| Title | : | How Much Should I Invest If I Have a Pension? |

| Lasting | : | 7.03 |

| Date of publication | : | |

| Views | : | 80 rb |

|

|

So i have a small predicament i have a roth 401k and roth 457 that i max out every year i also have a federal pension, and a traditional ira that has accumulated around 200k and im just 26, I've spoken to a financial advisor and he says i will be retiring with a monthly income of around 45k, due to the fact that i try to save 80 of my salary Should i just aim to fire up or should i just stay for the long ride at my job Comment from : @prenleen8563 |

|

|

Say my pension is x dollars after x2 years at x3 age should I have more or less that is needed?brbrHow much? Comment from : @Comeoffitman |

|

|

As a teacher who contributed 7 to my pension, i found it difficult to contribute to a 403B which had no matching I retired at 59, with about 100k with no debt and I'm totally satisfied with my lifestyle post retirement Comment from : @flrbase |

|

|

What if my pension is a raise from my take home now Comment from : @gokeymasterflex |

|

|

Wife has pension and social security and I have social security No debt That's not enough? Comment from : @JayJay-ii5un |

|

|

People are facing a tough retirement and it's even harder for workers to save due to low-paying jobs, inflation, and high rents Now, middle-class Americans find it tough to own a home too, leaving them without a place to retire in Comment from : @mariadrukker2557 |

|

|

I was dumb not realizing how valuable my pension was going to be I saved pretty diligently in a traditional retirement account Now that I'm within 5 years of retirement and know how much I'll have annually from my pension, I almost don't even need my retirement accounts and will either have to Roth convert, or get hammered by RMDs Moral of the story is: if you stand to have a sizable pension at retirement, prioritize Roth contributions Comment from : @kersting13 |

|

|

25 is way too much folks! Come on Not unless you live a lush life…retire early and enjoy your life… Comment from : @nikij6058 |

|

|

I suppose the biggest question is what happens if the pension plan reneged on its payout on the corporate side, you'd have the PGC but the max may be less than your pension and I don't think the PGC provides COLAs Even on the fed/military side, don't think reneging can't happen Paul Ryan tried it about 10 years ago with COLA-1 on mil pensions thankfully that was overturned shortly after implementation BUT it proves IT CAN HAPPEN! Comment from : @caseycooper2381 |

|

|

I don't think the military does pensions anymore Only 401k Comment from : @takedat8751 |

|

|

Plan C is I move to Mexico and never work at a job again lol at 42 I’ll have guaranteed 3400 a month Comment from : @Billy55577 |

|

|

Lets face it if you get military pension you are also probably "100 disabled" you are good Comment from : @KeepTheChange41 |

|

|

Who the h@# can afford to save 25? You people don’t live in the real world! Comment from : @markdavis1116 |

|

|

I am a federal employee and when I retire I will be entitled to to a pension, however I still aggressively save in the TSP and my own personal IRA, brbrOperate as though the pension doesn’t exist and plan for the possibility of fully funding your own retirement brbrNothing is guaranteed Comment from : @cameroncunningham204 |

|

|

In valuing a pension, what I do is to calculate how big of an annuity I would have to buy to duplicate the income of the pension Pensions are just an employer sponsored annuity plan Both pensions and annuities can be configured o provide spousal survivor benefits of varying amounts I chose to configure my pension at 100 survivor benefit, which of course reduced my monthly benefit somewhat, but it increased the value of the pension since my wife will most likely live longer than mebrbrOnce you know the real value of that pension, you can use that number to satisfy your fixed income portion of your portfolio’s balanced allocation You may be like me and not need any other fixed income sources (bonds, CDs, annuities, etc) and can put all of your savings to work in higher risk/reward investments like equities Comment from : @1wheeldrive751 |

|

|

Thank you! You guys are the first people to properly evaluate the value of pensions in calculating retirement savings and needs Well done guys! Comment from : @anthonyrichardson7543 |

|

|

How do you put 24 of your income into a Roth Assuming you’re making more than 30k Comment from : @SN-fl1qy |

|

|

Well housing and medical out of pocket costs seem to be the big middle finger to those of us stuck in blue states who definitely need to retire at 62brMaybe I need to move to Mexico and walk back over the border 😂 ‘cause a pension and ssr ain’t cutt’n it 😢 Comment from : @FoundLamb |

|

|

I work at UPS AND have a pension from the Teamsters brbrI DONT get a 401k match because of this but still max my 401k Is that a good decision?brbrI’ll have 30yrs at 50yrs Comment from : @giuseppegalante9269 |

|

|

Nothing mind blowing here Comment from : @christopherC1111 |

|

|

25 into a Roth for 50 years will give us the highest wealth and lowest taxes Comment from : @miketracy9256 |

|

|

Why can't you guys give even a single example on this question? Waste of time watching this video Comment from : @AirOnJohnson |

