| Title | : | Delaying retirement: Many struggle to save, fail to plan |

| Lasting | : | 2.03 |

| Date of publication | : | |

| Views | : | 92 rb |

|

|

If my mom didn't live with me right now she could not survive on what she gets My parents didn't think about the future, they worked hard to make it during the present Mom lives on SS and again, I wonder how people who live on SS make it if they don't have help Comment from : @TammyWalker-n2f |

|

|

Women's are the strongest independent women z ignorance and morron and Masses of women's prideful family members and friends Comment from : @paulsaragosa371 |

|

|

Can you women's prideful women's fixing the entire world of women's ignorance women's arrogance women's complacency women Comment from : @paulsaragosa371 |

|

|

I don't feel bad for people like these U are a grown adult when u reach 18 years old and should think about it when u reach retirement age nobody is there to help u except you Comment from : @sutkos3288 |

|

|

It helped watching my mom struggle when my dad died at 62 She made it but it was not lavish I knew I had to save Comment from : @tmusa2002 |

|

|

I'm not sure if im am a little tiny bit of a tiny little brain storming Comment from : @paulsaragosa371 |

|

|

Power up gum balls machines Comment from : @paulsaragosa371 |

|

|

What is never talked about in these discussions about retirement is periods of unemployment You can't plan for them, to be certain, and you certainly can't contribute to your retirement during them In 2001 when the Nasdaq bubble burst 440,000 IT jobs vanished, Just as they were beginning to rebound, 2008 happened Almost all IT work went to short term no benefits contracts It is virtually impossible to jump from one contract to the next without a pay gapbrI'm 70 years old , I work as a maintenance man at a church for 15/hour and I will have to ask for a half day off to go to my own funeral Comment from : @chesterwilberforce9832 |

|

|

I will never retire because I want to travel and that cost money and I will not travel cheap I will live my life to the fullest going on cruises and hikes Long as I'm alive each dime will be saved for resorts!! And more vacations Comment from : @movielover850 |

|

|

I established IRA and non-IRA accounts in my 20s, contributing to them regularly I always worked full time, lived frugally, saved and invested I never made a great salary and never worked for a company that offered a 401(k) or pension I retired 25 years ago At 66, I'm financially secure and living comfortably It can be done But one has to start early and make sacrifices Comment from : @KathleenMcNe |

|

|

The biggest key to retirement is to be out of debt No auto loans, no mortgage / rent payments and carry no credit card debt I am 54 and my wife is 50 We will have about $400k saved by the time I am 65 Our monthly estimated ss for the both of us at 65 will be $3600 We will do just fine Comment from : @re8746 |

|

|

As the saying goes "failing to plan is planning to fail It's never too soon to start Your future self will thank you Comment from : @bernie9728 |

|

|

Fail to plan ? Many of us cant afford anything The rich shouldnt do stories they cant understand- the comment section- many are from the very people, who dont pay their employees,what they need Our system is being destroyed With more seniors living in campers- a new system will come about, and u wont like it Comment from : @nealamesbury7953 |

|

|

There ain't no jobs here😵💫 Comment from : @JohnAlvarado-th7tt |

|

|

Looking for a financial planner at the age of 66? Oh well Comment from : @nomadictravelerfromTx |

|

|

gotta have a plan- without a plan- one plans to fail Comment from : @dennispatterson4998 |

|

|

Everybody should watch graham stephan Comment from : @joslu80eight5 |

|

|

Whilst people my age are driving to work in their Tesla’s I’m cycling to work and buying Tesla shares on my lunch break Comment from : @Swanseaguy1979 |

|

|

Women have to make better choices! RIP young lady! Comment from : @RETlREDAVIATOR |

|

|

A lady sitting at a restaurant claiming she can’t afford to save? Try skipping the luxury of eating out and put the difference in savings People are crazy!!!! Comment from : @tmusa2002 |

|

|

How often was that woman with a nickel left eating out at the diner and talking about not being able to save? Comment from : @aaap3875 |

