratulations Comment from : @nethu2307 |

|

|

I have 4 or 5 newish short pensions that i dont know what to do with but im paying into one atm with no details from them yet but its deducted for 14 months? Uk❤ Comment from : @checktheskies5040 |

|

|

Brilliant video thanks Comment from : @milkysue5496 |

|

|

Hi, is there any point of paying more in to a DB pension? Comment from : @tqhussain |

|

|

I’m 36 and I have about ($190k) liquid in savings which I plan to put towards becoming a homeowner, but based on the current high prices on real estate, do you suggest I hold from buying and look at stocks instead? Comment from : @AnnieHolsen |

|

|

Thankyou so much for your advice🤔And great news for your information❤❤🌹🌹 Comment from : @PloyphailinEkaphan-mh9cb |

|

|

Is it to late to get a personal pention at 55 ? Comment from : @releaseandrenewhypnotherapy |

|

|

My wife (54) does not have a pension and does not earn enough income to pay tax She recently inherited £400k After paying into ISAs, and setting some aside in savings, does it make sense to put a lump some into a pension? How much can she pay in ? Does the £60k tax limit apply? Comment from : @paulburton5150 |

|

|

If you have a dual national use it to your advantage definitely Comment from : @stanleystuart2008 |

|

|

This is the biggest scandal from the rich man on the poor man it's called financial rape you can't hide a pension fund but you can most certainly hide cash this is why they want a cashless society governments Comment from : @stanleystuart2008 |

|

|

Amazing video, A friend of mine referred me to a financial adviser sometime ago and we got to talking about investment and money I started investing with $150k and in the first 2 months, my portfolio was reading $274,800 Crazy right!, I decided to reinvest my profit and get more interesting For over a year we have been working together making consistent profit just bought my second home 2 weeks ago and care for my family Comment from : @Essien-ij |

|

|

What about if you leave the country before the end of your retirement age? Comment from : @Maria-qe5rx |

|

|

Hi I've got a pension access wanting to give my details rather are legitimate, I am worried because I am self-employed but are used to work for the council is this to deal with the council patent set up and still paying regards from Andy Comment from : @andrewellison1203 |

|

|

What happens when you reach the 1mil lifetime allowance? Is it inflation adjusted? Comment from : @luckyshaqqq |

|

|

Who ensures that the fund is keeping up with the inflation while you are waiting for 57YO?br30 years worth of inflation at 3 is 60 I would rather pay 40 today and take the money Comment from : @luckyshaqqq |

|

|

Is there a reason to pay into a pension rather than just put the money into an ISA? Comment from : @UglyChampion |

|

|

Thanks for the knowledge! Comment from : @lawistruth |

|

|

This was SO valuable you have no idea Comment from : @LiquidFlower |

|

|

Fiddle sticks brThanks for the vid I'll be right 👍 Comment from : @mattg6136 |

|

|

Can money move to other country if the person moves to its Home country? Comment from : @Patil202-n7o |

|

|

This is the kind of advice that I wish I'd had from pensions and savings advisers 30 years ago when all the jargon just went right over my head Thanks for this much simpler explanation which I can now finally understand! Comment from : @robm509 |

|

|

I am self employed so who do i pay into for my pension? Comment from : @Scouse-vr6lj |

|

|

Finally something that is explained in terms I can understand, thank you 🙏 Comment from : @elliottmakin3884 |

|

|

When I diie does my wife get her meagre state pension made up to a of my very good state pension(£14K) which includes lots of state add ons? Or does she have to live on a very small state pension because she never worked( housewife & kids) so never had any state contributions( she is 76 I am 77) Comment from : @grahamlongley8298 |

|

|

I understand the town of Manchester has gone bankrupt due inability to pay pension Comment from : @batuapi4340 |

|

|

Thanks for the information It would be better if you gave some salary examples Comment from : @moradizx |

|

|

Is is good to have a few pensions with various pension providers? in other words, would it be better to place all money in one pot and let it grow or have 2-3 pension providers to be growing various pots of money for retirement? Comment from : @wojciechfilaber2931 |

