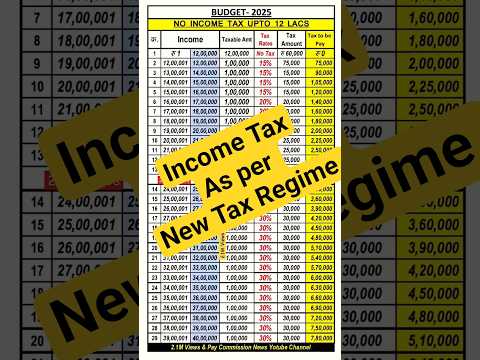

| Title | : | NEW Income Tax Calculation 2025-26 | Tax Slab Rates for Old u0026 New Tax Regime (Examples) |

| Lasting | : | 16.38 |

| Date of publication | : | |

| Views | : | 148 rb |

|

|

Even after paying 29 rupees, I still haven't got the excel tax calculatorbrbr Comment from : @xavierfernandis2810 |

|

|

I paid twice but u didn't gave link to download Ur fack Comment from : @advocateroopesh1756 |

|

|

केवल 10 लाख का stcg hai Fy 25-26 me kitna tax lagega Comment from : @vinodKumar-jk6fn |

|

|

Sir papa ki income 1396000 hai kitna tax lagega please bataye Comment from : @sonusunil568 |

|

|

Hi Comment from : @sonusunil568 |

|

|

Form 16 ki exam link send kijiye aap Comment from : @LokeshKumar-cb3ym |

|

|

Hi, Super!!! Hi,

bris the new excel calculator applicable for senior citizens and super senior citizens? Your excel file should include the option for resident / non resident / salaried / senior citizen / super senior citizen etc and their standard deductions and rebates under new regime Thanks Comment from : @svgkvideos |

|

|

Good guidance Comment from : @Rabin3668 |

|

|

as known, all about old tax regime, please make separate video for New Tax regime why mixed old and new Comment from : @sunildeshmukh2910 |

|

|

How much tax shud i pay if my income is 13L & paying home loan interest -2L ?brIn old tax & new tax ? Comment from : @vengaimavan8585 |

|

|

Thank you brother you're the best ❤ Comment from : @kabininadichuvannappol |

|

|

yar jab calculation up to 1275000 rs tak ka shi hi but beyond that calculation not correct you should pay the tax from start slab Comment from : @Anishkumar-jy6wc |

|

|

Bhai 12 lac gross income ya ctc? Comment from : @gauravmander3325 |

|

|

NicebrWant to know any rebate in new tax regime expect standard deduction Comment from : @aadishrusticollectionofkno573 |

|

|

HellobrI have a question brbrIf we file 2024-25 returns in may 2025 (salaried individual), will this new 12 lakh income rule be applied, or the old 7 lakh will be there?brPlease let me knowbrThanks in advance🙏🏼 Comment from : @sunandasardar7515 |

|

|

This IT slab will make more enemies for BJP than friends For, already people are grumbling that those who have income slightly above 12 lakhs, have to pay full IT This will create more liers, bluffers, risk takers, those who are within the 12 to 15 bracket BJP has just disturbed a hornet's nest Instead, they should have made it totally nil tax upto 12 lakhs instead of fooling people Comment from : @sttreetboy |

|

|

Government is confused and confusing about tax Comment from : @Satyanarayana0517 |

|

|

I have a query like if someone earns 13 to 15 lakhs and choose New Regime And if there is investment in 80cc and 80 dd should this be shown to income tax while filing IT Return Comment from : @abhishekchakraborty8838 |

|

|

Hi,bris the new excel calculator applicable for senior citizens and super senior citizens? Your excel file should include the option for resident / non resident / salaried / senior citizen / super senior citizen etc and their standard deductions and rebates under new regime Thanks Comment from : @svgkvideos |

|

|

Very informative Comment from : @eknathchikane5825 |

|

|

What about those sr Citizens who have no pensionand have only interest income earned from FDR Comment from : @sidiqi7867 |

|

|

Sir can you please confirm us which tax regime is good for 10-11 lakh income Comment from : @ajamoddinmomin8965 |

|

|

80ccd2?? Comment from : @UdaySingh-im4hd |

|

|

Lekin sir sob log bol raha hay ki Budget me jo 12 lakh tak income tax jhut hay wo is sall se lagu nehi hogawo agle sall se lagu hoga Comment from : @tupaighosh8290 |

|

|

Good video I have a query what proof we have to show for standard deduction of 75k in new tax regime Comment from : @RupaliDas-g5g |

|

|

Wrong calculation for new tax regime Comment from : @anujdixit7306 |

|

|

for 13L the tax 26,000 in new regime seems not correct, should be 66,300 right? Comment from : @lokanathmishra6512 |