|

|

In the end you are responsible for your own retirement very few companies offer pensions Comment from : @debbieframpton3857 |

|

|

Good for the lady that's doing waitress work she was smart and saved I can't say the same thing for the lady that is setting their eating if she had saved that $5 a week it would be more than she apparently has now Saving have to come first I quit working my full-time job as 65 I am now 67 as soon as I get my Social Security check I put $200 into savings and live off the rest for the month I did this one I was working full-time set amount went straight to my savings into a Roth IRA and a 401k that I made my house payment car payment and utilities I was lucky enough to never have carried any charge card debt people can always find a way to save something Comment from : @debbieframpton3857 |

|

|

It’s sad to think all people in America don’t retire a millionaire $100 a month invested in good mutual funds from age 25 to 65 grows to more than $11 million But instead it goes to beer, cigarettes, and car loans Comment from : @mkite715 |

|

|

You clean house for a living and your out buy breakfast every morning, when preparing meals at house would be way more cost effective How stupid are these people? Comment from : @benden5095 |

|

|

stop eating out Comment from : @priceandpride |

|

|

BS! All excuses I have only a high school diploma and retired last year at 55 with $14 million saved Again, I saved that amount on only a high school diploma and worked a IT Computer Desktop Support Job for the past 23 years with my last years annual earning only being $68,000 When I started that job I was making only $34k Plain and simple these people spent more than they saved and invested during their working years and are now winning To all the current 20-30 aged people, learn to cut back and live below your means and increase your saving and investing That means you buy a used car and drive it for at minimum 12 years and live in a smaller home to start with Comment from : @theadvocate1925 |

|

|

I bet the financial planner is living paycheck to paycheck ahha Comment from : @dvelop4975 |

|

|

aha yikes Comment from : @dvelop4975 |

|

|

Not saying anything against financial planners, but if they aren't telling you to save so you can purchase money generating assets, like rental properties, you still won't have enough in retirement Most people just aren't running the numbers and really thinking about what it will cost to maintain their lifestyle and what it will cost to do a little extra A little traveling, going out to eat, trying new experiences in my opinion, PASSIVE INCOME is the only way to retire and enjoy that retirement!! Comment from : @rillawhat8142 |

|

|

they spent like a lord while they were youngnow they pay the price Comment from : @ngdavid755 |

|

|

People who say the stock market is gambling when they're young end up here You HAVE to invest!!! Comment from : @cskillet2003 |

|

|

Always plan for retirement invest, own your own home and add to your retirement fund Having no choice but to work in past 60y is a terrible way to spend your last years Comment from : @unrealr33 |

|

|

White people are starving CUS IN USA ALL THE JOBS GIVING TO MEXICAN OR COUNTRY SURROUNDING,AROUND THEM, Africans JEWS, FILIPINOS , some AMERICANS JEW , India BUT AMERICAN CITIZENS R JOBLESS AND STARVING FROM NO FOOD N CHEAP JUNK FOOD Comment from : @tarabara5092 |

|

|

Only idiots need financial planners Comment from : @uppermostking02 |

|

|

SSI and work, I can never save for retirement because SSI is tested means based program Comment from : @ChristinaOstil115 |

|

|

I'm 67 working full time and plan to continue so I can max out my social security and not draw it until 69 or 70 Life dealt me two layoffs at different employers over the years so I have one very small pension, social security to come, and within a few years from now a paid off mortgage if I can continue working Even with a small pension and small savings I feel I'm one of the fortunate ones Comment from : @CaptainQueue |

|

|

Insurances won't work In most countries in Europe, we have government pensions even though we never worked with the government It's enough to live a decent life Comment from : @leonardell-bon7104 |

|

|

Common Sense especially after learning government lied about the Afghanistan War we the people have enough money to solve all the people's retirement needs but no Machiavelli politicians desire to destroy America like the elites destroyed the British Empire by trying to destroy GermanybrWar only destroys nations never builds nations Comment from : @jamesmurphy2828 |

