| Title | : | Cash Out My Whole Life Policy? |

| Lasting | : | 7.51 |

| Date of publication | : | |

| Views | : | 97 rb |

|

|

Dave giving her props when she solved her own problem better than he did is a humble move Comment from : @murphdoesitagain |

|

|

The thing Dave always does is leave vital information out firstly the cash value that is non taxable accumulated interest Secondly the insurance company fronts money in the case of death that money is the insurance company’s and your family for when you die that cash value if or when u make your premiums you will get regardless 3rd let’s say you invest in a stocks, u have a 401 k or Roth IRA the risk value is much higher than whole life Dave Ramsey is the king of blowing smoke up peoples ass Comment from : @MYGENESIS4evrNEW |

|

|

And this is why whole life is a good idea They are not keeping your money, they are just giving it back to you Comment from : @re2914 |

|

|

10000 at 7 average in the stock market for 25 years is close to 750k Wtf is this whole life insurane thing? Seems like a scam Comment from : @deathkyo |

|

|

She's doing to much pray about it Comment from : @shawngreen7160 |

|

|

How do you not get the cash value in the policy? Comment from : @NickFromLongIsland |

|

|

What happens when the market crashes on her 250k? Always the bet the market is going up? Given the risk and the time left in her life the policy is a good bet Is the Fed going to bail out the next crash like the last one? Comment from : @terryglime411 |

|

|

“You didn’t need me, I needed you” if only the whole life pushers that call in could admit when they’re wrong like Dave can good man Comment from : @jesusiscurtis |

|

|

240 would double in 7 years Comment from : @treycobb1636 |

|

|

Pretty sure she gets the full 666k for the death benefit Not sure why they subtracted the cash value It's like weighing potential loss vs certified gain Man had 5 coronaries and poor family history She should just stay the course at this rate imo Comment from : @Omni-King2099 |

|

|

She will owe taxes on that 240k Prob 40k Changes the numbers a bit Comment from : @BLAZIN68 |

|

|

Finances are not difficult Comment from : @realtalk2046 |

|

|

I think he’s wrong at 2:37 when he says it’s a $400k policy The insurance company keeps the cash value, but the beneficiaries get the full death benefit Right? Comment from : @ericwaters |

|

|

I wish she would return to tell us how his bad advice is affecting her or not I hope her spouse is doing well Comment from : @horizongrowthacademy |

|

|

Cashing out in Florida no taxes it’s worth the move Comment from : @Undermineded-333 |

|

|

Our company teaches how to buy term and invest the difference Started out as an FPU instructor I get to assist clients on doing what Dave teachesmost rewarding career I have ever had Comment from : @krissifaith6709 |

|

|

she has been paying 10k PA from 1997 for 25 years which is 250k she did not even break even She only has 240k in cash value Horrible product Comment from : @r4rasa |

|

|

104 years Na cash out now and days enjoy the money before kicking the bucket😅😅 Comment from : @fordresurrectionest9556 |

|

|

Well, I just got resold on Whole life! Why on earth would anyone, understanding money, have a term life policy, what a joke! Most of the comments here are typical of "Keynesian" economic math I'm scrapping banks altogether, and going Whole life Don't just listen to a financial planner or any of those people, read and do research Every approach to term life I've seen is a huge waste of money, but if you have a 401(k) you're used to wasting money With a Whole life policy, I would definitely not waste money in the stock market, have you peole seen the multiplier tables, amortization tables? Average mutual fund is 4-5, 6 if you get lucky (the ups and downs of the market), and the bank charges you interest on a load, so throwing your money away there too(?), credit cards same, consumer debt, same, and you people are fretting about small money? The S&P doesn't even return that kind of interest, in fact over time (the stock market isn't always up), it loses money 2008 is a prime example (heck, 2020-2024 has been awful) When I hear negative on anything, I always research it They're usually hiding something! Comment from : @jamestriplett2876 |

|

|

Husband had 5 bypasses???? Probably needed to take care of himself Especially if the men in his family dont live long My father is 75 and car drive and still works i am 46 amd the eldest in my family, and I am in the gym three times a week This dude needed to take care of his health after the first bypass Comment from : @2025fambam |

