| Title | : | Money supply and demand impacting interest rates | Macroeconomics | Khan Academy |

| Lasting | : | 7.34 |

| Date of publication | : | |

| Views | : | 376 rb |

|

|

Isn’t the money supply line vertical? Comment from : @jessiemayfield6749 |

|

|

Thanks 😊👍 Comment from : @suliyatfolake4380 |

|

|

Is the interest rate here real interest rate or nominal interest rate? Comment from : @sindywang7482 |

|

|

Sal, What happens when the money supply and intrest rates go up at the same time? This is what's happening now Comment from : @chuck50a |

|

|

RENTING MONEY I love it!!!!! Comment from : @messijr5145 |

|

|

Why is money supply not perfectly inelastic? Comment from : @bobo0991 |

|

|

This is amazing Awesome Comment from : @shuaiyang5508 |

|

|

Well why on earth is the Fed only lending the government 6 or 7 trillion? Why not 500 trillion? Comment from : @biulaimh3097 |

|

|

amazing video thanks Comment from : @Balance43 |

|

|

Nice explanation!! Comment from : @elisauldiaz |

|

|

Best explanation thus far 🙌🏽 Comment from : @thandekajwara9990 |

|

|

Central Branks?-lmao jk great vid Comment from : @umerrehman8784 |

|

|

Thanks! Comment from : @andreanicole7035 |

|

|

Just to clarify In the second curvebrPeople are saving less, thus supply drops That’s clearbrHowever I don’t understand why as you said, when people save less, they borrow more? (And push up demand for money) brbrHow does this work in real life? brAs I think, if I save less, it means I am using more money for consumption and thus I need for borrow less? Comment from : @gorillaofjohn15 |

|

|

So if the interest and money supply is fixed what does an increase in government expenditure by selling bonds to the public do? Comment from : @rojamillerover |

|

|

Ok The end of this video is the most important part Finally I understood why we deal with interest rate as "the price of money" That's because if supply for demand changes, the price of this must change too, in this case, interest ratebrSo, about interest rate is enough understand what affect supply and demand for money We are specifically talking aboug big consumers of money: governments, banks, consumer's sentiment, ? something more?brThat's what I learnt watching this video Thank you so much! Congratulations😆 Comment from : @oliveiraphael |

|

|

Q axis; wouldn't that be $ 'available' to lend? Comment from : @6789uiop |

|

|

Hi, could you please explain why in the 2nd supply & demand scenario, you took the demand curve to the right as if it was increasing but you said that since saving is going down people are gonna borrow less money? Comment from : @robertfaurisson6951 |

|

|

Sooo helpful Comment from : @naaakuokor63 |

|

|

Central branks Comment from : @danielrnuttall |

|

|

Brilliant Bravo Bravisimo Comment from : @nolisto1 |

|

|

Thank you Khan's academy Comment from : @vrinda888 |

|

|

why didn't you use the usual vertical curve for the money supply? Comment from : @camilleanneDT |

|

|

if consumer borrowing is less, how can that bring demand up? Your second graph is a bit confusing Can you clarify that? Comment from : @medicineherbal8421 |

|

|

thanks it was really helpful (: Comment from : @Sam91 |

|

|

JazakAllah Comment from : @SanaHasanArabianPearl |

|

|

For each of the following scenarios, tell a story and predict the effects on the equilibrium levels of aggregate output (y) and the interest rate (r) :brB During the summer of 2003, Congress passed and President George W Bush signed the third tax cut in 3 years Many of the tax cuts took effect in 2005 Assume that the Fed holds Ms fixed pdf Comment from : @kimsrengpajerosreang2620 |

|

|

For the 2nd graph, I get that the supply of money will decrease (shift left) and increase interest rates, but how would that increase in rate INCREASE demand of money? People will borrow less, yes - and so interest rates should reflect that by DECREASING (as people aren't demanding loans/money as much)brbrPls halp Comment from : @aceyboy |

|

|

Nice !brAmen ! Comment from : @grrrrrr911 |

|

|

Very helpful! Thank you! Comment from : @anumhussain8473 |

|

|

for the 2374687634827643th time, Khan Academy saved my life :) Comment from : @fernandokleinrocha1 |

|

|

i think "less" should have been "more" they save less cos they need to spend it, and MORE borrowing could help with that Comment from : @tareek72 |

|

|

whats a central brank? jk thanks for the vid it helped ;)

