| Title | : | New Tax Laws in 2024 Explained (WATCH BEFORE FILING) |

| Lasting | : | 13.30 |

| Date of publication | : | |

| Views | : | 114 rb |

|

|

Try Current and build your money future: currentcom/steve-ram Comment from : @SteveRam |

|

|

How about filing divorce Comment from : @rubenalejandre1298 |

|

|

We need to throw these people a tea party Comment from : @director_t6686 |

|

|

You forgot to say you are not an Enrolled Agent The real tax experts Comment from : @lenatran2471 |

|

|

? But TAX is not LAW Comment from : @michaelperez3887 |

|

|

Please note if you are married, but separated you do not have to file a joint return If you and your dependent live 6 months or more you can claim HOH Comment from : @sharonforrest594 |

|

|

Haven't filed last 30 yearsbrSo does that make me abrcriminal Comment from : @HappyHoverboard-lz9wq |

|

|

I want you to send me proof Proof we are suppose to pay taxes BY LAW! I’ll wait……… Comment from : @jasonsmoak3201 |

|

|

Thsnks for the video But why TF Do I have to learn so God D*mn much about tax code and financial obligation for a government that's laundering, all of our money to Ukraine anyway The government overreach in this country is astoundingly alarming Comment from : @bingbong-80 |

|

|

I have total of 5800 income tax deducted from two job as a student and all I’m getting is 2k$brSh***y government robbing from as students Comment from : @sagungrg9644 |

|

|

I hate it here This is a slavery country Comment from : @nobullshiit9615 |

|

|

Tax Code benefits the rich and corporations not the working class The biggest mafia of all time is the government You need to pay up to liv Comment from : @khristianvazquez4540 |

|

|

We owe this year that don’t make sense why does everyone have to pay this year so many of us do something don’t seem right Comment from : @Chrissymp16 |

|

|

Entertainment content I'm good 😊 Comment from : @Jazziemelo |

|

|

TAX REFUND will go to buy TESLA EV cars At least down payment Consumers will save a lot yearly No oil change requires and liability on TSLA EV in huge more than gas engine Comment from : @capsula2007 |

|

|

I feel like the government is doing this to get back all the money sent to us during covid This is awful Comment from : @leaha8159 |

|

|

Taxing anyone's personal wages for personal physical labor is theft Period That makes the federal, state, and IRS pimps They also own the slaves they tax We all have social slave number Comment from : @jeffsmith4600 |

|

|

We need other representatives in congress immediately to change all of this Comment from : @gio5099 |

|

|

Wow I literally cant fucking e-file because I’m a disabled veteran who is a student and have no taxable income so now I have to mail it in Comment from : @DonsleyB |

|

|

I dont understand why i owe taxes this year I haven't made any changes from last year or the year before Ive made the same amount And my weekly checks have been the same Comment from : @jtknight4061 |

|

|

Please explain to me why I would not qualify for the Earned Income tax credit? I am filing as Single, zero children, and no special factors Comment from : @kristinak2211 |

|

|

The funny thing is that companies like H&R Block and Turbo Tax lobby with millions of dollars to keep the taxes complicated Why would they want an easy to do tax return and keep them out of business? Comment from : @jjman533 |

|

|

Everyone should stand together and not pay this year😐 Comment from : @Hotcheetos25 |

|

|

Has anything changed for taxes in regards to HYSA's? Interest bearing savings accounts How is that kind of income counted towards taxes? As far as amounts, calculations etc? Comment from : @thethirdgeneration1738 |

|

|

Hard working, tax paying Americans need to make April 15th a nation wide "Do Not File Tax Return Deadline day"!!! I bet that will get this divided, biased, unfair government's attention Otherwise, we get no respect in the way we are being treated and disguarded during this illegal migrant invasion, dependency and abruse of our hard earned tax dollars we pay for 3 months out a 12 month salary Comment from : @virtualreality512 |

|

|

With the 2023 influx of the millions of illegal migrants we support from our labor tax deductions, we should claim not less than 1,000 Exemptions/ Dependants on the W-2 and tax return filings 😂😅brDependants dont have ti live in your house to write them off You just have to contribute to their cost of living, which applies to these illegal dependant migrants 😅😂 Comment from : @virtualreality512 |

|

|

I pay for youtube premium not to get ad, and this guy entered ads on his video Comment from : @PistokoRG4L |

|

|

It is a great video thanks for the great information and well delivered This is exactly what I was looking for Comment from : @lunamorris2091 |

|

|

I went back to work this year Married filing joint I only made 20,000 and claimed 0 Why do we now owe a few thousand when we normally get back 8 grand ? Comment from : @amandabrennick5304 |

