| Title | : | Martin Lewis Busts Pension Myths With His Money Masterclass | This Morning |

| Lasting | : | 7.56 |

| Date of publication | : | |

| Views | : | 306 rb |

|

|

£16000 before its taxed, £12000 after tax In twenty years time when i retire the £12000 will have the purchasing power of £8341 so i will have lost £3659 Comment from : @RATIONALSATANIST |

|

|

After watching this, I've not learnt anything which is a good sign, all of this I'm aware off, work towards my pension continues with a view as suggested by Martin when I reach that age of handling my pension (note, I have 7 pensions that I'm tracking, 2 final salary, 5 private)brbrOther key rule, start saving into your pension as early as possible, I started at 18 Comment from : @Ian-xq4rt |

|

|

Move abroad Comment from : @AG-so4gl |

|

|

I was a stay at Home mom with no money in my IRA or any savings of my own, which was scary at 53 years of age Three years ago I got a part time job and save everything I make After 3 years, I am 56 yo and have put $9,000 in an IRA and $40,000 in my portfolio with CFA, Evelyn Infurna Since the goal of getting a job was to invest for retirement and NOT up my lifestyle, I was able to scale this quickly to $150,000 If I can do this in a year, anyone can Comment from : @DannielleRosales |

|

|

I'm 54 and my wife and I are VERY worried about our future, gas and food prices rising daily We have had our savings dwindle with the cost of living into the stratosphere, and we are finding it impossible to replace them We can get by, but can't seem to get ahead My condolences to anyone retiring in this crisis, 30 years nonstop just for a crooked system to take all you worked for Comment from : @AlilatTiamiyu |

|

|

Wouldn't it be amazing if Martin Lewis ran for prime minister I'd vote for him Comment from : @arebrec |

|

|

My pension has been reduced although my contributions are fully paid In my late 40's genetic muscular dystrophy kicked in although I continued working several more years I owned a two bedroom flat in a Victorian house with many stairs so was forced to sell at a loss as it was during the bank crisis The day after I sold Brown changed interest rates without warning & property went up I lost most by renting as I could no longer buy so moved in with family for a while (bid mistake) I still have some savings but my pension is reduced for what is left I have to buy furnishings as I was forced to move when my landlord sold my flat & new furniture & will have to contribute to future care as my condition is progressive I hope Labour ministers suffer severe karma for what they have done to the vulnerable The irony is that my grandmother was rich but my mother made no will so her money went to the daughter of her second husband (he had dementia but outlived her by months), my grandmother hated both Comment from : @paulstuart551 |

|

|

Swissrow 😢 Comment from : @user-fv1576 |

|

|

Managing money is different from accumulating wealth, and the lack of investment education in schools may explain why people struggle to maintain their financial gains The examples you provided are relevant, and I personally benefited from the market crisis, as I embrace challenging times while others tend to avoid them Well, at least my advisor does too, jokingly Comment from : @nicolasbenson009 |

|

|

You talk about what you get in your pension but you dont talk about what is taken away when you start getting your pension My mum is bombarded with care bills now she hasa pension compared before she had a pension, it makes me think is a pension worth it Comment from : @pauldolman7487 |

|

|

These presenters look totally flummoxed but I doubt they have to worryprobably on 200k with a gold plated pension Comment from : @adams7405 |

|

|

Cashed mine in i paid a grand in got 750 back complete scam, with now pensions group, worst scam ever is the state pension ! Comment from : @doglover-t9b |

|

|

I sold an apartment in Springfield and made about $250K I was frustrated when I only earned $171 in interest from a regular savings account After doing some research, I was advised to invest in stocks Are these stocks a good point to start from? Comment from : @matteohenry33 |

|

|

Just read martins money tips and even he’s fooled by UP-TO which everyone knows is a joke Comment from : @Thomas-g5t2k |

|

|

His brain is swiss roll I think He has some good points and ideas but the last few years he's lost it to marketing Comment from : @jamesfoo8999 |