|

|

Exploring US stock trading from Australia changed how I view investing With a 30 surge, I gained about $50,000, But, it also revealed the complexity of its market factors it demands skill and strategy Comment from : @JosephGodwill9h |

|

|

She could use the cash value to pay the premium on the policy Comment from : @ML-qj9fq |

|

|

This advice is absolute malpractice brbrShe owns an appreciating asset, that cash flows but unfortunately doesn’t understand what she has Even more unfortunate she asks an equally ignorant person with an agenda what to do brbrWhether you like whole life policies or not she’s just been given permission to light money on fire It’s criminal brbrI can never tell if Dave is painfully ignorant or deliberately dishonest, either way this is really bad Comment from : @AndrewHansen-b8c |

|

|

Its an amazing product Whole life is the way to go Comment from : @chrisventura1881 |

|

|

That man isn't dying anytime soon She'll probably go before him, truth be told😊 Comment from : @GodessIsabelRaina |

|

|

Question anyone Does anyone know how Globe Life can sell life insurance so cheap❓️are they trustworthy❓️🤔 Comment from : @GodessIsabelRaina |

|

|

Take a loan on the cash value RIGHT NOW, keep paying the premiums and set the dividends to go to repay the loan Comment from : @reidbalzer9514 |

|

|

Dave is so intentionally misleading it's criminal Just buy term from his website is all he cares about Comment from : @ericklarman7049 |

|

|

Whatever you do do not use Northwestern Mutual that was still your money and I got the receipt to prove it Comment from : @Airmanmx1 |

|

|

Comment Comment from : @dylankramer9249 |

|

|

If my maths is right, she’s been putting in $10,000 a year for 26 years, that’s $260,000 she has contributed And her cash value is $240,000?! These damn whole life insurance companies need to be put in prison Comment from : @ChristopherNunn-hn6oc |

|

|

11 return on investment bullspit and as we all know the market never goes down plus taxes cut the crap dave Comment from : @Inyourpowero1 |

|

|

Christian Motivational Speaker is the beneficiary of a 666k death benefit Comment from : @kennykistler6735 |

|

|

9 years at a more conservative 8 investing the $834 per month they already are That gets them to nearly exactly $666,000 Comment from : @JasonGroom |

|

|

They must be rich I pay $500 a year on mine and think it's too much Comment from : @erickanew |

|

|

What's the tax impact? Comment from : @dorothyhodder203 |

|

|

666 lol Comment from : @barnabascollins4625 |

|

|

I love her!! Smart lady Comment from : @Cyber_Diva |

|

|

This is the only time I’ve ever seen a Caller stump Dave I guess age does come with smarts lol 👍🏽 Comment from : @kamakazecam |

|

|

Ramsey team: posts about cashing out whole lifebrbrMe, who has no whole life: interesting Comment from : @Mrqwerty2109 |

|

|

An 11 return on investment Dave?! That's egregious brbrIf caller has an advisor and insurance person looking out for their best interest, they all sit down together // Note 600k of death benefit only Growing to 666 in that many years Doesn't sound like a great policy mix Probably should have been suspicious of this up frontbrbrI like cash value for flexibility when markets suck the wind out of investments during retirement/ btw: cash value does not equal surrender value Comment from : @tbopens41 |

|

|

Reduce pay up the policy, take a policy loan for $250k, take the 10k of premium that you were putting in and invest it that makes the most sense You get everythingbrbr-$250k in handbr-Still have about $250k of DBbr-No more premium duebr-Invest the 10k a yearbrbrAnything other than this is bad advice… Like REALLY bad advice Comment from : @6040adam |

|

|

This woman contributed 10k a year for 27 years With compound interest at an 8 rate, she would've had 950k Holy fucking shit Comment from : @peterpham240 |

|

|

These whole life salesmen need to be in prison Comment from : @jameshorton3692 |

|

|

A great example of why whole of life is a horrible product She has to roll the dice here If she had the cash value in investments since 1997, it's going to be worth a lot more than the current face value Comment from : @maxshiraz3447 |

|

|

Policy loan has tax advantageif you understand the tax advantage, you cannot be fooled by buy term and invest in difference Comment from : @pj882 |