|

|

I'm retired Air Force also, with a pension that has an annual COLA I've seen some pure civilian pensions that do NOT have an annual adjustment for inflation, and those people need to take that into consideration Comment from : @buckbuchanan5849 |

|

|

We both started enlisted, I got out of the military husband got a degree and retired as a Lt Col he became a contractor and we both invested in 401k’s He gets two pensions and we saved our whole adult lives This doesn’t count SS My husband intends to work till 70 Comment from : @lizg1976 |

|

|

Crooks Comment from : @miketheyunggod2534 |

|

|

More on pensions please 👍🏽 Comment from : @traceyperrin1827 |

|

|

Wife will retire in five years, after 25 years working for state of CO Defined pension benefit is a very good deal brbrWe’ll likely sell the house in a couple of years in order to purchase additional years of service credit, to get to 70 brbrOver the next several years, we’ll be playing catchup with personal savings to get to a 100 equivalent Theoretically, we won’t touch the personal $ (stocks & bonds, munis, tax-deferred, etc) until we make a big purchase in retirement, which may not happen for several years brbrAlso, we plan to take a reduced pension amount option in order to have a survivor benefit for me God willing, we’ll have some time to enjoy our retirement Life is a gamble, tho, even when u plan ahead! Comment from : @hopoutside |

|

|

In my country, the pension depends exactly on how many years you have worked There is no storage system, but sometimes you want Comment from : @ArtemNesterov-yv8jn |

|

|

So true As i am now very near retirement, I am very happy to have a pension, but my wife and I still managed to save 7 figures I plan to retire this year at 55 I have $$, so I have options Comment from : @FirefightersFinancialToolbox |

|

|

If you were telling people with pensions to save the same amount as people without pensions, that is just horrible advice Sure, you should try to save as much as possible but if you have a pension and you’re saving the same amount as someone without a pension you’re gonna be further ahead of that person So basically, you’re telling people in two different situations to do the exact same thing Comment from : @toddh2000 |

|

|

He never spoke on railroad pensions Tier 1 and Tier 2 The best well funded pension Comment from : @trump1105 |

|

|

I’m going to have a Pennsylvania state pension when I retire But it doesn’t have a COLA like federal pensions have So I need to plan for more money from my retirement investments as I get older than I’m going to need when I first retire Comment from : @tscoff |

|

|

I have a forced pension - we are required to save 125 and upon retirement the employer will provide 100 match If I leave the pension I only get my contributions plus 1 growth I max out roth and 90 deferred comp and have for 15 years I plan to retire at 57 and go find a job on I LOVE to do, part time, on my terms I can't wait! Comment from : @abvincent12 |

|

|

I thought we could only fund a ROTH with "earned income" Pensions are not "earned income" as defined by the IRS I've been retired for a few months now and stopped funding my ROTH because I'm only currently receiving a retirement pension Comment from : @heymoe1179 |

|

|

Who can put 25 of there pay into a 401k… nobody! Comment from : @skepticalmechanic |

|

|

Consider this, if you pre deceased your spouse they may be left without a continued pension Also pension COLA generally do not keep up with inflation Medical and dental cost are also often not fully covered Comment from : @solidstream13 |

|

|

I separated from active duty after 105 years, due to medical and family reasons Luckily I was able to "buy back" my military time when I landed a GS government job So im still on track to get a pension In my situation i act like the pension doesn't exist, the 44 comes out, but i still max my roth ira, do 10 tsp (15 with match), contribute to taxable, and i plan on having 5 rentals (currently at 3) Honestly, if i keep up my current situation until i plan to retire at 50ish alot of my retirement will be fun money and setting my family up for success Comment from : @noone-um4hk |

|

|

Never a clear answer getting 70 of my income at 55 I am 44 which is 3335 in today's money Max out Roth IRA started late 43 Put 617 a month in 401k and 1000 in 457b Am I doing enough Comment from : @simpleman7923 |

|

|

Should you count required contributions to a pension plan toward your net worth statement? Comment from : @Ben-kb5qj |

|

|

You Would Need A Million Dollars In The Bank To Yield 50 Thousand DollarsSo A 50 Thousand Dollar A Year Pension Is Like Having A Million Bucks In The Bank! Comment from : @cueoneful |

|

|

I needed this segment as I am military , hoping my pension will be there Comment from : @bmcdonald7303 |

|

|

I think the way the payout is set up for the pension is how you would need to factor it in Comment from : @user-lr5ys4nk5w |

|

|

I have a pension but I don't understand it at all Need help with it lol Comment from : @bobbyheath2474 |

|

|

I plan to exit with a 30yr pension, currently @300k 457 b, and maxing ROTH from here out! 🤞 Comment from : @ahumm8280 |