|

|

Majority of all people die are retired Retirement kills people Never retire Comment from : @Kermit46 |

|

|

Wages have been stagnant for 40 years let's put that in the equation Comment from : @neilpuckett359 |

|

|

Good for her that she never asked "professional" advice!!! Comment from : @landlord5552 |

|

|

That patty melt looks good Comment from : @terryedwards8367 |

|

|

I just love all the douche bag comments when you don’t really know anything about these people but a two minute video 🤔🤣 Comment from : @georgegarner1425 |

|

|

so much expert advice and so many are 3 days away from being homeless don't believe these armchair experts the real world is harsh/unpredictable Comment from : @dufus2273 |

|

|

fail to plan my ass it's impossible to determine what increases will be in health care, taxes, groceries, insurance, utilities, maintenance on a house, clothes for children and college fees Not to mention money to mom and dad as their health fails Automobile for you and the wife plus associated expenses This video doesn't explain anything Try any of this with you AND your wife making 20 bucks per hour The government will always get WAY more than they need and leave you hanging and asking you why you planned to fail Been there , done that You are a slave Look at the number of homeless, totally broke and the rich get richer on OUR BACKS They're not working for your betterment Comment from : @dufus2273 |

|

|

Why never say retire? The job must be easy, relax and a way to pass time Comment from : @raytan1661 |

|

|

That’s great to have a savings account but But you should put at least some of it in a Roth IRA account for retirement because honestly having money in your savings is good but at the same time its only (looking pretty) and not really doing anythingor gaining any intrest the percentage you will get back is only 003 percent you wouldn’t have enough momey to retire just by keeping money in your savings have at least 2-6 months of a security fund saved so you wouldnt have to save as much and think of your Roth IRA as another savings account accept its basically money you cant touchwhich will have a higher return having 250 a pay check is 6,000 and year x 54 years(my retirement age) is 324,000 by the time you retire and with all the interest you will gain it will be about 500,000 by the time you reach 54 But that also doesn’t include social security and my employer match Comment from : @briannanicole830 |

|

|

I'm 75, forced to retire at 59 and have family income of 3,000 per month because: I never subscribed to cable sports packages, ate out only on special occasions, kept our cars for a minimum of 6 years, never drove a cadillac/BMW/Lincoln etc We never had credit card debt over $500 and never paid interest on it All these people interviewed have very nice furniture, clothes, homes The spent their future on good times all along the way Comment from : @charlieb8788 |

|

|

Old people are the biggest whiners ever - while they complain about the "younger generation", they've never saved and plan on "working forever"? How? Some 89 year old is gonna be serving coffee?brbrThey failed to plan and now they're getting desperate When they find out social security won't pay for most of the things they need, welp Good luck Thoughts and prayers are with y'all Don't expect the younger generation you love to badmouth so much to come bail you out Comment from : @srirachahero4679 |

|

|

How ridiculous these folks work all their life and people think they don't deserve Breakfast That lady's still working I think she can buy breakfast if she wants But our society would rather give to people who haven't worked a lick Comment from : @stephaniehargraves6137 |

|

|

For all idiots You can eat breakfast out for 199 Plus a tip u cannot cook at home the cheap I want to live long enough to watch all u fucks end up on skid row which you will Comment from : @hellooutthere8956 |

|

|

As usual Americans have no empathy or compassion These comments are so ignorant or either they are posted by gov trolls I am old enough to remember the sell out by Nixon The resulting no jobs And still no jobs to cover basic needs unless you are a criminal Comment from : @hellooutthere8956 |

|

|

How do you save money when you're making $725 an hour impossible Comment from : @judyvaughn761 |

|

|

If you're eating out on a regular basis INSTEAD of once per month, that could be why you're not saving money!!!! Shop the sales at your grocery store, TJMax, Marshalls, Ross for clothes, also some thrifty stores JCP with coupons for items also, Take walks to exercise and stay healthy, less meds and longer life Comment from : @pinkrose5796 |