|

|

Hey Steve Great show, I have a question? In 2023, a debt collecting company for approximately 5 months was taken out 25 of my wife's money from her check When she files her taxes next week brSo for 5 months they were taken out approximately $215 to $260 Can she get any of that money back when she files her taxes?? Because they never paid taxes on that money they had taken out of her check? This is a difficult question to answer I'm assuming You probably haven't had had asked that question before But if you have any knowledge I'm listening thank you my friend Comment from : @dolphin1346 |

|

|

Great video question?? A debt collecting company was taking out 25 of my wife's money every two weeks So every 2 weeks they were taken out approximately $23500 every 2 weeks My question is? can she get any tax break or benefit because she had paid the taxes on that money?brI think that's a good question to ask before she does her taxesbrSo for 5 months they had taken out that much money and that's a lot Comment from : @dolphin1346 |

|

|

If the bill passes will you be able to use last years income? Comment from : @masterpeace57 |

|

|

Ofc they want to give to single fucking moms and parents a rise but not single people tf? Comment from : @ohwell7680 |

|

|

I understood very little of this I work as a server and only claimed $22k I owe $600 in federal taxes and owe $80 for state I filed as single and no dependents Not sure why I owe $600 Seems crazy Comment from : @Necrotizer |

|

|

Crazy people with no jobs getting literally thousands while we both work and have kids but owe this year!!! 🤬🤬 Comment from : @oheyitskayyyyyy |

|

|

i just looked at my taxes I thought I was paying enough every week but apparently uncle sam needs even more money this year Comment from : @AP-fl8hr |

|

|

I had a 401k After I quit, I rolled it into an IRA brCan I turn that into a Self Directed IRA now? brI’m a realtor now and I want to invest all my money into RE instead of the stock market Comment from : @CindaMurphyRealEstate |

|

|

You look so handsome with your beard With all the respect your wife and my husband deserve Comment from : @wonderfuljoanna21 |

|

|

Has the new Child tax credit gone through , it’s the 29th and I thought the deal was supposed to go through Comment from : @chrisboardman2888 |

|

|

If you press the like button I’ll b**/b your b**/b Comment from : @Styles1991 |

|

|

Tax Brackets 1:40 brStandard Deductions 4:19brChild Tax Credit 4:54brAmerican Opportunity Tax Credit 6:07br401k & IRA limits 6:52brCost of Living Adjustment 7:34brGift Tax Rate 8:18brHSA Contribution limits 8:57brEarned Income Tax Credit 9:40brbrHigh Priority Changes -brBeneficial Ownership Information 11:17brInterest Rates 11:51brForm 1099-K 12:26 Comment from : @llthatjazz |

|

|

Wowwe,why they cut Texas gas lines for the border,Alert Patrick Humphrey Comment from : @sheilaplater3539 |

|

|

Thanks for the information for NEXT YEAR'S tax returnThis information does not benefit us for filing our 2023 TAXES I'm starting to think you're all about the CLICKS Comment from : @ReniseC |

|

|

Thank you so much , this video was very informative for me Comment from : @gloriajoesph6657 |

|

|

Thank you Steve 🤗 From Orlando FL Comment from : @trinarodriguez7697 |

|

|

And those health plans there selling will rob u if your returns and you will owe taxes and get zero money back Comment from : @Angie12392 |

|

|

Can we claim at least 1 illegal immigrant as a dependent this year on taxes since the tax payer is paying for their needs? Comment from : @Natalia-hs7bn |

|

|

So I was unaware of the child tax credit increase still waiting to be passed My return want be accepted until the 29th anyways or do I have time to void what I already submitted? Comment from : @Jazzzzieeeee_ |

|

|

When put my info on turbo tax it’s giving me the 20,800 for HOH not the 21,900 Am I doing something wrong or is this for next years taxes? Comment from : @chrisrodriguez2994 |

|

|

All of this information is covering next year's taxes (the ones we will file in 2025) This means nothing to us in the current tax year, 2023! Comment from : @A-RonHubbard |

|

|

Nobody is saying anything for ssi with ctc do they qualify if they are taking care of kids ?? Asking for someone so I can give the right information Comment from : @ranishacowser1093 |

|

|

I understood NOTHING about this This is only my second year of doing my own taxes I made 25,50635 in local wage from my previous job Local income tax is 66464 & state is 94195 Why is my returns only 1,56958 ? Can someone break it down in dummy terms 😂 Still fairly new to the tax game Comment from : @shelt370 |

|

|

I have an autistic 17 yr old! He turned 17 in Dec! He is a full time student! Can I still get full CTC AMOUNT FOR HIM?? Comment from : @Lori72604 |