|

|

Your calculations are wrong, take your video down and recalculate before uploading Comment from : @AST7117 |

|

|

Paid Rs29 but not downloaded Comment from : @tirupathirao6630 |

|

|

what if my income is 1275000 Comment from : @preyasnandedkar230 |

|

|

🎉🎉🎉 Comment from : @sumitkumar-ts1ii |

|

|

My gross salary is 1435000what I choose old or new tax regime Comment from : @SANJAYPATEL-x6y2j |

|

|

Sir what about 80 U exemption for disabled persons Comment from : @aejazpasha5344 |

|

|

To kiska income 15lakh and above gai Uska to koi fayda nahi Aur 12 lakh se jyada kamana matlab to Gunah hogaya Comment from : @motoziast6407 |

|

|

DO YOU INCLUDE FORM 16 IN YOUR EXCEL FILE? Comment from : @aijazuddinobaid3416 |

|

|

Sir mai ne 29 pay bhi kar diya par download nahi huya Comment from : @Rajputpavan-qt7qh |

|

|

So 25 lac difference in tax between New and Old Tax Regime for 25 lacs incomebrThis will mean deductions required is 833 lacs which is highly unlikelybrThere is no need to compare nowbrNew Tax Regime will be beneficial in almost all cases unless you are hiring a CA to claim deductions which are generally not usedbrThus Old Tax Regime has been eliminated without actually closing it Comment from : @Sabita-w9j |

|

|

Mera papa ka salary 70k ha to kya koi tax nahi laga ga 😅 please btaya bhyaa ❤ Comment from : @DEBAPRIYOSAMUI-e5w |

|

|

Is it applicable from 2025-26 AY Comment from : @shivnandanmishra3809 |

|

|

DIRECT TAX brSubject - slab brrebate Limit : raised from Rs 7 lakh to Rs 12 lakh for which Assessment Year either 2025-26 or 2026-27 Comment from : @incometaxlibrary5841 |

|

|

If some one has 30 lpa approx, will he get any benifit of the announcement of no tax up to 12 ??? Comment from : @VinayGautam-s8s |

|

|

Sir my only source of income is through stock trading ( short term) brMy income is around 8-9 lakhs per annum only in stock not F&ObrShould i pay tax or zero tax upto 12 lakh Comment from : @arijeetchakraborty1436 |

|

|

13lac par 75000 tax lagega app ko kach bhi malum nhi hai 12lac Tak hi 0 hoga Comment from : @khyaliram842 |

|

|

beawakoo ki tarah explain kiye hobrjust online app use kar kbr13L me 26K kaise ho gya?brkis hisab se?brtukka maar ke?brBaaki to bacha bhi calc kar legabrmain point ko hi skip maar diye ho Comment from : @ironman3482 |

|

|

CA ho ya utuber Comment from : @AJAYKUMAR-im1ye |

|

|

I have paid for the tax calculation sheet and not received any download link Send me the link Comment from : @bharteshkatke1891 |

|

|

For taxable income 1300000 you calculated Rs 26000 leaving slabs of 5, 10 and standard deduction 75000 Observe minimum commonscence Comment from : @reddappaogeti5152 |

|

|

आपका calculation galat hai Please check amendment again Comment from : @amol6873 |

|

|

Tax rebate 80000hai Comment from : @amol6873 |

|

|

Does this include cess ? Comment from : @theteamol22 |

|

|

Good Comment from : @tkbhudhbelastory |

|

|

Mene excel ke liye payment Kiya or mujhe excel nhi send Kiya ye fake hai Comment from : @amitsahu5290 |

|

|

How to calculate tax for assessment year 2022-23, I have not filed itr for that year Comment from : @shrikantkattimani8028 |

|

|

Thanks sir Comment from : @kuldeepvaish6745 |

|

|

Can I download your excel sheet Comment from : @mudikasoni |

|

|

New regime is best Comment from : @qursheedali2684 |

|

|

Thank you so much Comment from : @shaikhsaif715 |

|

|

Wrong informationU missed 5 and 10 in new slab Comment from : @Dream_hunter_2025 |

|

|

new (2025) tax calculation is WRONG Comment from : @bmx-in |

|

|

Sirbr1 For a sr citizen, the bank interest deduction has been increased from 50000rs to 100000rs brbr2 The standard deduction has also been increased by another 25000rsbrbrIf my total income is 1350000rs can you please explain the amount of tax that I may have to paybrbrThanks Comment from : @kannans9927 |

