| Title | : | I Retired EARLY – Here’s My Numbers and My Plan |

| Lasting | : | 8.28 |

| Date of publication | : | |

| Views | : | 484 rb |

|

|

Best lesson I had before I retired was coworkers who went for a fancy, new upgrade (truck, house, boat, and/or spouse) "they had always wanted" upon retirement And they sold/divorced at painful losses If you're smart, 500k is enough to live well If you're stupid, millions will not save you from yourself Comment from : @occamsrazorblades |

|

|

What are you doing with Health Insurance? Thank you for your response in advance Comment from : @schellingrs |

|

|

I’ll be 60 in August Will retire by October at the latest I’m married and my spouse does not work I should have about 750k and a small 700/mo mortgage I’m a bit nervous but hoping for the best Anyone out there have a similar situation that worked out well? Comment from : @leehudgins6148 |

|

|

Your story is incredibly inspiring and refreshingly transparent I love how you broke down your strategy step-by-step, from the three buckets to your withdrawal plan and tax management It’s a great reminder that early retirement doesn’t require a million dollars—just careful planning, discipline, and a willingness to tailor your strategy to your unique situation Thanks for sharing your numbers and insights; it really makes the idea of retiring on a moderate income feel achievable and empowering Keep up the great work, and I can’t wait to follow your journey! Comment from : @EarlyRetirementRoadmap |

|

|

I would say rent out your house in Virginia and live in Uruguay or Peru full-time, that would reduce your expenses to 2k/month Comment from : @RyanHartwigOfficial |

|

|

I just found your channel and thanks so much! I’m approaching 50 and am a widow that would love to retire early from corporate America I’m curious as how people manage health insurance until Medicare eligibility? Comment from : @birdamanda76 |

|

|

I’m single 55 with $1M and no mortgage (paid off) or debt Why am I working so much? Lol Comment from : @jamievidd775 |

|

|

Sit on my face Comment from : @arandomdumbass667 |

|

|

An annuity for 200k will give around 16k a year for the rest of your life That is an option Comment from : @joelandrade1630 |

|

|

I did it too I retired at 56 (7 years ago) Forget about the age your parent’s passed Change your lifestyle to extend your life expectancy My mother and father died with Alzheimer’s and Dementia, respectively…bad genes? In 2022, I was obese, had a horrible diet and was on 9 medications (two were Alzheimer’s meds) I had watched a lot of YouTube videos about how diet impacts the brain I started a Keto diet, ate all my daily food in 4 hours and fasted 20 hours a day I started walking and got up to 8 miles every other day October 2022, i had lost 73 lbs and my doctor titrated me off all 9 medications I still follow this lifestyle 3 years, 1 month and 20 days later My brain is so much clearer Don’t give up on life based on the age your parent’s died You CAN live longer if you change the way eat and exercise I believe our health is 85 diet and 15 exercise Comment from : @WilliamFluery |

|

|

3800/month to live on is $45,600 for the year Your 500K portfolio needs to generate over 9 annually to over that Good years are fine but not all years in the market cover 9 Good luck but IMO, 500K is not enough Plus you said you still have a mortgage Comment from : @user-vi7xy2wj3u |

|

|

What do you do about health insurance before 65? Comment from : @henrychen5254 |

|

|

Top of the Morning to ya ☕️☕️ Was just setting in the truck out in the parking lot before I walked in this morning here at work @5:50 this morning 🙄, lol Anyways still at the grind and definitely feeling the pressure this morning with waking up to a couple inches of snow here Hope your morning and day goes well I enjoy this video and will for another shortly ;)) Comment from : @user-if9ru9nd1v |

|

|

Congratulations as I hope to be retiring soon as well Did you calculate how much for monthly healthcare premiums? Comment from : @christaylor7436 |

|

|

Congrats! Welco,e to retirement I retired at few years ago just shy of 61 Just started taking ss Dont look back it's fun Comment from : @stevenbarnes8238 |

|

|

This was so informative Thank you so much for sharing! Comment from : @callynt |

|

|

The obstacle of retirement early is health insurance I don't hear much people cover this part? health insurance Comment from : @traidang1 |

