| Title | : | Federal Spending, Debt, and Deficits |

| Lasting | : | 6.27 |

| Date of publication | : | |

| Views | : | 32 rb |

|

|

The info on the printing of money info whileinformative in the comment below does not address the market value of the US dollar and how it is affected by increasing a deficit year after year In its simplest form we all understand that you need to on average over a period of say 3 to 5 years the revenues should match the expenditures so as not to devalue the dollar Americans do not want to have a monetary crisis at the federal level Comment from : @robertskinner9388 |

|

|

Great explanation! Comment from : @Kinsale101 |

|

|

I know this was a simplistic understanding But once again The POOR are the scapegoats MANDATORY SPENDING such as social security An action passed by Congress to COLLECT MONEY FROM US WORKERS and what? Match it? I've never heard that before I don't know why the government is paying for any of that All they should be doing is managing that And why are more and more people in need of the social safety net? Because we refuse to tax the Billionaires and Trillionaires to cover the things needed to promote an economy Courts, Roads, Healthcare, Internet Comment from : @aicram62 |

|

|

But Dave, how did the government tax money before it spends it? Arnt dollars creates by the government (or the fed)brbrWhat if one if the buyers of the debt is the fed?brbrDoesnt the fed vote on what the value of the debt will be (for short term bonds)brbrHow can a government that can create more money default? Comment from : @MaxwellGisborne |

|

|

I think if gov wants to charge us the normies more in tax, corporations should raise our pay It’s probably already been said but idk that just makes sense They don’t get taxed, people make essentially the same so we don’t have to cut our costs and so on Comment from : @IrrelevantParanoia |

|

|

You should read "the deficit myth" before you make another stupid video like this Comment from : @MF0722 |

|

|

and?>>brbrhappiness,in slavery Comment from : @sirloin869 |

|

|

Is government allowed to invested in profitable endeavors to finance its own budget ? Comment from : @EricPham-gr8pg |

|

|

Adam and eve did not need money to survive Comment from : @sarahbranstetter157 |

|

|

FCK STT Comment from : @jeymon243 |

|

|

Debt is always a bad thing, only in finance people treat debt as a normal thing Comment from : @vanvihung8982 |

|

|

that's a very nice exposition, though it relies on the orthodox neoclassical approach to money (which is the 'exchange' or 'barter theory of money'), assuming they are just a simple commodity and don't play any 'real part' in how the economy works in the long runbrbrall of those are very serious assumptions that are being critized more and more even by the leading mainstream economists, let alone various 'skeptics' without any position within academia Comment from : @NewDeal1917 |

|

|

Do philosophy more, don’t do economics anymore This is incredibly ideological topic, and you’re unknowingly reiterate tired neoliberal dogmas that are either wrong, or misleading or inconsequential (like debt/GDP ratio) brYou’re not equipped to do this if you’re not prepared to study Marxism, Keynes and MMT first Comment from : @egorkotkin |

|

|

This seems what you get when you have someone who is better editor than producer or camera talent sounds like your reading text book too fast Comment from : @JLMtime |

|

|

Dave, You failed to take into account that the US federal government is the only entity that can legally issue US Dollars (USD) That creates an interesting phenomenon The federal government bmust/b issue USDs before they can be returned to the government via taxes So the flow of USDs is as follows: The federal government buys goods and services by issuing USDs to cover those expenses The USDs remain in circulation until they are removed from the economy via taxes The federal debt is the difference between the amount of USDs issued minus the USDs returned to the government via taxes Once I really stopped to think about the implications of the above, I realized that most of what I thought I knew about the federal budget was wrong Comment from : @andremaloney4128 |

|

|

Pay child support Dave Comment from : @Lala-vv4qy |

|

|

" Is it bad for a government to be in debt?"brbrRonald Reagan and Thatcher made sure people clearly didn't need to think about debt ever all of what you are saying is true on one level, but the reality is that neoliberals have made a complete mockery of the economics of the 20th century not a good thing, mind, but that IS the reality in the Western world now Comment from : @thomasneal9291 |

|

|

Sovereign debt is different than foreign debt This is an important distinction Also important is the fact that the US dollar is the world's reserve currency These two factors are important Because most of US debt is not foreign, the US does not have to acquire foreign currency to pay it off The US owes people something that only the US can create an unlimited amount of There never need to be even the possibility of defaulting on that Again, other countries that are not the creators of the worlds reserve currency and who owe money in foreign debt obligations - think Greece owing Euros - another story The US is not Greece and it is important to understand that difference Comment from : @petertrahan9785 |

