| Title | : | What is Marginal Relief in New Tax Regime 2025-26 | Income Tax Calculation |

| Lasting | : | 9.23 |

| Date of publication | : | |

| Views | : | 89 rb |

|

|

Marginal Relief in New Tax Regime video kaisa laga? COMMENT KARO 👇👇brDownload Income Tax Excel Calculator 2025-26:br fincalc-blogin/income-tax-calculator/ Comment from : @fincalc |

|

|

Very well explained thank you Comment from : @mugdhakadam9001 |

|

|

On what basis you said marginal relief' will be applicable upto 1345588/- Comment from : @abilashmacherla2719 |

|

|

really good job in explaining this in simple format Comment from : @samsay87700 |

|

|

Stilll for someone earning 1300000 will have net income 1274000 and some one earning 1275000 will have net income 1275000 which is more Comment from : @adityatripathi6557 |

|

|

Thank you for the information but I have one question brHow to claim Marginal Relief while filing Income Tax? brBecause it shows only the total amount of tax payable but not Marginal Tax payable Comment from : @soumebhachatterjee |

|

|

Nice Thanks for sharingbrCould you please confirm is this marginal relief applies example 1278 lpa has tax just 3k instead of 60k brbrMine is 13lpa salariedbrFew CA's are saying that this is not confirmed yet Is this confirmed ? Comment from : @kondisrinivas325 |

|

|

Still i have concern bro my latest ctc is 129 lpa is tax applicable on ctc or gross little bit confused bro will you please help me out here? im not able to rectify the gross salary in my ctc Comment from : @narayang6421 |

|

|

Can you clarify one thing? Will FD interest be clubbed with my salary while calculating income tax? Comment from : @MrDaman95 |

|

|

Are you sure this marginal benefit applicable for salaried person also who already got 75000 as standard deduction or this marginal benefit only applicable for non-salaried person ? Please answer Comment from : @ayushgupta-2592 |

|

|

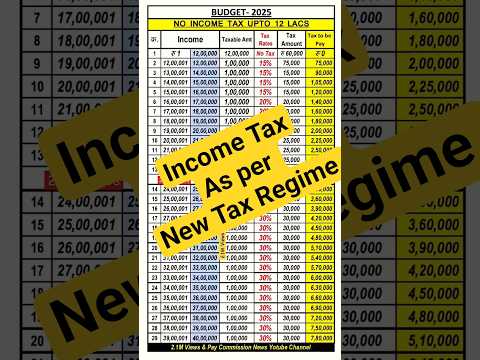

Marginal relief is offered to resident individuals earning between Rs 12 lakh and Rs 1275 lakh However, once an individual's income exceeds Rs 1275 lakh, they will no longer be eligible for marginal relief and will be subjected to the regular tax rates as per the CBDT Comment from : @manikandaniyer8570 |

|

|

Is this marginal relief aplicable for this financial year with any changes? Comment from : @kiransuryawanshi6512 |

|

|

Nice information sir Comment from : @kiransuryawanshi6512 |

|

|

Bhai, new tax regime me PF contribution ko income me calculate hoga ya nhi? Comment from : @sujeetrao26 |

|

|

All doubt cleared after watched this videothank u sir Comment from : @jayrana1408 |

|

|

Formula not working bai Comment from : @mahesham3254 |

|

|

Amount debited hogya Excel sheet dounload nahi hui Comment from : @ashfaqueshaikh6534 |

|

|

I am currently in old regime What happens to my pf if I move to new regime with new tax slabs? Comment from : @shashank4friends |

|

|

Very specific and to the point video without stretching long Subscribed for that reason Comment from : @preetiprasannaghosh914 |

|

|

Thank you so much sirbrNice explanation Comment from : @surendrashankarnaik1143 |

|

|

😁 Good you gave a clarification that salaried people don't have the habit the of investment for their next generation Comment from : @ausne03 |

|

|

12lpa ho ya 1345 lpa same earning hoga beech ka amount gayab, 12 se jyada earn karna hai to 14 plush chahiye 😅😂 Comment from : @RanjeetKumar-xyz |