|

|

You sound like you should wait until 62 Comment from : @warst04 |

|

|

retiring early , its up to u , money planning is everything , i retired at 55 , i am 67 and all is well u must do your homework , high school only , first thing home must be pd for no payments on cars trucks credit cards , no debt , than look at your income it will tell u if u can retire , good luck Comment from : @60panhead1 |

|

|

I'm 39 and retiring at 40 because my uncle died at 55 and never got to see retirement Comment from : @Growing_Sequoias |

|

|

For your bucket 2 money, as your cd’s mature, you may consider putting that money in SCHD It currently pays a dividend around 375, however the dividend is qualified so it is taxed favorably versus the money paid out by a savings account or CD and in your tax bracket you likely wouldn’t have to pay any federal income tax on the schd dividends SCHD’S dividend has also been growing by about 10 per year and it also helps to fight inflation as the underlining shares continue to go up in value while paying that 375 dividend As an added bonus, since it doesn’t have to many tech stocks that make up the etf, when the market go into a downturn, SCHD’s drop won’t be nearly as significant as say the nasdaq or S&P 500 Food for thought Comment from : @johnwedgeworth4908 |

|

|

Who paying for your health insurance until 65 ? Comment from : @Art-nd7mh |

|

|

I am planning to retire at age 60 I have both Roth and Traditional IRA/401K accounts When I retire, I intend to convert my Traditional 401K to a Roth through Roth conversions once my income decreases While I'm not suggesting you do the same, it might be worth considering Congratulations on your retirement! I wish you all the best I will be following your videos to see how your journey unfolds Thank you for sharing it with us Comment from : @DennisFazekas |

|

|

The bottom line is, obviously - what are your monthly expenses? Calculate that and your work's basically done, at least if you do homework you'll have a reference point to start from You did an excellent job of laying out your situation, and thanks for that I'm in a similar situation All these channels who post this stuff about needing a million dollars or this amount or that - well, it gets tiresome Just figure out what you spend on a monthly budget BEFORE you retire, and equate that to what you have in retirement and factor in the social security You did a fine job of laying it out in a simple way It's not what we make, it's what we spend, JUST like when we are in our working years Figure that amount out, and we are fine Comment from : @Mark-i3p2e |

|

|

Thanks so much! This was great! Comment from : @whatimontoday |

|

|

If we only knew our expiration date, decisions like this would be so much easier Thanks for sharing your thought process Comment from : @AllenRReid |

|

|

Thank you for this information My company downsized and I will be impacted soon I am turning 60 My wife is younger than me, still works with very comfortable income We’ve discussed in the past the desire to retire early and we both feel that instead of looking for another job, that I should retire The fear of not having enough is very real and I haven’t come to a conclusion just yet Your video is very encouraging Comment from : @grabcoffeeandgo |

|

|

I’m in the same boat I retired in 2022 at age 55 with a little over $500K in total retirement investments and savings I also own three rental properties, but I took out 80 mortgage on each about 10 yrs ago, so not much equity My pension starts when i turn 62 and I plan to take SS as well Both my pension and SS will combine for a total of $3K per monthbrbrMy strategy is very different from yours I sold my residence home to help finance my retirement until I collect SS and my pension I put 98 of my money into index funds and individual stocks I used to keep $30K in emergency funds, but I burned through it last year I keep less than $6K in my checking account If I need emergency cash, I use my travel credit card or sell some stock brbrSince I don’t own a personal home or car, and my rental properties do very well, I don’t have a lot of expenses I spend most of my time traveling I stay in Stafford, Virginia when I’m visiting the states Take a look at may FB page I spend most of my time in Mexico, but I travel a lot to Asia and I take lots of pictures and videos Comment from : @donaldkinsey5245 |

|

|

One thing I try to do with passive investments ie indexed funds is focus on 15 - 20 year averages rather than 5 year averages These span most economic cycles and I think give you a better long term forecast indicator of how well you are doing Comment from : @whitecaps0 |

|

|

Total gilf Comment from : @dalethedippa5822 |

|

|

Congrats! I wish u the best of life! Comment from : @LyAceramica |

|

|

I’m on Long Island Please advise You are very pretty Comment from : @WaterDesignirrigation |

|

|

Your investments should be taxed as long term capital gains not income That means that for the first $48k you pay no taxes as a single filer Comment from : @phyzixlab |