|

|

I don’t work and still pay 2k a year into pension get tax relief Comment from : @156dave |

|

|

I cannot stand that pratt Comment from : @CarlosAlberto-ii1li |

|

|

Pension schemes often fall short of providing adequate retirement income, leaving many retirees with insufficient funds to maintain their desired standard of living, due to factors such as low contribution rates, poor investment returns, and increasing life expectancy Comment from : @LilianScott-dy5nz |

|

|

The two Swiss Rolls didn't help to understand the point he was making 🤷 Comment from : @jay-lm4we |

|

|

Wait until the Autumn Budget when Labour strike again Comment from : @Mudplucker |

|

|

still dont get it Comment from : @grindle1234 |

|

|

In view of Kier getting into power you're going to have to review your suggestions and proposals, or drop this video Comment from : @Peter-uu2tn |

|

|

She is scratching a lot are there fleas in the studio ? Comment from : @crumplezone1 |

|

|

As clear as mud, Comment from : @RaymondMoore-c4g |

|

|

It is not a benifit, I paid all my life into my uk pension! 15 to 66! Comment from : @terasci5102 |

|

|

Great advice as always Comment from : @RosieHarp |

|

|

Working exponentially harder for currency that is getting exponetially weaker (in purchasing power) is the road to serfdom! Comment from : @finglisCave |

|

|

Ring fence pensions,this would give the chancellor more money Comment from : @stevewright8204 |

|

|

What?? Vast majority have small company pension, very small if you changed jobs but enough to make you pay tax when you retire - so even my 80 pence per week for reaching 80 is taxable!! Comment from : @atnassayshi2505 |

|

|

By the way if you have extra cash also have a private pension on top of your workplace pension Every 80p you put in the government top up 20p also On top of that they give you tax relief in your income tax :)brPS you say you can get into the cash of private pension at the age of 55one pension company said it has not increased to the age of 57 due to government guidelines Comment from : @lin90210 |

|

|

It is actually 25 added In order to make up the gap of 20 tax, the gov have to add 25 For example, if you earn £100 and are taxed 20 you are left with £80 If you add that £80 to a pension, the tax relief makes it back to £100, which is a 25 increase of the £80 I am baffled why so called experts always get this wrong Comment from : @TheSilvercue |

|

|

A lot of people with family single earner cannot afford £100 per month😊 Comment from : @MEF1215 |

|

|

I wouldn’t pay into a pension now days the government will only steal it at the end Comment from : @Annie-yv7rc |

|

|

I've got an Artic roll and I'm afraid due to global warming nothing will be left when I retire! Comment from : @zenstars1148 |

|

|

Just discovered your channel with this video -- I was able to think about my situation and I'm curious to know best how people split their pay, how much of it goes into savings, spendings or investments, I earn around $90K per year but nothing to show for it yet Comment from : @myah00jordan |

|

|

Hes just repeating the same thing he said when he was on last time Comment from : @marton349 |

|

|

Withdraw it all earliest possible time pay a wedge in tax but spend why your youngish Comment from : @muzzer8869 |

|

|

He loves himself so much he over-explains and thus complicates what is actually relatively simple Comment from : @derekwholden |

|

|

I can see the tax relief on pension payments going before the years out Comment from : @chrisstevens8505 |

|

|

Remember the the age limit for taking it goes up from 55yrs to 58 yrs in 2028 Comment from : @farnyone |

|

|

I paid in from 16 years old with the NCB until 30 and Paid in to DCC for 24 years Retired at 54 best thing I ever did Comment from : @ivanglossop5106 |

|

|

Money is a tool to be put in position so it can print more money for you Comment from : @ashassets |

|

|

Im a bit confused What age do i get my swiss roll? Comment from : @robuk3723 |

|

|

The vast amount of Workplace Pension money can be used by the next Labour Government to finish Big Government projects like HS2 They can give it to the Water companies to sort out the sewage problems One advantage of Pension Schemes is you are stopped from taking it out allowing Governments to re-allocate it's use Fortunately for the rich who keep their money off-shore they won't suffer the pain Comment from : @curiousinterests9453 |

