| Title | : | Earned Income Tax Credit Explained - Everything You NEED To Know! |

| Lasting | : | 6.36 |

| Date of publication | : | |

| Views | : | 14 rb |

|

|

🎉🎉 Comment from : @KhanKhan-h3c8d |

|

|

A single person with no children and an income of $15,820brThat is NOT moderate income! That is poverty! This tax credit is purposely designed to discriminate against people with no children Comment from : @DavidJohnson-tv2nn |

|

|

The income limits is a joke Who can survive making less 50K with 3 kids With the way rent, food, utilities have increased if you make less than that your living in poverty I make a tad more than that and I’m definitely check to check I’m a single parent of 3 and we struggle But according to them I’m not low to moderate income SMH Comment from : @tiahutchinson8932 |

|

|

Why is noone talking about how the amount slowly phases out as you make up to the max amount of AGI to qualify I feel like this is important information for people trying to calculate their own taxes Show some charts so people aren't confused on why they are not getting the full amount Comment from : @AstralAvatar |

|

|

Could someone please help me in answering my question: is EITC credit separate credit that is issued to us than the credit we receive for each dependent filed? Comment from : @rudymcgill23 |

|

|

48k with 2 kids won't get it Comment from : @kerrjason8537 |

|

|

Eitc is welfare, and is the leading reason why many people with children are not getting married and intentionally lie about having other income to the home Comment from : @twintwo1429 |

|

|

Sir,brCould you prepare videos one latest updates please (Tax rates, Credits ,deductions ,Exclusions ,Exceptions IMP forms ) Because We can better understand by your videos Comment from : @akhilkumarraparthi8179 |

|

|

How many years far back can I claim mine? I have been filing taxes since 2012 and had no idea Comment from : @CecileSolange |

|

|

your video is really helped me thanks for the video Comment from : @akhilkumarraparthi8179 |

|

|

I was qualified for this for the last 10 years and every person that did my tax return didn't know how to file it on the paper work So, I never got it They kept saying you need a child to get it They charged hundreds of dollars to do my taxes Comment from : @rebeccashetter2309 |

|

|

I have a question So my girlfriend and I share a child She is 25 years old We live together Pay bills together All is well just simply not married So this year she claimed our child and received an earned income credit of $2,753 and an addition child tax credit of $1,400 She is only giving me my half of the 1400 saying thats all the child tax credit gets and says the earned income credit is all hers bc of her low income My thought that since we both pay everything equal for the home and child, shouldn't we split the earned income credit also? I just don't know enough about it Comment from : @Diego-Delgado |

|

|

I’m 21 years old and I made around $16,000 last year do I qualify? This is my first time filing taxes and I have no children and I’m not married Comment from : @wholelottapain8130 |

|

|

If my girlfriend claims my child on her tax form can I still claim my child on the eitc? Comment from : @gabemac2057 |

|

|

Thanks! So informative!! Comment from : @LidiaRiveraFilms |

|

|

Nice, our brains aren't fully developed and we can't get tax deductions until we're 25 but expected to become a full fledged member of the workforce at 18, sometimes earlier to 16 Niceee Comment from : @TheAnimatedOsprey |

|

|

Hi, just found your video!!!! For 2020 I made 19,800 I have no dependants and im 34 will I be eligible for the eitc?? And should I file head of house hold or single? Thx for all the info you provide!!! Comment from : @tamara4070 |

|

|

Is the eitc something I’d have to pay back in the future?? Comment from : @hamsyde7167 |

|

|

Do I have to pay the EITC back? Comment from : @mohamedelbadawi3044 |

|

|

Hi Sir, What is the difference between EITC, CTC, and ACTC when I checked my tax transcript for 2019 I see only that I get a refund for CTC, but not the others I think you have to apply differently are them the same? Comment from : @mohamedibra151 |

|

|

Hi sir I didn't apply EITC 2019 except w-2 tax return which I got couple thousand refund I have 2 kids and made 35000 Can I claim now? What about 2020 tax return? Can we talk? Thanks Comment from : @mohamedibra151 |

|

|

The enhanced unemplyment has put my family over the income bracket for married filing jointly with children I was laid off but my husband continued to work Do you think there will be new tax rules for EIC for families in our situation? Comment from : @Jenny-ju1ng |