|

|

ohhh god She's depending on SS?! big trouble Comment from : @davedeboy5726 |

|

|

Thanks so much This was extremely helpful Comment from : @matthewgarcia5567 |

|

|

Finally , a person at retirement age , talking about their experience Also refreshing to hear about retirement on less than a million dollars! Glad I found this sensible YouTube channel Comment from : @edwardgh57 |

|

|

I am hoping to retire early to help take care of our parents- this has been very informative! Comment from : @robynames9213 |

|

|

Please Thank your Son for his service to our country! You are to be commended for a parade of decisions, 1 out of 24 consumers I helped had a written budget (or an APP) The one just happened to be a lady So much good content in this video 62 is a sure bet, but this is why You're yielding over double digits on your own 59 and retired here Congratulations to you! Keep that will updated, although 95 is a ways off yet! USN '84-'88 Comment from : @dougcharles6845 |

|

|

Thank you for sharingGod bless you!❤ Comment from : @GODLOVESSAM |

|

|

Do you think I can do this at 30-35 if I wanted? I’m nearly there in total but that’s a longer runway of time to think about Comment from : @ryanc4955 |

|

|

Subbed & following, I just discovered your channel I just turned 59 1/2 and have a very similar financial situation, but I've never owned a home or had kids I've recently had the urge to get out of the rat race to enjoy the youth of my senior years while I still have my health even if I have to pick up a job later in life to supplement my income, but don't have the confidence to make that move yet I hired a financial advisor and tax specialist last year to help me work through my retirement planning and probably into retirement Do you have an advisor or are you educated in the process yourself? I'm not, you sound like you know what your doing My advisor is suggesting that I pay current taxes and start moving tax deferred retirement accounts into Roth accounts to avoid RMD's and social security from pushing me into a higher tax bracket in my 70's which would also create IRMAA surcharges through medicare parts B & D I'm in the 12 tax bracket now and the Tax Cuts & Jobs Act is scheduled to sunset at the end of 2025 so that will move us into higher tax brackets next year I expect to live into my mid 80's or beyond but have nobody to leave a legacy to I'd prefer to live my life to the fullest and bounce my last check on the day I die Comment from : @Big2Wheeler |

|

|

I’m retiring June or Dec 2026 at 59 Comment from : @carolyn8103 |

|

|

Impressive! Comment from : @funnytito |

|

|

I’m 52 and almost there you are my hero Comment from : @barbararios246 |

|

|

How do you handle medical insurance? Comment from : @alanawang353 |

|

|

I like your plan What are you putting in your box 3 high risk Comment from : @tonycollins1278 |

|

|

Great video!! I aspire to have at least half a million invested by 50 Your journey is inspiring!! All the best to you🙏 Comment from : @tankhajj |

|

|

I retired in November at age 64 and received 2 early retirement benefifts, a cracked tooth in December and another one just last week It will cost about 8k for implants Moral of the story, take care of your teeth! Good luck to you Comment from : @yetivanmarshall1473 |

|

|

Thank you for sharing ❤🎉 Comment from : @sacausa |

|

|

Wow so happy to have found your channel, my husband is 56 and I am 48 so we are getting our plan together and this is super helpful ! Excited to follow along Comment from : @lindatrionfo2288 |

|

|

You probably shouldn’t be withdrawing from your Roth account first, especially while you’re in a low tax bracket Comment from : @RealMuperSan |

|

|

Hi Trina - I appreciate the transparency and clarity of your videos, including this one I'm 56 single no kids (but am unfortunately not a homeowner; I rent) with $900k in my IRA, and am considering making the move Videos like yours help me realize it is indeed a possibility Comment from : @morrisj68 |

|

|

Thank you for making this video and being transparent with your portfolio numbers You mentioned withdrawing from your second bucket which includes some pre tax accounts Are you paying penalty? Age was not mentioned or i may have missed it and don’t want to ask but it matters when withdrawing from retirement funds pre tax post tax doesn’t matter Also how are you paying for your health insurance until you’re eligible for Medicare? Comment from : @aditisen9722 |

|

|

Great Job and congrats on early retirement! May I ask what you are doing for healthcare until you are eligible for Medicare? Comment from : @chrisarvanitis198 |