|

|

That is all well and good for people with secure jobs and skill sets tht don't fade with time So what do the everincreasing class of people do who are on zero hour contracts, or work in the gig economy? Comment from : @Lifeintheslowlane16547 |

|

|

All sounds good, but just you try any of this if you left the UK and live outside the EU All those options reduce to only one option: Withdraw the entire amount as a lump sum, jump into a super-high tax bracket because of it, and pay tens of thousands of pounds in taxes that you would not have to pay if you stayed in the UK and withdrew it slowly over time Comment from : @mathematician1234 |

|

|

Start paying in young, it's those ealy years of investment that will earn the most and will make up the bulk of your pension pot(s) Comment from : @Paul-yh8km |

|

|

Make people aware of MPAA when talking about drawing pension income Comment from : @LiamR90 |

|

|

If you do a net contribution it's actually a 25 top up The maths is the same as 20 tax relief thoughbrbrIe Put £800 in and it becomes £1,000 Comment from : @LiamR90 |

|

|

Can get at it until your 57 not 55, come on man Martin keep up! Comment from : @peterb8500 |

|

|

So put money away for day 30 years Hopefully you will have a lump sum ? Do you think Taxes will increase in 30 years or decrease !! Comment from : @paldavi2876 |

|

|

If you're under 40, you would be insane put anything in a pension Zero chance of ever seeing a penny of it Comment from : @jackryan2135 |

|

|

Labour are going to change all the pensions rules to raise tax so I’ll look forward to a new Martin discussion on how to avoid them? Comment from : @stephenthwaite3115 |

|

|

I pay 2k per year into my pension and my employer tops it up by 10k ! No savings account can come close Comment from : @ynwa3476 |

|

|

In 30 years there will be no state pension unless you have spent your life on benefits! Comment from : @craigrothwell6144 |

|

|

I do not no any poor pensioners, Some of which have never paid a penny into the system! Comment from : @craigrothwell6144 |

|

|

I dont understand how the last bit is not taxable because youre not a "tax payer" Anything you take out of a pension is considered income, so its still taxable over your personal allowance of 12k right? Comment from : @babyfreezer |

|

|

One inaccuracy here is that if you take the jam first sponge late option you will not be a non taxpayer if you draw your state pension because that will use up most of your personal allowance Probably the best you can achieve is paying tax at only basic rate Comment from : @tangoterrier |

|

|

Yeah put money in you pension and let the goverment tell you when you ca retire 🎉 Comment from : @BrantJonah |

|

|

Martin Lewis makes money out of the not so savvy public He tries to be a modern day robin hood but in my opinion that is not the case Comment from : @clstravel |

|

|

Yeah, because employers have unlimited money to waste on employees ! Comment from : @andyasia |

|

|

I’m sorry but he should no longer be called Martin Lewis, it should be Sir Marin Lewis! Comment from : @TazBo-wd2ig |

|

|

It's a loud b*b****/b and all you're gonna get is mugged at the end of the day when it comes to claiming it And make sure that you put down next to kin or otherwise they keep it Comment from : @jojackson2818 |

|

|

hello Comment from : @superlative_custard |

|

|

Trouble is the tax threshold being kept at £12,570 so once’s the state pension is factored in most will still be paying tax even on a small pension 😡 Comment from : @s9enny |

|

|

Can someone explain how 3 of £100 is £60? Comment from : @mattm7007 |

|

|

Love a workplace pension 34 and 70k in mine already Compound interest is your friend Comment from : @garybarnes9254 |

|

|

We have the eorst pension in the western world Comment from : @bowjana8128 |

|

|

Don't mind Cat she's just having a seizure 🤣🤣🤣 Comment from : @Kiwiboy1929 |

|

|

i think he dyes his hair to look younger than he is Comment from : @beetleything1864 |