|

|

Your content is some of my favorite Do you have any plans to release a video regarding anything in the recent train derailment in Ohio? Comment from : @redvsblueftw |

|

|

Have you heard anything from Tour, aside from the one email he wrote back to you? I can't wait to watch this absolute bloodbath, that is if it even happens Comment from : @jamessgames1156 |

|

|

Could you please do a video on Modern Monetary Theory? Comment from : @suborbitalmelon8822 |

|

|

is it possible for the government to place some money in banks to get good returns?brwhat about stocks? Comment from : @WetDoggo |

|

|

Wow Dumbarse Dave doesn't even know how the monetary system works, what a fool Comment from : @snappysummers7222 |

|

|

Thank you Dave ! I think it would be great to have a series that covers the current state of the art and literature in origin of life research, a series that starts from the building blocks, up to the oligo- and polymerization of different classes of biomolecules (and the problems to be solved), Lipid bilayers, RNA world / evolution of metabolism, autocatalysisetc Starting from Oparin and Urey-Miller and the evolution of the science of Abiogenesis Best ! Comment from : @DeepSpace145 |

|

|

💓💓💓love u brother Comment from : @eka_brahmanrishiputra4998 |

|

|

Impeccable timing your majesty Comment from : @ZalamaTheDragonGod |

|

|

Government spending ain't mostly made of taxes recieved as you suggest Governments have wide range of revenue sources Comment from : @Dopaaamine27 |

|

|

the rise of a dynasty Comment from : @youtubeuser206 |

|

|

Hey Dave, I haven't any knowledge on this topic But my country is going through a tough financial period so I thought I'd learn something about it Forgive me if i sound really dumb but why can't my country simply just print more money? The dollar rate here is currently 260 PKR per dollar So if 260 PKR means 1 dollar, why can't we just print a billion PKRs and make a ton of dollars in exchange for it? Comment from : @novaapostle9739 |

|

|

Calling Social Security an entitlement is twitch-inducing Social Security holds funds in trust for account holders (citizens) Separate contributions fund Social Security, and recipients of payments are receiving a purchased benefit, not a government hand-out "Entitlement" is a weasel word used by "budget hawks" to make recipients of benefits appear to be a drain on the economy, and promote casting already disadvantaged people into further disadvantage Comment from : @newsundies |

|

|

I'd offer that the single biggest issue the US has right now isn't government spending on CoVID (or, rather, the economic impacts of CoVID), or even how much we spend on the military (though both of those certainly are issues we need to deal with) In my view, the biggest issue we have right now is in the formulation of our Entitlements Program The period between 1946 and 1964 (those years that we often consider the birth years for the societal group we collectively call "the Baby Boomers") saw a massive explosion in population (hence the name: Baby BOOMERS)brbrSo, in the 60s, 70s, and 80s, the ratio of people paying into Social Security (there are other Entitlement Programs, but I'll just pick on Social Security to make a point) to people retiring and withdrawing from Social Security was quite high The burden on those paying into the system at that time was comparatively low Later, as the 'Boomers' began to retire and the next generations (with vastly decreasing birth rates) became the payers into Social Security, that ratio completely flipped So, today, the ratio of people paying into social security to those withdrawing from it has fallen dramatically, which puts much more of a financial burden on those who are paying in today It also explains why the retirement age continues to increase - to try to put more controls on the number of people withdrawing from Social Security in the hopes of forestalling its bankruptybrbrWe must eventually face the fact that unless something turns this trend around (that is, subsequent generations suddenly get the urge to start making more babies again) our current Entitlement System will eventually go bankrupt - it's almost inevitable I'd further note that I'm not arguing for people to start making more babies, since also looming is that as the Earth's population continues to grow at an exponential rate, the Earth will eventually go bankrupt, too, so to speak We will eventually run out of space, raw materials, or both If a retirement system is to last for the long haul, it must be based on something other than relative generational birth rates Comment from : @glennpearson9348 |

|

|

Lenin summarised imperialism as follows: “Imperialism is capitalism at that stage of development at which the dominance of monopolies and finance capital is established; in which the export of capital has acquired pronounced importance; in which the division of the world among the international trusts has begun, in which the division of all territories of the globe among the biggest capitalist powers has been completed” Comment from : @jon82489 |