|

|

could you offer financial advice Comment from : @geraldinekew8315 |

|

|

why is this not thought in schools?? im 48 still don't understand pension never been employed always self employed and saved money no private pension if pensions were that good how come so many old people r broke Comment from : @truthseeker3661 |

|

|

Great presentation Which mic and camera may I ask, did you use to produce this specific video presentation ? I will be grateful Comment from : @muslim5211 |

|

|

Please Can you have both DB and DC pensions? Comment from : @xtopherokenz8403 |

|

|

I need to now why I'm been scammed out of my private pension funds Comment from : @lesliehenriques62 |

|

|

Tax relief on is taxed later when you withdraw from pension Comment from : @KienTang-y8u |

|

|

VERY SIMPLE WAY TO EXPLAIN THANK YOU Comment from : @fahimsamji4403 |

|

|

I don’t worry any more my wife just turned 80 and she now gets 25 pence extra wow we’re in the money Comment from : @Thomas-g5t2k |

|

|

Hi thanks for the video, I was working in the uk for almost 12 years and every 3/4 years I had differents companies and now I don't work any more,, my enquire is that I have two Pensions, 1-Aegon and 2-Pension People , I try to withdraw the money but a friend of mine say No,, I don't know what to do,,, any advice could be great please Comment from : @JC-yx5kx |

|

|

Best not bother with pension you get no benefit and very little money Comment from : @amandahudson2038 |

|

|

Hi there, I would like to know if I should opt into my employer contributions pension scheme or opt out and invest money into an index fund to gain compound interest overtime? What’s the best option? thanks Comment from : @glasgowrangersloyal4659 |

|

|

Thanks so much Mathew for the good work You have taught me so much I have learnt so much in 3 day watching your channel than I did in 30years I have a question, I work with the NHS, I want to know is it possible for me to have another private pension outside my NHS pension? Secondly will that affect my ISA account which I invested in S&P index with vanguard? Thanks, looking forward to hear from you Comment from : @ikennaasiegbu8441 |

|

|

All this is great if you worked for a decent company or the government, if you didn’t and had a low payed job most of your life this is irrelevant Comment from : @1eddwood |

|

|

Well explained Please advise with Defined benefit scheme what happens if you had to leave your job due to I’ll health before the retirement date Do you get any enhanced amount as a result? Comment from : @surinderkenth7064 |

|

|

I have a question, i have two pensionsbrOne is a work place pension which with nest i no longer work for the company and dont contribute to this pention, also this Nest pension does not accrue intrestbrShould i transfure this to my personal Pru pention which does make interst Comment from : @mickrobinson8150 |

|

|

Did I hear that right As an employee high rate earner I have to do self assessment to claim the higher rate back? Comment from : @purplemonkeydishwasher5269 |

|

|

Easily explained, just get Australia to pay for expat Brit pensions Solved Comment from : @seanlander9321 |

|

|

😊❤ß Comment from : @Stormer115 |

|

|

Can you explain why, for those of us who left the UK for Canada, that our UK pension is frozen at the point in time you first draw the pension, meaning we do not get increases on an annual basis like I would if I had remained in the UK? There are millions like me who are flabbergasted that we are losing money every year to this rule Comment from : @egastap |

|

|

So can I have a SIPP independent of any other pensions? As a 40 percent tax payers with far too much cash in the bank, how much could I put in per year? Only been in the UK since 2018, this is all still a mystery to me Comment from : @mikebreen2890 |

|

|

Hi I've set my pension to withdraw the lot at 55 its dc pension will I still be able to do this or do I have to wait until iam 58 Iam now 50 as I want to buy land with it at 55 thanks Comment from : @colscopters |

|

|

I’ve been self employed all my working life, I have never paid a stamp or what ever it is you pay, I was to busy working and I just never got round to it, so I don’t think I will get any pension, I’m 64 so if I live much longer I’m in trouble Comment from : @youtubeman5033 |

|

|

Great video Pete I wish I knew all this in my 20’s 😮 Comment from : @lindab4214 |