|

|

Just retired from the military in September after 30 plus years so I have a pension paying at 76 percent of my base pay when I was active duty Never left off the gas in investing before I retired(knowing I would have the pension after I hit 20), and still investing over the 25 percent (I also have a nice paying government gig to go along with the pension) If you have the ability to do it, why not keep going? I plan to retire at 62 (in about 12 years), so I will also have that government pension, along with my military pension and plan to withdraw the social insecurity at 62 - not gonna wait Comment from : @davidsmith5868 |

|

|

Many people have the misperception that federal pensions are very generous You get 1 of your salary for every year of service, so if you work 20 years you get 20 of your salary in retirement It helps, but you still have to save a lot for retirement Comment from : @AAS1-kp9cs |

|

|

Another benefit of a military retirement is the medical benefit That is also worth a small fortune Comment from : @fuzzy3440 |

|

|

Finally they talk about people with pensions I'm so confused if I'm behind or ahead with one Comment from : @mistyhoffman3751 |

|

|

I'm 37 and I should have a government pension at retirement That said, I don't take that into account at all when I calculate for retirement You just never know what might happen What if something happens to me so I can't contribute any more to the pension? What if I want to, or am forced to, leave that job early? Comment from : @Azel247 |

|

|

Super helpful This has always confused me Comment from : @danielnelson2820 |

|

|

Pensions are all different Some states don't put into social security if you have public pension Some pensions are limited or don't include much of a COLA The health care benefits also differ In Maryland (my state) While the full 7 percent of salary contributed by individual teachers is for benefits, the state contributes only 438 percent The remaining 1121 percent state contribution is to pay down the pension fund's debt This only pays 50 of my final salary plus SS So, I still try to max out my Roth and put as much as I can in my 457b Medical is $1k a month for me in retirement Comment from : @danhowell3574 |

|

|

I have a pension but I also have a TSP, a Roth IRA, and a taxable brokerage…the taxable brokerage exists to support my lifestyle once I retire from active duty after 30 years Comment from : @Melanie9908 |

|

|

My company fully fund my pension and match my 401k 100 up to 4 Comment from : @mikedelrossi6981 |

|

|

In Germany we have too pay 18,6 percent to the Government and get a Pension of about 1/2 of our gross income average which has to be taxed afterwards And than you have to work till 67 or you get much less I hate our Sytem Comment from : @gtfreakmotzi |

|

|

Firefighter/EMT from RI here I help new hires understand our retirement benefits and how to save for retirement I constantly refer to your videos and send people to your YouTube channel Needless to say, I will be adding this video into the mix Thank you! Comment from : @joenotarantonio6149 |

|

|

Thank you for this, I always find it confusing to have a pension rather than a 401k that gives stricter numbers to work with Comment from : @cassnate6259 |

|

|

Pensions are a "black box" we don't know how it's invested My employer requires 7 employee contribution and they contribute 30 That employer contribution includes healthcare Trying to determine what is actually going to my retirement is impossible I try invest 20 paycheck into a retirement IRA or even brokerage account Comment from : @JosephDickson |

|

|

Also have to look at survivor benefits Likely a reduction in pension payout for the spouse if the pension holder were to pass Comment from : @slabjr2 |

|

|

Less than a year before I retired from the Air Force I was med boarded, which means they would evaluate me and determine if I could continue in the Air Force because of a medical condition Because I had an approved retirement date they ended up canceling the med board The questionnaire may have the intent of retiring, but until you are actually retired and receiving that pension nothing is guaranteed Comment from : @resterAnonyme |

|

|

he doesn't mention when he is retiring and if he plans on continuing to work after the military retirement Military can retire as early as 20 years in with a pension IIRC so lets say you retire from the military at 38 and don't plan to work over 38 you are only getting about 1/2(or less) of a full military pension To many variables and really needs to be handled on a case by case basis Comment from : @yeahnawnaw |

|

|

To a degree, maybe worth ignoring the pension a bit because always possible it goes belly up… Comment from : @Ultrajamz |

|

|

I’m a teacher in NJ The pension will never run out in my lifetime Gov Murphy paid in billions to keep it afloat My 403b is also decent Comment from : @EvanYoungMusic |

|

|

Love when you all feature a question from Military/Federal Employee subscribers! As you mentioned, we don't know what the future holds, as far as taxes, etc For example, I believe this past year there was talk about changing how VA disability will be taxed Which would be a huge game changer for many of the Veterans I know The one thing I've learned from focusing on the percentage rate of gross income invested, is that the higher the percentage the more you learn to live with less When the time comes to leave the workforce, the higher your savings percentage the less you'll have to fill the gap with your investment income For example, if we use the 4 rule, $30K a year would need a $750K portfolio, and $40K would need $1M (if I'm calculating it correctly)$250K extra is what he would to have had to accumulate to sustain that $10K increased lifestyle Obviously a lot of other variables go into it It's tough to predict the future, but if you think your sources of income will be a Military pension; VA disability (possibly); Social Security; TSP/IRA's; and non retirement brokerage accounts, the individual is miles ahead of the average Soldier who spends every dollar, doesn't invest, and goes into debt for a fancy car But yes, stick with 25 of gross income, IMHO! :) Comment from : @CheJoffre |