Comment from : @toddaillon |

|

|

Consumer savings goes less when there is inflation In such case well to do consumers will save less while those on the borderline will have to borrow now to meet their needs So we will have an aggregate effect of middle class saving less and poor borrowing more HTH Comment from : @StudentKats |

|

|

Thank you very much, explains really clearly! Comment from : @jewishunited |

|

|

@KaninoWorldIsThis When consumers save less, it's usually for the intention of using that would-have-been-saved money to buy goods Or, instead of saving money, they decide to spend it on consumer goods, shifting the demand curve outwards Comment from : @ITogoPogoB |

|

|

if consumer savings goes down, why would the demand curve shift up? Comment from : @KaninoWorldIsThis |

|

|

macro at its best nice ass video Comment from : @G0TSt33Zy |

|

|

@swedishorient Greed ?? Comment from : @spirituelconnexion |

|

|

whenever the government interferes it just effs up the economy! Comment from : @JasonCtutorials |

|

|

is there anything this guy doesn't know?? Comment from : @swedishorient |

|

|

Branks Comment from : @xAL3Xx |

|

|

@baydood510 yes to an extent they would be forced to raise the interest rate if inflation increases Comment from : @Financeloverleo |

|

|

I thought the fed artificially controls the interest rate, regardless of market conditions Comment from : @baydood510 |

|

Nominal interest, real interest, and inflation calculations | AP Macroeconomics | Khan Academy РѕС‚ : Khan Academy Download Full Episodes | The Most Watched videos of all time |

|

Demand curve for money in the money market | AP Macroeconomics | Khan Academy РѕС‚ : Khan Academy Download Full Episodes | The Most Watched videos of all time |

|

Money supply: M0, M1, and M2 | The monetary system | Macroeconomics | Khan Academy РѕС‚ : Khan Academy Download Full Episodes | The Most Watched videos of all time |

|

Market equilibrium | Supply, demand, and market equilibrium | Microeconomics | Khan Academy РѕС‚ : Khan Academy Download Full Episodes | The Most Watched videos of all time |

|

Commodity money vs. Fiat money | Financial sector | AP Macroeconomics | Khan Academy РѕС‚ : Khan Academy Download Full Episodes | The Most Watched videos of all time |

|

Quantity theory of money | AP Macroeconomics | Khan Academy РѕС‚ : Khan Academy Download Full Episodes | The Most Watched videos of all time |

|

LM part of the IS-LM model | Macroeconomics | Khan Academy РѕС‚ : Khan Academy Download Full Episodes | The Most Watched videos of all time |

|

Money Market Interest Rates - How Do Central Banks Set Interest Rates? РѕС‚ : EconplusDal Download Full Episodes | The Most Watched videos of all time |

|

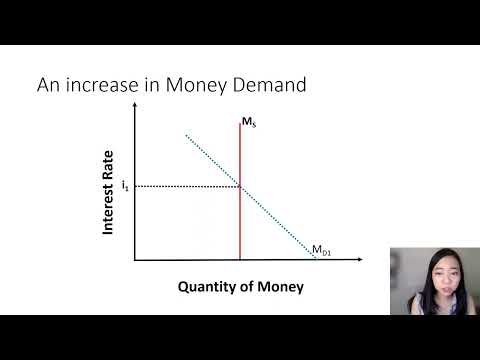

Money Demand, Money Supply, and Equilibrium Interest Rate РѕС‚ : Iris Franz Download Full Episodes | The Most Watched videos of all time |

|

Tutorial 9: The Money Market│Money demand, money supply, target interest rate, real money РѕС‚ : Macroeconomic Models Download Full Episodes | The Most Watched videos of all time |