|

|

But what if I don't like Swiss Rolls? Can I apply the same to Collin the Catapillar even though it's not my birthday until November?? 😥 Comment from : @qdis662 |

|

|

Pensions are still being sold as if they mean something, but government seems intent on forcing people into buying overpriced government bonds from the insiders I doubt pensions of this type will be worth that much when it comes to retiring Comment from : @InvestgoldUK |

|

|

The House of Lords or the “Upper Chamber” should consist of people like Martin Lewis! A subject matter expert there to advise the elected government and hold them and their policies to account A person who doesn’t have (at least strong or overt) party political views but does have a view of what is right and wrong based on his specific expertise and a sense of moral fibre! Reform the lords to include more people like this! Comment from : @samlight95 |

|

|

I wish Martin had covered the scrapped LTA and Keir's statement that Labour would bring it back It is great having your 40 saving plan used as a political football Comment from : @markkenyon8760 |

|

|

Pre tax salary or pre tax income ? I’ve deferred my SE pension and have a small rental income that will soon drag me into paying tax due to fiscal drag I’m still paying contributions to my pension scheme - is this tax allowable ? Comment from : @lawrie3448 |

|

|

Wish I wasn't thick Too complicated Comment from : @russellthompson9271 |

|

|

Martin should be chancellor 👌 Comment from : @Leon-lt5gv |

|

|

Pension is like a ponzy scheme Comment from : @loslos2650 |

|

|

I'm becoming more convinced every day that for anyone under the age of about 45 pensions are now a complete waste of time 😢 Comment from : @andrewpepper3145 |

|

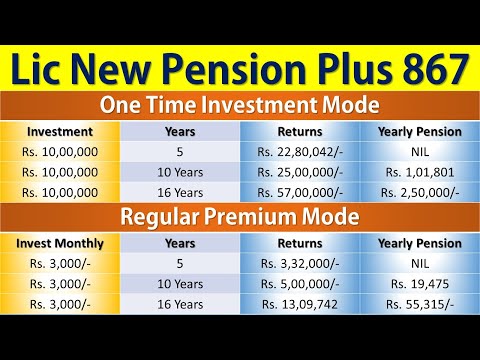

Lic New Pension Plan 867 | Lic Pension Plan 2022 | Lic New Pension Plus Plan | नई पेंशन प्लस योजना РѕС‚ : Insurance Clinic Download Full Episodes | The Most Watched videos of all time |

|

Martin Lewis Reveals His Expert Money-Saving Travel Tips | This Morning РѕС‚ : This Morning Download Full Episodes | The Most Watched videos of all time |

|

Martin Lewis Shares His Advice on Mortgages | Good Morning Britain РѕС‚ : Good Morning Britain Download Full Episodes | The Most Watched videos of all time |

|

Money Saving Expert Martin Lewis Offers Advice to Thomas Cook Customers | Good Morning Britain РѕС‚ : Good Morning Britain Download Full Episodes | The Most Watched videos of all time |

|

Martin Lewis Offers Advice on Solar Panels | Good Morning Britain РѕС‚ : Good Morning Britain Download Full Episodes | The Most Watched videos of all time |

|

5 Student Finance Essentials You Need to Know With Martin Lewis | This Morning РѕС‚ : This Morning Download Full Episodes | The Most Watched videos of all time |

|

How To Get Cheaper Car Insurance With Martin Lewis | This Morning РѕС‚ : This Morning Download Full Episodes | The Most Watched videos of all time |

|

How much should you have in your pension? - Average UK pension pots by age РѕС‚ : Money to the Masses Download Full Episodes | The Most Watched videos of all time |

|

Essential Hayek: Economic Booms and Busts РѕС‚ : The Fraser Institute Download Full Episodes | The Most Watched videos of all time |

|

6 Pension Secrets That Could Get You an Extra £10,000 or More | This Morning РѕС‚ : This Morning Download Full Episodes | The Most Watched videos of all time |