|

|

Marginal relief ka section kya hain? Comment from : @itsmesujoy9351 |

|

|

new tax form in excel when available ? like calculatar paid Comment from : @KGBHALODI0099 |

|

|

I have paid the amount but not received the excel sheet and can't download it Comment from : @sayedafarhat4613 |

|

|

I made 29 for excel please share it to the given Mail id or watsapp mobile number Comment from : @mohanrajkannaiyan5831 |

|

|

Sir 13L wale ka fir v net yrly income 1275L wale se kam ja rha h Comment from : @rekhakumari9452 |

|

|

What about the employer's NPS contribution? Comment from : @PrasantBaral-d6l |

|

|

But not received till now Comment from : @reubanfernando7 |

|

|

I paid Rs 29 for downloading the excel sheet but received till now Please do the needful to send the excel sheet Comment from : @reubanfernando7 |

|

|

I am not sure if it is correct, i have tried to search about margin benefits but mostly showing Marginal benifit only for who having income from above 1200000and they need to pay according to regular tax slab above 1275000 incomenot sure who is correct 😉 Comment from : @aks08146 |

|

|

As there is investments row in the excel sheet , what type of investments can be done or will be considered? Comment from : @sivapraneeth2644 |

|

|

i was totally confused before watching this video When i calculated using cleartax for 13lakh it was showing 26K as tax SO i thought there is some bug with that calculator But now i got complete info about why the tax is reduced to me Thank you so muchbrbrAnd one more thing will the employer PF will be considered for TDS calculation? Comment from : @yashuneerkaje9019 |

|

|

What would be tax for 1345588 Comment from : @msaravananreddy4947 |

|

|

Now in new tax code jo araha hain ,usme stock market income ko normal income bola jayega 😂 Comment from : @arghyapathak2497 |

|

|

you are incorrect brbrMarginal relief is available to resident individuals whose income exceeds ₹12 lakh but does not exceed ₹1275 lakh If a taxpayer's income exceeds ₹1275 lakh, marginal relief no longer applies, and they will be subject to the regular tax rates Comment from : @ronak3600 |

|

|

Bhai new tax regim me if salary se nps ya food wallet me cut hota hai to taxable income jo calculate hoga wo nps and food wallet amount deduct hone ke bad hoga or include hokar Comment from : @RKGpikka |

|

|

Marginal relief salaried person ko milata hai nahi Comment from : @ManjeetSingh-sx4nw |

|

|

But the marginal relief not for salaried Comment from : @mohanrao8246 |

|

|

Good work no great work👏👏👏 Comment from : @AgamAseesAnhad |

|

|

I paid and downloaded the excelbrI was checking for a range between 1300000 to 1350000, person who gets salary in this range his take home will be 1274000 to 1276000 😂 Comment from : @sachinlbangera6515 |

|

|

Marginal relief is available to residentbrindividuals whose income exceeds ₹12 lakhbrbut does not exceed ₹1275 lakh If abrtaxpayer's income exceeds ₹1275 lakh,brmarginal relief no longer applies, and they willbrbe subject to the regular tax rates Comment from : @tarunghanshala6813 |

|

|

My sal is 1475 lpa Will the marginal relaxation apply in my case? Comment from : @annieshiney4243 |

|

|

Good video doubts cleared Comment from : @DeepakKumar-fk8tx |

|

|

Downloaded and paid Rs29 Comment from : @DeepakKumar-fk8tx |

|

|

After payment it is not redirected to the download Comment from : @saichanduboyapatilucky |

|

|

How to claim marginal tax benifit while filling ITR for salaried class individualits auto applied in ITR acc to new taxable income or we have do fill something extra?????? Comment from : @labishsingla |

|

|

Asper ur calculations Net income for salary of 1275 lakhs is 1275 , net income for 13 lakhs salary is 1274 lakhs? How far it is fair? Comment from : @cj7ks |

|

|

बहुत अच्छी जानकारी 👌👌👌 Comment from : @kavalibalaji8602 |

|

|

best video Comment from : @mayurvijaykode |

|

|

You reduced my overthinking of reducing my salary 😂😂, my net is just above the 1275000rs, every finance expert is misleading people, I think you really provided necessary information, Thanks dude❤ Comment from : @Mani-xp5nf |