|

|

After looking for hours online you told me what I needed to hear in the first 10 seconds lol I didn't know if I qualified because I'm self employed and my deductions were going to be more than my income I technically earned money yet, won't have to pay taxes and wasn't sure if I would qualify Thank you for this video:) Comment from : @caffeinatedkat3 |

|

|

Working my way through income tax school as we speak I'm more of a visual learner and this was super helpful Thank you for sharing Comment from : @MingoK19 |

|

|

EITC comes from your bosses contribution to SSI and Medicare payroll taxeswhich why self employed can qualifyno one ever talks about how this is funded Comment from : @stevenjustice8258 |

|

|

I will probably make 16k from my job this year and I am single with zero children My mom would claim me on her taxes from 2000 to 2016, I was 14-30, and I was disabled and she made up to and including 21k in wages and received about 3k a year in refund without paying into taxes at all Comment from : @stevencastellano1613 |

|

|

I like this video When I pressed the Like button it said unlike But the number did go up on the thumb up Comment from : @candacejones8115 |

|

|

Thank u so much for this video just subscribed to ur channel Comment from : @lejan86 |

|

|

Great video , very valuable info , keep it up bro thanks Comment from : |

|

|

I haven’t filed taxes in a few years I don’t owe the IRS I have one child How far back can I file for the Earned Income Tax Credit? Comment from : @abumyriam |

|

|

Thanks bud Very informative and helpfuland you didn’t say “smash the like button” like every other youtuber, thank god! Comment from : @MichaelHenryGomes1 |

|

|

Great video Thanks Comment from : @carrieculver7680 |

|

|

Thorough coverage, thanks for your efforts Comment from : @dmoon9037 |

|

INCREASE EITC CREDIT FOR THE 2025 TAX FILING SEASON-Earned Income Tax Credit 2025 РѕС‚ : Simplistic Motivation Download Full Episodes | The Most Watched videos of all time |

|

Tax On Gift Income 2024 | Income Tax On Gifts Received | Taxation Of Gifts Under Income Tax Act РѕС‚ : Banking Baba Download Full Episodes | The Most Watched videos of all time |

|

Earned Income Tax Credit (EITC) Explained РѕС‚ : Tax Teach Download Full Episodes | The Most Watched videos of all time |

|

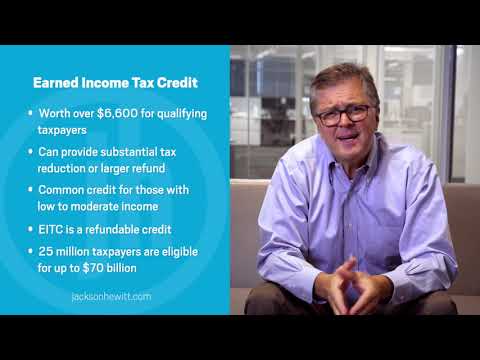

Earned Income Tax Credit (EITC) Explained РѕС‚ : Jackson Hewitt Download Full Episodes | The Most Watched videos of all time |

|

BIG! $4200 Child Tax Credit: New! Families Need to Know 2025 Update | More Money in Child Tax Credit РѕС‚ : Money Makers Download Full Episodes | The Most Watched videos of all time |

|

What is the Earned Income Tax Credit? | Do You Qualify For It? РѕС‚ : The Locum CPA Download Full Episodes | The Most Watched videos of all time |

|

What is the Earned Income Tax Credit and Do You Qualify For It? РѕС‚ : Jackson Hewitt Download Full Episodes | The Most Watched videos of all time |

|

Expert Gives Advice on Child Tax and Earned Income Tax Credits РѕС‚ : theGrio Politics Download Full Episodes | The Most Watched videos of all time |

|

Child Tax Credit 2025 Everything You Need to Know for Maximum Benefits РѕС‚ : Dr. Business and Finance Download Full Episodes | The Most Watched videos of all time |

|

Income Tax on Stock Market Earnings | Tax on Share Market Income | Tax on Fu0026O Trading in Budget 2025 РѕС‚ : MyOnlineCA Download Full Episodes | The Most Watched videos of all time |