| Title | : | How Pension Income Affects Social Security Benefits |

| Lasting | : | 6.04 |

| Date of publication | : | |

| Views | : | 92 rb |

|

|

Make sure to check out our video Pension vs Lump Sum Buyout: Which One is Best? youtube/LmBjqUO4dac Comment from : @StopBeingSoldMedia |

|

|

Hi sir,brIf possible can you provide a brief video on how to calculate SSA and pension from 1040 Comment from : @shalukumar7584 |

|

|

Amazing video, A friend of mine referred me to a financial adviser sometime ago and we got talking about investment and money I started investing with $120k and in the first 2 months , my portfolio was reading $274,800 Crazy right!, I decided to reinvest my profit and gets more interesting For over a year we have been working together making consistent profit just bought my second home 2 weeks ago and care for my family Comment from : @MorinsRosses |

|

|

It’s ridiculous Why don’t they leave our money alone we didn’t ask for this just leave us alone I worked at a place for 30 years Only got $1300 and I got my husband‘s pension and now they want to take money back from you from the city this is just ridileave our money alone And now I’m just getting up to Comment from : @barbarahayes7176 |

|

|

Seriously you act light we are dumb and talk but no information Comment from : @georgekershner6626 |

|

|

I don't understand I worked and contributed to social security for almost 20 years but for the last 5 I've been working for the gvrt and contributing into a pension So, am I not going to receive one of those? Comment from : @zamev |

|

|

But what about private pension?🤔 Comment from : @alvarodias68 |

|

|

I love the security of a pension, but I want my child (in the era after pensions were taken away) to focus on Roth and brokerage Get that $0 taxable income, 0 capital gains, and 0 taxes on Social Security Win, win, win Comment from : @papasquat355 |

|

|

Pensions don’t affect SS Comment from : @Earthtime3978 |

|

|

The guy did a great job, but the giggling girl added nothing to the content Actually, she made it hard for me to continue listening Comment from : @TheTangoAlfa1 |

|

|

I'm 54 and my wife and I are VERY worried about our future, gas and food prices rising daily We have had our savings dwindle with the cost of living into the stratosphere, and we are finding it impossible to replace them We can get by, but can't seem to get ahead My condolences to anyone retiring in this crisis, 30 years nonstop just for a crooked system to take all you worked for Comment from : @FlorentGulliver |

|

|

🤪🤷♀️?? Comment from : @debraparker1550 |

|

|

We Are in Unchartered Financial Waters! every day we encounter challenges that have become the new standard Although we previously perceived it as a crisis, we now acknowledge it as the new normal and must adapt accordingly Given the current economic difficulties that the country is experiencing in 2024, how can we enhance our earnings during this period of adjustment? I cannot let my $680,000 savings vanish after putting in so much effort to accumulate them Comment from : @Anitasolomon-u4p |

|

|

I have a Broward County State Pension Does that Affect ? Yes I payed taxes Comment from : @mireles811 |

|

|

Work two jobs for a larger retirement and the Gov eliminates half of your SS benefits What a crock of shit and how is this fair???? The Gov hates people who are successful and love to keep us poor Comment from : @tray8411 |

|

|

3:08 my mom has 12 years is she excempt Comment from : @thedonzo506 |

|

|

If pension or social security but only choose one may be better than both Comment from : @TriPham-j3b |

|

|

30 cent s on the dallors per day if you're still living on your own Comment from : @paulsaragosa371 |

|

|

Thy Chessmaster said thy totally amount s of money 💰 money that you made interest and massive amounts of money 💰 don't ever rely on the social security system at all costs okay Comment from : @paulsaragosa371 |

|

|

Am 58 retiring next year but the thought of retirement gives me weakness My apologies to everyone who have retired and filing social security during this time after putting in all those years of work just to lose everything to a problem you never imagined to happen It’s so difficult for people who are retired and have no savings or loved ones to fall back on Comment from : @Beatricegove733 |

|

|

So, the person who works TWO jobs, or twice as hard gets the Social Security benefits cut? That sounds very social(ist), I thought when you paid into a Plan B, you would get “what you paid for” Imagine yo pay for a pallet of cinder blocks, and paid for the entire pallet, you see the truck stop and drop off only half of your order, when the Delivery Driver says they cut the delivery in half because you received a “windfall” ! Comment from : @harrychildress4575 |