|

|

I guess salaried employess will not get the marginal relief they will avail the standard deduction of Rs 75,000/- Margial relief for individuals other than salaried who earn more than 12 lakh to 1275000/-everyone will not be able to avail both "standard dedution" and "marginal relief"brcorrect me If I am wrong Comment from : @rajeshlad4297 |

|

|

Can anyone please clarify one thing Out of the following which ones are considered for gross salry calculation brBasic,hra, pf (employer ,employee), gratuity, variable paybrAlso if the new regime and old regime has the same formula for gross calculation? Comment from : @shivamsoni7540 |

|

|

Payment kai bad bhi , excel file download nhi hue, please see Comment from : @nightfantasy1812 |

|

|

Old tax regime me kuch changement ayi he ya same he Comment from : @activeharishchandra6172 |

|

|

Brother my salary is 13 lakh If I take part of my salary from HRA or company Nps Contribution of around 30000, will I get 0 tax as my income becomes 1270 lakhs ?? Comment from : @SasukeUchiha-do1vx |

|

|

if the income is above ₹12,75,000, there will be no marginal relief, and tax will be payable on the entire income Comment from : @danishhussain4719 |

|

|

THANKS SIR MARGINAL RELIEF ME CONFUSION THA AAPNE CLEAR KAR DIYA THANKS Comment from : @ramansalwan6350 |

|

|

Perfect explanation Comment from : @AshishSao-fd7xr |

|

|

Can a salaried person file his/her itr on this new tax regime based on the income from 2024-25??Or it will be implied only for income from 2025-26 Comment from : @ankitkumaryadav8603 |

|

|

Finally got the correct video, i sas scared what above 1275, i would request if you also add deduction as well that we can use in this nez scheme Comment from : @ashishagrawal3307 |

|

|

Sir NPS government contributio new tax regime me 80ccd2 ke tahat kam kiya jata he use bhai calculate me liya kee je Comment from : @manojgajbhiye2691 |

|

|

Bhai paise paid kar diye but calculator download nahi ho raha hai Comment from : @JitendraKumar-tj9cr |

|

|

When compared to the person earning 1275 LPA, the person earning 13 LPA still ends up with Rs 1000 less moneybrPerson earning 1345 LPA ends up with approx Rs 3000 less brSo, the problem remains 😅 Comment from : @209kranthi |

|

|

Nicely explained 👍 Comment from : @vivekrajpurohit2260 |

|

|

Sir kuch log bol raha hai 12 lakh tak jo income tax chhut hay wo iss sall se lagu nehi hoga,wo agle salse milega Comment from : @tupaighosh8290 |

|

|

Due to cess of 4 , jiska salary 1276 lac salary hoga uska in hand salaary kam hi hoga compared to 1275 lac, ?? because 1276lac will pay 1040 rs in tax? and his in hand will be now 40 rs less than 1275 lac ?? please correct me if i am wrong Comment from : @chintandesai2236 |

|

|

Kudos to you Very well explained Comment from : @d_k_pawar |

|

|

So people earning above 14(approx) will not be eligible for marginal relief right? Comment from : @sagarbm4283 |

|

|

Thanks Comment from : @Kamleshmimrot |

|

|

Thank you Comment from : @jayakumarmg5270 |

|

|

Hi Abhilash, The payment got deducted but in razorpay it's showing as retry I will share the details amount deducted can you share the contact details please Comment from : @ravishekar996 |

|

|

Please share notification for marginal relief in new tax regime Comment from : @10_MT |

|

|

Please make one video from scratch how to calculate tax for salaried person, how to compare form16, AIS, TIS, etc and fill ITR form step by step Comment from : @shubhamdas5820 |

|

|

Really good video and crisp explanation brbrI have been checking so many videos and none explained like you Kudos 🎉brbrI am going to download the excel sheet, thank Comment from : @VikasJaink |