|

|

Jab 60k dena hi h toh 5or10tax kyu le rhi h Comment from : @RahulYadav-ni9kh |

|

|

13 lakh pe 65000 Comment from : @rabimajhi6262 |

|

|

It is a superb analysis comparison between the Old and New regime i have seen many videos yesterday but this video has clarified all my doubts thanks keep going on Comment from : @IloveIndia-md |

|

|

Ye rebate monthly salaries se deduct he nahi hogi ya ITR bhrte time pe 60 K return aayegabrPls Inform Comment from : @mednet8171 |

|

|

How come 13 lac pe 26000 ka tax even i deduct 75000? Comment from : @manishmowar9226 |

|

|

ThanksIf my salary is 10 lakhs per annum, from my monthly salary will they deduct tax and we should claim refund while filing return or they will not deduct any tax Comment from : @srk14314 |

|

|

15:00 INCOME OF 1500000 Comment from : @raveeshroy |

|

|

Thanks Well explained I already made the payment Comment from : @vijaykeer2950 |

|

|

Please correct new tax regime figure to 66300 instead of 26000 Comment from : @phaltukam |

|

|

How much tax for 135 lakhs bro, pls someone please tell me Comment from : @Audi0000 |

|

|

Old me upto 8 lac exemptions kaun lageyega Comment from : @deepakarya1077 |

|

|

You have to add cess on tax Comment from : @shankark5149 |

|

|

मार्जिनल रिलीफ का प्रावधान है अथवा नहीं? Comment from : @spneducation701 |

|

|

Thanks for sharing I was waiting for this video ❤ Comment from : @Engineeryogeshpawar |

|

|

Excel income tax is calculation excellent I need clarification for salaried emp exampted upto 1275000/- if 1500000 salary person tax should be calculate on 225000/- than how come 97500 tax? Comment from : @prabhakarm1197 |

|

|

Very nice calculation sir😊 Comment from : @swatantrakumar773 |

|

|

Thanks Great vdo Informative and user friendly Comment from : @deeppahalwan5300 |

|

|

There should be Rs 75000 tax instead of 26000 on 13 Lakh income in new tax slab Comment from : @mlnassociates9205 |

|

|

Ye calculation totally galat haibrKyo kisi ko gurah kar rahe ho bhai Comment from : @swetaKumari-m8o |

|

|

As of now, your app is not updated with regards to new tax changes please update as I have uploaded the same Comment from : @DeepakGupta-zb1xf |

|

|

Aap nay tov sallery waley aur pensioners ka dikhaya magar jinko khali interest income hai unka kia,Kindly us per bi dikhayein Comment from : @pradimanpk |

|

|

Sir, beautifully explained 🎉🎉 Comment from : @ADDON980 |

|

|

Let's see what happens after 8th pay commission implementation how much will be the taxes it will matter 😊 Comment from : @bhadraparajitaj6750 |

|

What is Marginal Relief in New Tax Regime 2025-26 | Income Tax Calculation РѕС‚ : FinCalC TV Download Full Episodes | The Most Watched videos of all time |

|

Income Tax new regime Tax Calculation РѕС‚ : 2 .1M Views Download Full Episodes | The Most Watched videos of all time |

|

Income Tax Calculator in Microsoft Excel | Income Tax Calculation on Salary in MS Excel РѕС‚ : StudySpan Download Full Episodes | The Most Watched videos of all time |

|

Why grade your coins? To Slab or not to Slab that is the question. РѕС‚ : Numistacker Download Full Episodes | The Most Watched videos of all time |

|

Tax On Gift Income 2024 | Income Tax On Gifts Received | Taxation Of Gifts Under Income Tax Act РѕС‚ : Banking Baba Download Full Episodes | The Most Watched videos of all time |

|

Income Tax on Stock Market Earnings | Tax on Share Market Income | Tax on Fu0026O Trading in Budget 2025 РѕС‚ : MyOnlineCA Download Full Episodes | The Most Watched videos of all time |

|

Income Tax Slabs 2025-26 Budget 2025 Live Updates: Income tax relief | Budget 2024 LIVE Speech РѕС‚ : Zee Business Download Full Episodes | The Most Watched videos of all time |

|

Income Tax on Foreign Income | Income Tax on Foreign Remittance | TCS on Foreign Remittance РѕС‚ : MyOnlineCA Download Full Episodes | The Most Watched videos of all time |

|

How to Calculate ESI | ESI Calculation In Excel #ESI Calculation - Employee State Insurance Scheme РѕС‚ : BPO Tutorials Download Full Episodes | The Most Watched videos of all time |

|

Fixed Deposit Interest Calculation in Rastriya Banijya Bank || Fd interest calculation in Nepal РѕС‚ : Ankit Rawal Download Full Episodes | The Most Watched videos of all time |