|

|

Save as if it doesn’t exist I’ve seen people in their 50’s take a rug pull from a company going out of business Comment from : @Ethernet480 |

|

|

Know your number and what you’re saving/investing for Mastery of this will allow you to answer the questionbrbrIf saving/investing 25 of your income will allow you to replace X of your income, and your estimated expenses in retirement is Y, and your pension is Z, and your retirement date is T you will be able to answer thisbrbrKnowing this variables allows you to play with it What if I retire sooner? What if I want to spend more in retirement? What if I want to invest more/less? What if I want a higher margin of safety? What if I have a lower rate of returnbrbrYou should know this in and out backwards and forwards It might take you twenty hours to build this framework or less and it is time well spent Comment from : @zoraster3749 |

|

|

I retired in '17 after spending 27 years on Active Duty I can tell you 25 is enough, but if you have the opportunity to do more - do it! I understand Bo's POV, but this is the US Government and if they're not able to pay the pension for a retired military member we have bigger problems I'm in the situation they mentioned, but a minor difference My wife is a Federal Employee and will also have a pension so in retirement we will have my pension (inflation protected), VA compensation (inflation protected), spouses pension (inflation protected), and two additional SS (inflation protected) Even with all that I work for a contractor and make 6 figures and between my wife and I we still invest $100k annually I want to live a retirement full of ABUNDANCE, but we're also grateful to be in a situation that we can live today and still do everything we want to do! Comment from : @roburb73 |

|

|

Did they ever answer the question? Comment from : @mkjackman87 |

|

|

I have a pension, a SERP, and a 457 through my employer and I have a Roth IRA on my own I’m 24 and hoping to retire early :) Comment from : @Flaccid_Banana |

|

|

Id be interested to hear yalls thoughts on private pensions and if we view those differently than govt pensions? I know there's not many of us, but we exist! Comment from : @kenhcpcu |

|

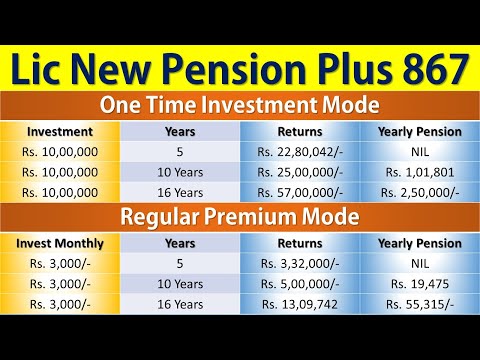

Lic New Pension Plan 867 | Lic Pension Plan 2022 | Lic New Pension Plus Plan | नई पेंशन प्लस योजना РѕС‚ : Insurance Clinic Download Full Episodes | The Most Watched videos of all time |

|

How much should you have in your pension? - Average UK pension pots by age РѕС‚ : Money to the Masses Download Full Episodes | The Most Watched videos of all time |

|

How much money will you be paid from the UK State Pension and when? РѕС‚ : Improve Your Finances Download Full Episodes | The Most Watched videos of all time |

|

HOW much you need to save to RETIRE COMFORTABLY - Episode 3 Pension Income Planning РѕС‚ : Bouncing Back Download Full Episodes | The Most Watched videos of all time |

|

The UK State Pension What is it and how much will you get? #statepension #financialplanning РѕС‚ : Xenia Download Full Episodes | The Most Watched videos of all time |

|

How MUCH will my pension pot give me? £500K/£250K/£100K РѕС‚ : Principles Personal Finance Download Full Episodes | The Most Watched videos of all time |

|

How much can my partner earn before I lose my Age Pension РѕС‚ : About Retirement TV Download Full Episodes | The Most Watched videos of all time |

|

How Much Should Australians Invest In US Stocks? РѕС‚ : Sebastian St James Download Full Episodes | The Most Watched videos of all time |

|

Trick to Invest in Gold | Gold vs Silver - Which is a Better Investment | Watch it Before Invest РѕС‚ : Sun News Download Full Episodes | The Most Watched videos of all time |

![4 Small Business Investments [Investing for Beginners] How to Invest. Why Invest? Smart Investors!](https://i.ytimg.com/vi/sL9V90d5wTw/hqdefault.jpg) |

4 Small Business Investments [Investing for Beginners] How to Invest. Why Invest? Smart Investors! РѕС‚ : JJ THE CPA Download Full Episodes | The Most Watched videos of all time |