|

|

I get a pension from the City of Philadelphia and I also get SS My SS wasn’t affected at all Comment from : @christophersmith505 |

|

|

With a ROTH there are no RMD’s and no matter how much you withdraw, your SS check is not reduced Comment from : @backcountyrpilot |

|

|

I get a pention a annuity,SS and a stock portfolio I hope I’m good Comment from : @jimcatanzaro7808 |

|

|

56 seconds into this, the guy takes off into "two scenarios" that come into play But it doesn't apply to me or MOST people UNLESS they don't contribute to SS/FICA Whatever is in the final 5 minutes? Leave me a note This guy is working up a head of steam to comment on the ways exceptions play out without the most COMMON info The opposite of listen to the end delsigh/del Comment from : @timisaac8121 |

|

|

just another way the government can screw you over in mass we have a double dipping law that spanks you if worked in state and regular jobs you get less SSI money Comment from : @remir2010 |

|

|

It seems so unfair, especially when you're the employee help so many people and you have worked hard to get a pension, only to find out you won't get social security, because it's not enough to get by on in today's economy Great podcast ❤ Comment from : @StevenPhelps-sr8co |

|

|

I retired from the military and have worked for over 40 years I get my Army and VA pension and will collect my social security when I turn 62 wwwssagov/pubs/EN-05-10017pdf Comment from : @fortgrove3166 |

|

|

My retirement is made up of a military annuity (23 years), FERS annuity (22 years), VA disability (10), and TSP monthly withdrawal I just got my SS letter explaining that none of those matter and I'll be getting $1570/month starting next month Pretty sweet, even though SS should be done away with since it's A-unconstitutional, and B-terrible return on the $$ paid in Comment from : @HeinzGuderian_ |

|

|

Wondering what my retirement would look like I work for a government contractor that collects SS and I have a pension through that company (private) Comment from : @robertl9065 |

|

|

I received a part of my ex wife’s pension I haven’t collected any of it yet I am 63 years old and I am going to take social security next year Comment from : @jetclntn |

|

|

I'm 56 I retired in 2018 worked 30 yrs for a company now receiving a pension though Teamsters Retirement didn't work for me , so I went back to work 2019 in a different field My plans are to apply for SS at 62 giving me 2 sources of income, that being my Pension and SSbrMy question is, will my pension income compromise my SS ? Comment from : @abrahamjackson6019 |

|

|

I am a retired copnot yet retired, but if i understand the windfall correctly they will be taking 60 percent of my ssi have a small ss that will be 1000 k when I turn 62 and I will be left with 400 dollars each monthfor the life of me I do not understand why I have to get dinged on thisI did not pull the 40 quarters out of my assI worked for that from 1981 to 2019 of course with some very small earning years and even about 5 zero years I can not complain due to have 3 pensions and a VA disability, but I still busted my butt for those quartersOh well Comment from : @US_ARMY_25_INF_DIV |

|

|

Ia a police officer never paid into SS and not entitled to regular SS Are they eligible for Spousal benefits? Comment from : @bigtoeknee11 |

|

|

You need to distinguish between spousal benefits and survivor benefits If one spouse was covered by SS and another had a pension subject to windfall elimination and Government pension offset and the spouse with the Government pension passes away, the surviving spouse will begin to receive the survivors portion of the Government pension without it affecting their own entitlement to social security (no offset/windfall elimination for the surviving spouse of someone receiving the Government pension) This is a very important exception to the rule! Comment from : @jameslandolt5835 |

|

|

Great links Comment from : @frances4773 |

|

|

If I worked for a municipality and paid social security tax, and now I’m receiving a pension My Social security does not get penalized? Thank tou Comment from : @jrperezphotography |

|

|

I worked for the Federal Postal Service for over 30 years I have been collecting a federal pension since 2010 No SS was ever taken out Since 2010 I have been in the work force paying in to SS I want to retire from that now soCan my wife who has never worked, can she collect my SS since I can't because my federal pension is too high? Comment from : @CultureWars_ |

|

|

WEP is a government rip off… Plain and simple Comment from : @thedolt9215 |

|

|

I served just over 30 years as an active duty US Marine Are my benefits to be reduced or am I exempt from any reduction (during the video you appeared to say both) Comment from : @richardcoleman1083 |

|

|

I have a county pension when I retireI pay ssi all of my jobsWhen I take my pension and not ssi until later do they still take fica payments out of my pension paymets?If yes do they stop taking fica once I take ssi? Comment from : @bluecollarbullionballer4269 |