|

|

I'm not sure what I listened to of yours to subscribe to you I am almostv10 minutes in to this video and it literally sounds like you are pro wef and who and pushing this disease x crap WTF? I keep thinking maybe you'll speak up as to what a line of shit these elites are spreading their bioweapons to kill us, but I have not heard a peep that you are pro human, anti elite Comment from : @odinsdottir3898 |

|

|

I know a guy who had 15 kids and would get back thousands upon thousands of dollars from IRS I don't have a problem with you getting a good tax credit on your first one After that it's on you We shouldn't be paying these people thousands of dollars every year because they chose to have their own football team and the rest of us have to pay for their existence? How fair is that? Comment from : @tidasium1785 |

|

|

Can I file my social security and disability non taxed to get child tax credit…I have two kids Comment from : @lindapalmer2786 |

|

|

Good for you Comment from : @mikehocking4836 |

|

|

All the money goes to people who have kids its called if your single you get crap I just retired back in September I paid in almost 4grand federal I might be lucky to get a 100 bucks back I will pay into state if you have kids and get welfare never paid a freaking penny in you get thousands back for having kids total BS my opinion Comment from : @mikehocking4836 |

|

|

Let me explain something to you I made almost $1 million before I had to quit working and Social Security payments I’m sorry but just cause you guys are still working doesn’t mean as people that already have worked and can’t work doesn’t deserve that kind of money either or do you realize that your people are paying $2 million now that Social Security by the time you retire or did you forget that one you need to really check yourself before you go running off and threatening people like that because be honest with you, you’re taking all our money and we gotta live less than $1000 a month when I lived on more than 2000 a month because I had to pay child support taxes bills rent and take care of the children I have with me so I’m sorry when you wanna talk crap I suggest you really look at the history of what this country is done to its own people before you go run your mouth telling me I shouldn’t get no money I’m not the worthless scumbag next-door got the point Comment from : @jamesstamp3706 |

|

|

Trump only paid every year ,$75000 paid with all thosebr businesses Comment from : @georgiaspivey4535 |

|

|

It's do not matter how many times they change the tax sheet low n middle class will always pay more taxes or the same taxes thats why they are changing the minimum wage so u can stay in the range the rich will always win Comment from : @Lacarloclincy |

|

|

sure things for child and student but seniors get screwed again that is congress for you worthless Comment from : @frankvanhouten1946 |

|

|

I’m not surprised by this Comment from : @mariegriffin7966 |

|

|

I'm single and own my own home Does that make me single or head of household? Comment from : @Carnage1975 |

|

|

I can’t listen to this anymore Why are you talking about taxes in our buzzard world of paying taxes 100 to foreign countries You’re insane Comment from : @shanetrane |

|

|

Aren't we filing now for 2023? Not 2024 Comment from : @kmac265 |

|

|

Should we still wait until the 28th to file???? Comment from : @iTsMeBrandi419 |

|

|

SSN $50 increase I will try to remember not to spend it all in one place Comment from : @Dumbluck14 |

|

|

Yes sir, that 32 raise did not help because they dropped down the food stamps assistance by 16NO HELP AT ALL Comment from : @timmycoleman1064 |

|

|

What about the those who arebrSingle and filling 0 dependent ? Comment from : @VictorMRamos-vj6do |

|

|

So I guess it passed Comment from : @andyrice3242 |

|

|

Crumbs for the peasants , millions for the DC crooks FJB Comment from : @ibraunchy20-vn5kd |

|

|

Great news like always Steve and if you get SSI and have 3 kids can you still get the child tax credits Comment from : @stephenzucchari6937 |

|

|

I don't understand this very well And I don't understand what you're talking about with so security Can you just sign us summarize things are we in bigger financial troubles now???? Comment from : @steveterribile4678 |

|

|

too late xD Comment from : @JusticeAndLibertyUSA |

|

|

Thank You SO MUCH❤❤❤😇🥰😘 Comment from : @anitanelson7494 |

|

|

The smartest thing people do lately is building a strong investment that isn’t controlled by the government Like digital currencies Comment from : @kourtneyrice8667 |

|

|

Thank you for the information Praying for everyone Comment from : @annadonaldson9718 |

|

|

I already done my taxes and I always look over them again before filing them if I made any mistakes with TurboTax, also if anyone has Gambling Winnings of W2G's forms to use when filing taxes they can help lower your Federal Taxes that you will have to owe because I gotten at least $800 off my Federal Taxes this year Comment from : @Michael69101 |

|

|

If they don't renew the Trump Tax Cuts the reduction will be cut in half back to the Obama rates If Congress does nothing as expected everything goes back to the old rates so Taxes will go UP Unless they pass a bill to stop it The Dems won't! Comment from : @josephjuno9555 |