|

|

Her only problem was not canceling maybe 6 years ago She had kids and only way to get life insurance, so she had no choice Comment from : @sdsudjrtz |

|

|

more simple questions that need to be asked like are there dividends that could be applied to reduce premium ? Does the death benefit increase over time ? What’s the increase in cash value every year I’m sure when all questions are answered it would make sense to keep Comment from : @jonathangoldstein7246 |

|

|

Not the 666 upon death 😢😅 Comment from : @Prettyricky504 |

|

|

Finally he admitted he’s wrong 😅 Comment from : @ricardoalcides7184 |

|

|

Don't give up the whole life policy, it is an asset and possible you are now un-insurable Whole life will always be there for you and your family, great product!! 11 returns in stock market are no guarantee Comment from : @darrend9313 |

|

|

It’s not genetic it’s their diet Comment from : @Hunter2847 |

|

|

Why not cash out and keep the policy? Also, should she not consider an investment? Comment from : @AaronDMiller23 |

|

|

Policy purchased 1997 Supposed policy maturation date of 2062 at age 102? Can that even be right? Comment from : @humblekind4189 |

|

|

This is clearly a great policy for this family, and a prime example of the power (both financial and emotional) that a good whole life insurance policy can bring I’m glad Dave decided to listen here first before making a blanket statement to cancel an in force whole life policy (which I’ve seen him do before) Comment from : @cscorona1 |

|

|

Or they can simply stop paying the premium… Comment from : @pastorjacob |

|

|

Be careful talk to your agent / company that issued policy - if you cash in the policy there are tax consequences- you may want to keep policy and withdraw premiums you have paid - and you can invest that money- also see when it will be paid up Comment from : @darrellyoung3602 |

|

|

Why cash it out? Comment from : @Wall2000x |

|

|

I'm surprised astroman hasn't comment on this video yet Comment from : @multimeter2859 |

|

|

If they had invested 10k a year from the beginning they would be better off Comment from : @ianmowbray3284 |

|

|

So by the end the question is, will he live at least 5 - 7 more years? Comment from : @ericonca |

|

|

people hate what they don't understand Comment from : @madchevy121382 |

|

|

Dave what are you talking about Comment from : @madchevy121382 |

|

|

no buy an iul and stop acting like term is for every circumstance dave ramsey Comment from : @madchevy121382 |

|

|

Do not cash out Whole Life cash value, take out a policy loan insteadbrIt is called an "& asset" for a reason Comment from : @infinitevelocityCA |

|

|

With his poor health, I would keep it He could expire tomorrow Comment from : @alinatamashevich3354 |

|

|

They also don't need life insurance if you have no kids at home and have a good retirement Comment from : @jwise7777 |

|

|

I'd take it out, saves me 10k per year and invest the rest in the S&P500 Comment from : @webfreakz |

|

|

That's around $30 per day Comment from : @jdjose3268 |

|

|

I don’t like this advice at all He’s 62 and has had cancer in the past and health problems and family longevity is against him When he passes away the beneficiary is going to receive $660K –not $420K It doesn’t matter if $240K has been paid in over 25 years in premiums The life insurance contract says $660K -assuming no policy loans have been taken

brLife insurance is not an investment folks because there are no risks Life insurance has guarantees and safety I hope she keeps the policy because of the questionable health of her husband I only wished it was a dividend paying life insurance product with growing death benefit Doesn’t sound like it is Comment from : @jimcrowley1709 |

|

|

whole life is garbage too many people fall for that pipe dream the rate of return of the cash value is nothing Comment from : @whoyoume1 |

|

|

Anyone notice how many times millionaires call this show Comment from : @52CA |

|

|

FV of 240K, 10K pmt, at 10 per year gets to 666K in 145 years Comment from : @colbyallen5750 |

|

|

First time I've heard Dave put the mathematics ahead of the ideology Comment from : @Lon1001 |

|

|

Yeah problem is he is uninsurable Humble of Dave to admit he is wrong I think the reason he didn't jump at it right away which he ALWAYS does to cash out whole life is because it sounds like he is uninsurable so he can't just replace it with some term as most people could It is kinda close because she figures he only has probably 10 years left but if I was in there situation I would probably cash out the money and go take that trip of a lifetime you have planned in your mind, sure maybe you are blowing $20k but why not, they would have over $1M still, their house is paid off and they are out of debt so not a lot of bills Comment from : @TheDjcarter1966 |