|

|

Call me crazy but I'm 38 and almost have 500k and thinking about retiring when i'm 40 Comment from : @TheRealWurstCase |

|

|

If you're making youtube videos, you're not really retired Comment from : @barbtiller5455 |

|

|

Congrats! It's great to hear from a non-CFP or other so-called professional, but from an actual retireebrbrI honestly don't know how most of our cadre (GenX) will do it I'm fortunate that when I retire from the federal government, I'll have around $3,500/mo, plus the supplemental for an additional $1,500 In a few years, I can garner my military retirement ($3K/mo) Comment from : @josephpilkus1127 |

|

|

Retired at 21 about 54 years ago and began doing what I wanted to do Comment from : @1776AllOverAgain |

|

|

👍 Comment from : @RajReviewsDualSportPhotoGadget |

|

|

Finally Someone who's planning to live today, rather than stressing about having enough money to live until 90 I hope you do outlive your money! But that's a good problem to have in my opinion Much better than the other way around brbrCongratulations on planning this out do well Comment from : @logicalparadox2897 |

|

|

This makes me more anxiety!!! You already have half million dollars alone, not including your social security yet So why not retired?! If I was in your situation, certainly retired at 58 But how many people have this amount of money when they are at 58, honestly I don't, sadly Comment from : @bluebird66918 |

|

|

Healthcare under 65 is so exepnsive is that included in your monthly budget? Comment from : @reesesha2289 |

|

|

I also have a son in the Navy! Mine is a Nuke and serving in Guam! BNMH Comment from : @Ramonryan |

|

|

The proposed strategy appears well-thought-out and robust However, it's worth considering how unexpected major expenses might impact the plan For instance, what provisions are in place for significant automotive costs, such as purchasing a new vehicle or covering substantial repairs? Similarly, how would the plan accommodate sudden home maintenance issues like replacing a water heater, furnace, or addressing severe plumbing problems? These unforeseen circumstances can result in expenses ranging from thousands to tens of thousands of dollars, as exemplified by a $25,000 water line replacement in my case It's crucial to account for these potential financial setbacks, as they often arise at the most inopportune moments Good luck with your journey and I wish you the best! Comment from : @seattlecougar1 |

|

|

Congratulations! I have 2 more years! I have a pension and spouse still working for benefits to achieve this! I can't wait and thanks for sharing your journey! Comment from : @jjjj-by1hu |

|

|

I'm 44 with over 10 million Main problem is I'm in Vietnam and 10 million only buys a loaf of bread Comment from : @ds5398 |

|

|

With $500k and your home, you’ll be fine Comment from : @frankyu6984 |

|

|

What about the medical insurance? How do you get coverage as you retired early I suspect in private insurance market it’s expensive Comment from : @qzb3bq |

|

|

Congratulations on your Retirement i drove to Virginia in 2009 from Boston, i hope you enjoy your retirement Comment from : @bengunns |

|

|

I like the video Straightforward I suggest learning how to use covered call options in a brokerage account to increase your income / nest egg It's very easy There are lots of videos on YouTube about this You could likely increase your annual income by 25-50 with little trouble and reasonable, controlled risk You can use the money directly or reinvest it in your ROTH It is highly unlikely that your current funds will continue to make such a high rate of return as the last couple of years which are huge anomalies over the long term view of the market (7-11 per year on average depending on allocation) You can accomplish this in just a couple of hours per month Good luck and enjoy your retirement Comment from : @_BlueHorseshoe_ |

|

|

How do you know when to take SS ? I like your tax strategy Comment from : @lanuiiohu |

|

|

You do realize how much health care costs are when you're older, right? It can cost say 10k a month if in nursing home unless you have medicaid Comment from : @quincylloyd1997 |

|

|

Congratulations! I'm also planning to retire early—I'm 52 and aiming to retire at 58 I have a pension in place as well Do you offer any consulting services? I have a few questions, particularly about financial planning Comment from : @haripasupuleti3869 |

|

|

Im in my 30s sitting here taking notes Comment from : @KaliHuntArt |

|

|

Congratulations on your retirement Really useful video Comment from : @Howtogetfluent |