|

|

oes any one know how much the government receives say weekly monthly yearly from every one in the uk Comment from : @billybunter5575 |

|

|

If you die, that’s what I was concerned the most ! No one knows the future Pension companies should paid all your money you worked hard for to your children 😢 Comment from : @bouyasylla3275 |

|

|

I just feel that pensions are a way of raping the poor man of his many years of hard work and saving for such little reward but for all the time there are stupid people out there the guys at the top will keep pushing the importance of a pension pot am 57 and they want to inroll me into wpp lol no way I said another 10 hrs what sort of return would I get not alot I opted out and do so every year I decided to put a large chunk of my money by instead brSame with the youngest generation still paying NI contributions and they will get nothing when they retire I can hear the government you have a pension you won't get state pension that's the sad truth how do they get away with it gangsters in suites Comment from : @StanleyStuart-e3v |

|

|

When I was I white collar worker there was one phase saying drummed into my head if you have everything you get nothing if you got nothing you get everything fact Comment from : @StanleyStuart-e3v |

|

|

After 35yrs contributions to a state pension makes no difference to your pension cause all of your contributions are going towards people that can't work and won't work brOne thing you learn quick in this country they give and one hand and take away with the other sorry to be negative but these are the facts Comment from : @StanleyStuart-e3v |

|

|

Amazing thanks Comment from : @123sumom |

|

|

Please can you give your view on 'Aegon BlackRock World (ex-UK)' for my defined contribution fund choice Comment from : @matthewparker4517 |

|

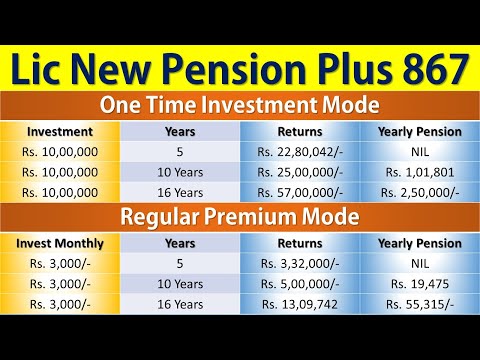

Lic New Pension Plan 867 | Lic Pension Plan 2022 | Lic New Pension Plus Plan | नई पेंशन प्लस योजना РѕС‚ : Insurance Clinic Download Full Episodes | The Most Watched videos of all time |

|

Are Pensions Still Tax Efficient? The 2027 Tax Changes You Need to Know. #pension #inheritancetax РѕС‚ : Xenia Download Full Episodes | The Most Watched videos of all time |

|

Increase Your 25% Tax Free Pension Lump Sum | UK Pensions РѕС‚ : Chris Bourne Download Full Episodes | The Most Watched videos of all time |

|

How much should you have in your pension? - Average UK pension pots by age РѕС‚ : Money to the Masses Download Full Episodes | The Most Watched videos of all time |

|

What income will I get from a £100K PENSION POT? - Retirement income explained (is £100,000 enough?) РѕС‚ : Money to the Masses Download Full Episodes | The Most Watched videos of all time |

|

Minimum RRIF Withdrawals u0026 The Pension Income Tax Credit Explained РѕС‚ : Parallel Wealth Download Full Episodes | The Most Watched videos of all time |

|

❗️MORGAN SILVER DOLLAR COLLECTING AND STACKING❗️THE BASICS EVERYONE NEEDS TO KNOW❗️MY COIN JOURNEY❗️ РѕС‚ : KY_Coins_and_Collectibles Download Full Episodes | The Most Watched videos of all time |

|

She Has 1000X Zoom Power in Eye So She Cheats Everyone??⁉️⚠️ | Kdrama Movie Explained in Hindi РѕС‚ : Mr Hindi Rockers Download Full Episodes | The Most Watched videos of all time |

|

What Everyone Gets Wrong About Global Debt | Economics Explained РѕС‚ : Economics Explained Download Full Episodes | The Most Watched videos of all time |

|

Deciphering Your FERS LES (Leave and Earnings Statement) to Maximize Your Pension РѕС‚ : Haws Federal Advisors Download Full Episodes | The Most Watched videos of all time |