|

|

Dave’s reaction to 666k at 2:13 😂 Comment from : @cw5948 |

|

|

Dave didn't consider the crash in 2023 that will leave everyone with just 10 of they have now Comment from : @tracygaluszynski1868 |

|

|

Only time Dave ever said “no, you know what your doing “ Comment from : @jonathanmitchell7610 |

|

|

You promote greed 👎 Comment from : @chipsnotchunks2620 |

|

|

Ahh yea, another woman who just can't stop talking about when their husband is going to diepoor guy probably doesn't have it in him anymore to remind his wife that he's sitting right here when you're running the death calculations Obviously a very humble "Christian" motivational speaker Comment from : @Nick-gk6hj |

|

|

What about tax implication? Comment from : @IsaacGTX |

|

|

Cursed number Comment from : @Naturenerd1000 |

|

|

She just wants to cash out on her investment That husband is like a walking mutual fund Poor guys gonna die working Would be nice for her to work and make more and for him to retire and enjoy life Comment from : @djpuplex |

|

|

Yes, cash it in and get dividends Comment from : @mjwmontgomery |

|

|

She is planning for her husband’s death ☠️! Never marry an American 🇺🇸 woman!!! Comment from : @roolyfe |

|

|

Wow, Dave admitted that he was wrong This is like sun rising from the west Comment from : @MrSandeeparneja |

|

|

He didn’t consider the other option which is to find out what the life insurance face amount would be if they took a reduced paid up optionbrThat life policy has been based on a time when interest rates were higherbrPlus, her husband is no longer insurablebrAnd everyone dies… Comment from : @michellemorford349 |

|

How to borrow against your whole life policy www.adpiinsurance.com РѕС‚ : Active Duty Passive Income Download Full Episodes | The Most Watched videos of all time |

|

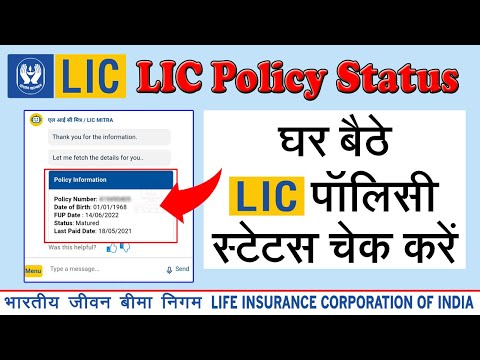

Lic policy status || lic policy status kaise check kare || how to check lic policy status online РѕС‚ : Info Gyan Download Full Episodes | The Most Watched videos of all time |

|

LIC policy status | LIC policy status kaise check kare | How to check LIC policy status online РѕС‚ : Aakash Garg Download Full Episodes | The Most Watched videos of all time |

|

LIC Policy में कितना पैसा जमा है कैसे चेक करे | lic policy me paisa kaise check | Policy StatusCheck РѕС‚ : Hindi info Download Full Episodes | The Most Watched videos of all time |

|

Lic Policy Status | LIC policy status kaise check kare online | how to check lic policy status РѕС‚ : TechTutorials Gyan Download Full Episodes | The Most Watched videos of all time |

|

LIC Policy में कितना पैसा जमा है कैसे चेक करे | lic policy me paisa kaise check | LIC Policy Status РѕС‚ : Future Tech Tube Download Full Episodes | The Most Watched videos of all time |

|

Lic policy Status Check l Lic policy status check online l lic policy Status Check mobile app РѕС‚ : Hindi info Download Full Episodes | The Most Watched videos of all time |

|

How To Cash Out A Money Order (How Do I Cash Out A Money Order?) РѕС‚ : The Savvy Professor Download Full Episodes | The Most Watched videos of all time |

|

How to use Whole Life Insurance to Get Rich (Become your own Bank) РѕС‚ : Whiteboard Wealth Download Full Episodes | The Most Watched videos of all time |

|

How to Borrow Money from Whole Life Insurance РѕС‚ : TOP CELEB MEDIA Download Full Episodes | The Most Watched videos of all time |