|

|

Get real! Life throws many people unexpected tragedies and events Certainly some when working don't save but that is certainly not true for many who have burdened their share of hardships Remember never judge until you walk in another shoes" And for the majority stay clear of the "financial advisor" they make their money off of you! Comment from : @suepearn1323 |

|

|

Our government has done this to us and this is wrong Comment from : @helenboula3538 |

|

|

I had to laugh when they brought up getting help from professional financial plannersbrTens of thousands (perhaps millions) of people have had their retirement savings stolen by these supposed "experts"brBetter educate yourself and make your own plan and decisionsbrThose people are worse than used car salesmen Comment from : @steelcastle5616 |

|

|

Move to thailand Comment from : @farhanpatwary9345 |

|

|

Complain about not being able to save, but you are a "regular" at a diner? Found your problem lady Its not society, its you Comment from : @rwg4397 |

|

|

Why not work part time instead of retire? Comment from : @ktee1403 |

|

|

watching videos like this makes me feel so much better about myself brive been saving 40 of my income since my early 20's and plan to retire early Comment from : @LeapingRat |

|

|

Victim mentality Comment from : @PapaSmurf63B |

|

|

Don't smoke, don't drink, stay in school, don't prematurely have children you can't afford, save 2 of your annual income for retirement and you can work a fast food job your whole life and be baller status Comment from : @Sandlin22 |

|

|

I think we need a millennial tax Millennials should pay everyone over 60 to retire Comment from : @cato451 |

|

|

Don't waste money on an 'expert'brIt's all common sense Comment from : @ERIN_198 |

|

|

Financial consultant ,good for the rich ,who can diversify ,for poor people you can get into debt trough risky investments or credit card debt,don´t use credit cards ever brShould have a house ,however small at that age ,frugal living ,don´t compare yourself with others who have more Comment from : @farangdee |

|

|

I think Eller's has a 401 K Comment from : @jeffreyrichardson |

|

|

Another thing: since 2008 interest rates for all savings accounts have been well below inflation Saving is not as easy just sticking it money market and saving account anymore Comment from : @douglaz74 |

|

|

Yes this can and probably will happen in the USA: wwwtheguardiancom/world/2013/mar/25/cyprus-bailout-deal-eu-closes-bank Comment from : @douglaz74 |

|

|

financetownhallcom/columnists/philgrande/2011/03/01/our-nation-gets-screwed-by-401ks-n1211235 Comment from : @douglaz74 |

|

|

wwwforbescom/sites/johnwasik/2013/04/24/why-401ks-have-failed/#511d19f8588b Comment from : @douglaz74 |

|

|

wwwmarketplaceorg/2013/06/13/sustainability/consumed/father-modern-401k-says-it-fails-many-americans Comment from : @douglaz74 |

|

|

Another thing, How people that have simplistic answers spend less and save more realize the US Government is $20 Trillions in debt In 2008 when the collapse happened the government printed more money to save wall street The result is the purchasing power of the dollar has been in decline since 2008 I know I go to the supermarket prices have gone higher Now the Fed is removing the plug that supported the economy for 10 years by rising interests rates Wall Street has been hit hard this year by such increases Eventually the dollar is going to have to come to terms with reality unless their other plans to prevent this from happening Comment from : @douglaz74 |

|

|

My response to all you people that say it was there fault for not saving and using credit cards that is a simplistic answer Look at the structure of our economy and how it has changed Until the early the 1980s companies produced goods to sell which is how they made their money Since 1982 the financial industry took off fuelled by credit card debt and corporate mergers What happened during the corporate mergers defined pensions that were promised were axed Yes the same people that brought us the wall street crash in 2008 were responsible for the current state of affairs I am sure I will get negative responses to my comments but deep in your hearts you know it to be true No credit card debt no wall street profits to push the Ponzi scheme higher Comment from : @douglaz74 |