|

|

Amazing videoThe government has really called things more difficult for its citizens, and we can't sit back and bear all the consequences of the bad governance It's obvious we are headed for inflation,it is always the poor who take the hit Comment from : @Matthieu922 |

|

|

Big Love, Brother Steve God Bless you and the family Comment from : @AngelBlancoDTLA |

|

|

I am single no dependants so I Never get any of these benefits? Comment from : @josephjuno9555 |

|

|

Thank you Comment from : @darlenecarter7859 |

|

|

Thank you so much for sharing this very valuable information! Would you be able to do a video explaining the difference between the child tax credit and the adult dependent credit? Thank you so much explanation point Comment from : @tinaalbritton3450 |

|

|

Hi Steve we saw your channel in an intro to Survival Dispatch News That was cool !!! Comment from : @caliboy3443 |

|

|

Taxes the biggest scam in the history of mankind! Comment from : @ChrisPBacon1 |

|

|

I am on full and permanent disability and did not work in 2023brIs there any good reason that I should file, considering that there may be some added benefit? Comment from : @robertvanbuskirk2219 |

|

|

I'm sure Joe Biden is all mouth and no action🤔 Comment from : @lindakelley4332 |

|

|

Honestly if they would give us a 1000 like retirement because the price of living counting non- taxable rent bills not enough this is how they take all your possessions so you’re beneficiaries don’t get what you left them Comment from : @jamesstamp3706 |

|

|

EITC CREDIT MORE INFO FOR NO CHILDREN TY Comment from : @Harleyquin62 |

|

|

It’s not enough we need more money not benefits Comment from : @jamesstamp3706 |

|

|

Everyone gets a raise or a tax break except us ppl on a fixed income It's sad bc alot of us on ssi or other fixed incomes have dependents but we get nothing We work our whole lives to have to struggle in our older years Bull💩 Comment from : @gracieking9586 |

|

|

Ok we already get 2000 so will we but get a extra 1600 do someone know Comment from : @nicolebarnett2902 |

|

ITR Filing Online 2024-25 | Income Tax Return | ITR Filing TUTORIAL | ITR Filing Malayalam РѕС‚ : Groww Malayalam Download Full Episodes | The Most Watched videos of all time |

|

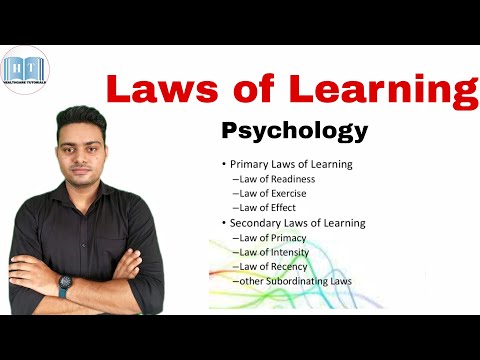

Laws of Learning in Hindi || Thorndike Laws Of Learning || 9 Laws of Learning in Hindi РѕС‚ : Healthcare Tutorials Download Full Episodes | The Most Watched videos of all time |

|

INCREASE EITC CREDIT FOR THE 2025 TAX FILING SEASON-Earned Income Tax Credit 2025 РѕС‚ : Simplistic Motivation Download Full Episodes | The Most Watched videos of all time |

|

How to File Federal Income Tax Return for US LLC?? | IRS Tax Filing 2025 ? РѕС‚ : Webics Solution Download Full Episodes | The Most Watched videos of all time |

|

NEW Income Tax Calculation 2025-26 | Tax Slab Rates for Old u0026 New Tax Regime (Examples) РѕС‚ : FinCalC TV Download Full Episodes | The Most Watched videos of all time |

|

Income Tax Return Filing For New Taxpayers РѕС‚ : URA TV Download Full Episodes | The Most Watched videos of all time |

|

UK Income Tax Explained (UK Tax Bands u0026 Calculating Tax) РѕС‚ : That Finance Show Download Full Episodes | The Most Watched videos of all time |

|

Tax On Gift Income 2024 | Income Tax On Gifts Received | Taxation Of Gifts Under Income Tax Act РѕС‚ : Banking Baba Download Full Episodes | The Most Watched videos of all time |

|

Costly Tax-Filing Mistake #6: Not Requesting a 1098-T from your School to Claim the AOTC РѕС‚ : College Tax Refunds Download Full Episodes | The Most Watched videos of all time |

|

Costly Tax-filing Mistake #2: Failing to use your Form 1098-T РѕС‚ : College Tax Refunds Download Full Episodes | The Most Watched videos of all time |