|

|

MISSOURI TEACHERS BEWARE: Social Security will STEAL your benefitsespeciallyyour SURVIVOR BENEFITS! Repeal: WEP & GOVERNMENT PENSION OFFSET HR 82 S 597 My deceased husband PAID INand I DON'T get ANY of his larger benefit! Theft!!! Comment from : @jimbrauer1711 |

|

|

I paid into SS for 46 years I also paid state taxes in Kentucky for 46 years or more State workers wanting SS because they paid in is like me asking for a state pension because my tax dollars funded the state pension system Currently taxpayers are contributing 30 of salary to teachers' retirement in Kentucky By their own logic I should get a public pension Comment from : @glockonr |

|

|

My pension is from the State of Alabama for the years 2001-2019 I have worked 22 years before and I know SS was taken and presently working Will my pension make a difference in my social security monthly payment? Comment from : @lisac6609 |

|

|

I have Military pension and paid social security for 20 years the Social security administration website says I have 40 work credits Will they reduce benefits? Comment from : @layndretti13 |

|

|

Began collecting pension from my County Hospital RN job at 55 Claimed Social Security benefits at 62 That combo gives my finances a nice 1-2 punch The extra money provided me by Social Security,helped me get out of debt within 9 months Comment from : @christopherhennessey8991 |

|

|

What about retired military? I retired from the military after 20 years service and I paid into Social Security the entire time Will I get my full Social Security Or will they consider my retired military pension a source of income and I will not be able to go over that 1950000 Without being penalized by Social Security Comment from : @SgtD1981 |

|

|

Even if you worked in another country you also fall under WEP, which is not fair I worked 23 years in Germany and 26 years in the US Comment from : @beautyRest1 |

|

|

Thanks so much for watching! We invite you to SUBSCRIBE to NOT being a transaction ever again bitly/33TpKqD Comment from : @StopBeingSoldMedia |

|

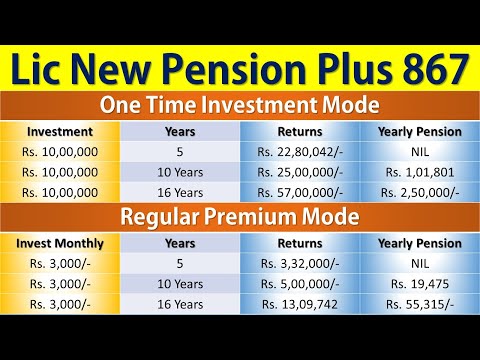

Lic New Pension Plan 867 | Lic Pension Plan 2022 | Lic New Pension Plus Plan | नई पेंशन प्लस योजना РѕС‚ : Insurance Clinic Download Full Episodes | The Most Watched videos of all time |

|

NEW Social Security Benefits Bill Boosts Payments SSA SSI SSDI Medicare Social Security Update РѕС‚ : its Jimmy Download Full Episodes | The Most Watched videos of all time |

|

The Social Security earned income limits do NOT include your Social Security payments РѕС‚ : The Medicare Family Download Full Episodes | The Most Watched videos of all time |

|

Social Security Disability - How Age Affects Eligibility РѕС‚ : Disability Advantage Group Download Full Episodes | The Most Watched videos of all time |

|

How much should you have in your pension? - Average UK pension pots by age РѕС‚ : Money to the Masses Download Full Episodes | The Most Watched videos of all time |

|

What income will I get from a £100K PENSION POT? - Retirement income explained (is £100,000 enough?) РѕС‚ : Money to the Masses Download Full Episodes | The Most Watched videos of all time |

|

2025 Income Limits While RECEIVING Social Security, SSDI, SSI u0026 Survivor Benefits РѕС‚ : Social Security 247 Download Full Episodes | The Most Watched videos of all time |

|

Social Security Disability SSDI is based on how much you earned and paid into Social Security РѕС‚ : The Medicare Family Download Full Episodes | The Most Watched videos of all time |

|

VA Disability u0026 Social Security Disability Insurance | VA u0026 SSDI | Social Security | theSITREP РѕС‚ : U.S. Dept. of Veterans Affairs Download Full Episodes | The Most Watched videos of all time |

|

Social Security Explained | How to Maximize Your Social Security Benefit РѕС‚ : James Conole, CFP® Download Full Episodes | The Most Watched videos of all time |