|

|

Save early, save consistently, invest savings in the broad equities market, reinvest dividends, and don't touch that account The result will be that you will not be poverty-stricken in retirement, even if you saved as little as ten bucks a week on averagebrbrGranted, some people are going to be hit with bad luck, adversity not of their own choosing or making There's no way around that happening to some of us But for most of us, we can save enough to be secure and minimally comfortable in retirement brbrThe numbers tell us, however, that most people don't do it The most widespread bad idea is that because I can't save enough therefore there's no point in saving at all That's deadly Comment from : @louiscgasper7588 |

|

|

Mabey if they were investing since they first started working and were thinking about there future instead of spending every dollar they make and more / and racking up credit card debt they would have something meaningful saved It’s not a hard concept to grasp brbrSpend less than what you make and invest the rest I also have bills but when I’m done paying them I still have a decent chunk to invest in good ETF or Mutual fund or growth stocks or dividend stocks Comment from : @muradshawar |

|

|

woman said she could never retire, as she at breakfast out its cheaper to eat at home Comment from : @genevieveheater705 |

|

|

Stephanie Tucker was correct For many of us, life's tragedy's can wipe you out Having a family member or yourself facing a devastating illness turn your financial world upside down Most people don't see that one coming, and with people living longer it's becoming more of a certainty Comment from : @CatTalesCrafts |

|

Older Americans struggle to save for retirement РѕС‚ : CBS Evening News Download Full Episodes | The Most Watched videos of all time |

|

SBI life ewealth plan complete details | sbi life ewealth plan | sbi life e wealth plan | ulip plan РѕС‚ : YouTheReal Download Full Episodes | The Most Watched videos of all time |

|

How much money do I need to retire? Retirement calculator and retirement plan! РѕС‚ : Swan Thinks Download Full Episodes | The Most Watched videos of all time |

|

Save petrol Save Money Drawing | Save Fuel Save Money Poster | Save petrol Drawing РѕС‚ : drawing web Download Full Episodes | The Most Watched videos of all time |

|

SBI life insurance smart elite plan | sbi life smart elite plan | sbi smart elite plan | Hindi РѕС‚ : YouTheReal Download Full Episodes | The Most Watched videos of all time |

|

SBI life smart champ insurance plan | sbi life smart champ plan benefit | sbi life smart champ plan РѕС‚ : YouTheReal Download Full Episodes | The Most Watched videos of all time |

|

LIC Jeevan Labh Plan 936 10 Years LIC Plan Example | LIC New जीवन लाभ 936 | LIC short term Plan РѕС‚ : Aakash Garg Download Full Episodes | The Most Watched videos of all time |

|

LIC SIIP Plan No 852 | LIC Sip Plan Details | LIC ULIP SIIP Plan | Best Sip Plans for 2022 РѕС‚ : Insurance Clinic Download Full Episodes | The Most Watched videos of all time |

|

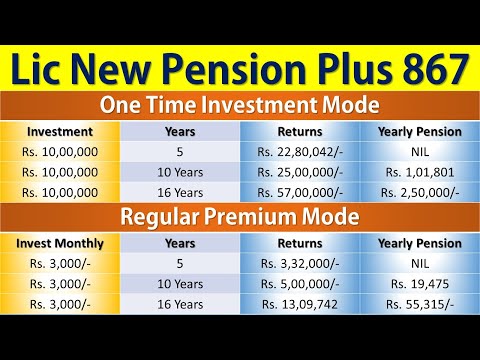

Lic New Pension Plan 867 | Lic Pension Plan 2022 | Lic New Pension Plus Plan | नई पेंशन प्लस योजना РѕС‚ : Insurance Clinic Download Full Episodes | The Most Watched videos of all time |

|

LIC Nivesh Plus Plan Vs LIC Index Fund Return calculator, LIC New plan 2024, Best SiP plan 2024 РѕС‚ : Insurance Pathshala -Ankesh sahu Download Full Episodes | The Most Watched videos of all time |