|

|

tax question: why isn't most if not all of your income considered LTCG if you're drawing from your brokerages? You have held those assets for longer than a year, yes? if so, you should owe ZERO taxes on anything under $47k Comment from : @kayomichael |

|

|

How do early retirees go about the health insurance cost? Comment from : @nulek5555 |

|

|

good luck I am in a similar position as yourself Comment from : @mrsullyrox |

|

|

Lower overhead would be the key I'm at this crossroads and making the decision about how much longer to go My big challenge is lowering overhead and leaving the big city to get costs down Nice video, thanks for sharing your journey Comment from : @whiskeywoman8711 |

|

|

Good for you! Enjoy every minute of your early retirement Comment from : @gpdoyon |

|

|

Thanks for sharing! I hope to hear more about how everything is falling into place during your journey and whether you would made any adjustments as time goes on Comment from : @ConserveMore |

|

|

How do you pay for health insurance? Comment from : @cjmb4 |

|

|

Congrats on retirement! You may have quite a bit of interest rate risk in the fixed income/CD part of your portfolio Next time the fed cuts rates (as they always do whenever the economy lags), your 5 return will disappear You could consider mixing in longer term treasuries in there to make sure you lock in that rate of return Comment from : @TR-lh9yz |

|

SBI life ewealth plan complete details | sbi life ewealth plan | sbi life e wealth plan | ulip plan РѕС‚ : YouTheReal Download Full Episodes | The Most Watched videos of all time |

|

ABC 123 Song | The Alphabet Numbers Song Compilation | Learning Alphabet and Numbers for Kids РѕС‚ : eDewcate Download Full Episodes | The Most Watched videos of all time |

|

SBI life insurance smart elite plan | sbi life smart elite plan | sbi smart elite plan | Hindi РѕС‚ : YouTheReal Download Full Episodes | The Most Watched videos of all time |

|

SBI life smart champ insurance plan | sbi life smart champ plan benefit | sbi life smart champ plan РѕС‚ : YouTheReal Download Full Episodes | The Most Watched videos of all time |

|

LIC Jeevan Labh Plan 936 10 Years LIC Plan Example | LIC New जीवन लाभ 936 | LIC short term Plan РѕС‚ : Aakash Garg Download Full Episodes | The Most Watched videos of all time |

|

LIC SIIP Plan No 852 | LIC Sip Plan Details | LIC ULIP SIIP Plan | Best Sip Plans for 2022 РѕС‚ : Insurance Clinic Download Full Episodes | The Most Watched videos of all time |

|

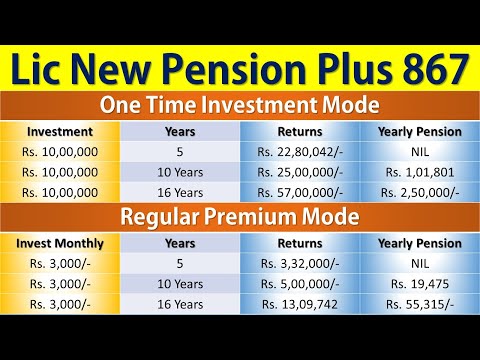

Lic New Pension Plan 867 | Lic Pension Plan 2022 | Lic New Pension Plus Plan | नई पेंशन प्लस योजना РѕС‚ : Insurance Clinic Download Full Episodes | The Most Watched videos of all time |

|

LIC Nivesh Plus Plan Vs LIC Index Fund Return calculator, LIC New plan 2024, Best SiP plan 2024 РѕС‚ : Insurance Pathshala -Ankesh sahu Download Full Episodes | The Most Watched videos of all time |

![[18 minutes] number 1 to 100 - Numbers Puzzle | Learn Counting Numbers 100](https://i.ytimg.com/vi/-D2XmKKlRpI/hqdefault.jpg) |

[18 minutes] number 1 to 100 - Numbers Puzzle | Learn Counting Numbers 100 РѕС‚ : 키즈키키 어린이TV - KIDSKIKI Download Full Episodes | The Most Watched videos of all time |

|

Count to 100 | Learn Numbers 1 to 100 | Learn Counting Numbers | ESL for Kids | Fun Kids English РѕС‚ : Fun Kids English Download Full Episodes | The Most Watched videos of all time |