|

|

Thanks bhai mera 1308 LPA hai mujhe bht tnsn thi but ab relief mila mjhe bs 36000 tax dena hai mtlb 3k per month Pehle mera 8k per month kt jata tha 😢 Comment from : @osmtechbox2658 |

|

|

tax on ctc or on taxable income?? Comment from : @hiteshsuthar5810 |

|

|

Good effort Comment from : @gg-ho4nc |

|

|

Thank you so much bro Was searching a lot to get clarity on marginal relief basis new tax slabs Good that you also find out the salary limit till which marginal relief can be availed Comment from : @jomonjohnson9854 |

|

|

17 lk me marginal revate keya hay ?? Comment from : @subhadipbiswas4169 |

|

|

Bhai meri gross salary 8 lakh h to new tax regime me monthly salary me se tax nhi katega kyaya phir tax katega or itr file krke rebate mil jayega Comment from : @New_contentlover |

|

|

Clear explanation Great effort on educating people Well done 👍 Comment from : @v22rap |

|

|

bhai rejan dal di video me super se b upar Comment from : @harishchander1138 |

|

|

Any deduction for NPS in 2025-26???? Comment from : @bichchuhalder2909 |

|

|

No one in the entire country explains what happened if 13LPA prevails I saw more than 50 videos and no one explained it But u did it Comment from : @ATManikandan |

|

|

Excel file is read only and not able put self data Comment from : @harishkumarsinha9942 |

|

|

Great explainationbest video so far on latest income tax in YouTube Comment from : @vijaysai7789 |

|

|

Jiska 13 lakh income hai unko marginal relief lene ka baad v loss hai qki unko total 1274000 e milraha hai lekin jinko 1275000 income hai unko pura ka pura mil raha hai Comment from : @prasenjit2912 |

|

|

Very well explained bro Comment from : @DHARMABIRPRADHAN |

|

|

pls 1300825/- Show tax Calculation Comment from : @bhaskardeore51 |

|

|

nice clearfication goog job bhaya Comment from : @bhaskardeore51 |

|

|

Vivid descriptionThank U Comment from : @tapankrdasgupta |

|

NEW Income Tax Calculation 2025-26 | Tax Slab Rates for Old u0026 New Tax Regime (Examples) РѕС‚ : FinCalC TV Download Full Episodes | The Most Watched videos of all time |

|

Income Tax new regime Tax Calculation РѕС‚ : 2 .1M Views Download Full Episodes | The Most Watched videos of all time |

|

Income Tax Slabs 2025-26 Budget 2025 Live Updates: Income tax relief | Budget 2024 LIVE Speech РѕС‚ : Zee Business Download Full Episodes | The Most Watched videos of all time |

|

Income Tax Calculator in Microsoft Excel | Income Tax Calculation on Salary in MS Excel РѕС‚ : StudySpan Download Full Episodes | The Most Watched videos of all time |

|

Tax On Gift Income 2024 | Income Tax On Gifts Received | Taxation Of Gifts Under Income Tax Act РѕС‚ : Banking Baba Download Full Episodes | The Most Watched videos of all time |

|

Income Tax on Stock Market Earnings | Tax on Share Market Income | Tax on Fu0026O Trading in Budget 2025 РѕС‚ : MyOnlineCA Download Full Episodes | The Most Watched videos of all time |

|

Income Tax on Foreign Income | Income Tax on Foreign Remittance | TCS on Foreign Remittance РѕС‚ : MyOnlineCA Download Full Episodes | The Most Watched videos of all time |

|

How to Calculate ESI | ESI Calculation In Excel #ESI Calculation - Employee State Insurance Scheme РѕС‚ : BPO Tutorials Download Full Episodes | The Most Watched videos of all time |

|

Fixed Deposit Interest Calculation in Rastriya Banijya Bank || Fd interest calculation in Nepal РѕС‚ : Ankit Rawal Download Full Episodes | The Most Watched videos of all time |

|

online income site 2025 | online income on mobile 2025 | 2025 Free income app | Tech Forhad РѕС‚ : Tech Forhad Download Full Episodes | The Most Watched videos of all time |