|

|

Nice explanation, but there is a risk from a shrinking economy Most people don't know how big a trillion dollars is Our current debt is about $32 trillion Here's some easy ways to visualize how big that isbrbrLay 32 trillion dollar bills end-to-end, about 6 inches each You stand at one end and a nasty old Congressman sets the other end on fire You wouldn't see the blaze for four and a half hours - because that's how long it takes light to travel the distance of 32 trillion dollar bills That's long enough to go from Earth to the sun and back again about 17 times with enough left over for about 125 round trips to the moonbrbrA dollar bill is about two by six inches and is about 00043 inches thick The Goodyear blimp is six stories tall and half the length of a football fieldbrbrIf you packed the Goodyear blimp's envelope with tightly compacted dollar bills, you would have enough to pay the interest on the national debtbrbrFor about 61 hoursbrbrAll it takes to kill our economy is a downturn because our borrowing will skyrocketbrbrBut have no fear, the dollar will always have value Why? Because the government will not accept any other form of payment for taxes The guaranteed baseline value of the dollar comes from the value of not going to prison for not paying taxes, and from not having your property confiscated for not paying property tax That's the final reason to work for dollarsbrbrOther than that, have a great day! 🤪 Comment from : @johnnyragadoo2414 |

|

|

Government spending in itself is what governments are supposed to do to provide services for the citizens of that government Taxes in itself make sense to be able to afford projects like making roads and utilities But there is a problem when the government spends too much, causing inflation which harms the poor the most becaus the rich usually have enough money to afford goods despite inflation, but the poor might not be abl to afford food or gas under high inflation brbrThe increased government spending for bailouts can be good, or bad, depending on the circumstances But the current US spending is too much compared to the debt Te debt has been increased by trillions in 2 years, which is just too much The US government needs to limit its spending but they have made deals with certain companies or industries to push that industry, such as the increased subsidies for battery powered cars under Joe Biden and the cutting of all subsidied on oil and gasoline cars brbrGovernment can go into debt and its fine, but over time too much debt without the growth to offset that is not good for the economy Comment from : @degen83 |

|

|

no, margaret thatcher mantra "there is only taxpayers money" is false a state isnt funded by taxes and an economie is more complicated than calculations for a household if a state reduces its debt, it makes everyone aka the economie poorer dave is unfortunatly propagating neoliberal missinformations here Comment from : @cologneconductor8591 |

|

|

So we have to raise taxes, that's what I heard brAnd before you say anything , Yes to all your hypothetical back-sass questions because of course it's gonna get harder We could also decrease military spending, but I'm sure we don't agree on anything now so don't @ me bro unless you have a solution you can share without your ego holding the mic brGood Day👍🏽 Comment from : @NBC1232014 |

|

|

goverment should not use the darn central bank thing ah well Comment from : @DeconvertedMan |

|

|

I love your videos, Dave I am also honored to share your first name 😉 I've heard that we are the coolest dudes at the party! Who knew?✌️ Comment from : @UnkleF |

|

|

The ideal is to only spend based on taxes collected Yes 100 agree brbrWhy is this the “ideal”? brbrBecause it is the ideal we CAN say that spending money that doesn’t exist is “bad” or “not good” Just because the perception that the benefits outweigh the cons doesn’t change this ideal brbrJust because the short term effects are desired & the long term effects out of sight & mind to the beneficiaries doesn’t change the reality Someone or some group benefits from the unwilling sacrifices of others brbrShort term debt is not good but with manageable side effects But beyond that risk grows & controls weaken as debt increases Comment from : @jsedmonds256 |

|

|

👏👍 Comment from : @-JA- |

|

|

The 1 pocketed 50 trillion dollars in the last 40 years brbrThe national debt is 31 trillionbrbrIf somebody stole your credit card and spent the last 40 years racking up debt on it, would you pay the bill? Comment from : @jeremygregorio7472 |

|

|

In before the budget deficit makes a 900 part YouTube series "debunking" ProDave Comment from : @Randomstuffs261 |

|

|

A good way to keep people informed considering our current risk of having our economy crash if we don’t increase the debt ceiling Comment from : @Power_to_the_people567 |

|

|

Wow Dave, the quality of the animations in this video is great! Comment from : @proxagonal5954 |

|

|

It's worth pointing out that the budgeted Entitlements every year is well over what is actually paid out - and that current Entitlements do not match inflation Comment from : @danielcrafter9349 |

|

|

Mandatory spending: requiring by federal law to keep an active dozen aircraft carriers that are tactically worthless Comment from : @Breakfast_of_Champions |

|

|

Second Comment from : @whatdoyouexactlymeanbyhandle |

|

Milton Friedman - Deficits and Government Spending РѕС‚ : LibertyPen Download Full Episodes | The Most Watched videos of all time |

|

What is a Secured Loan and How does it work? | Secured Debt vs Unsecured Debt | Secured Debt РѕС‚ : Rocking Finance Download Full Episodes | The Most Watched videos of all time |

|

Trump pauses federal loans and grants as his administration reviews spending РѕС‚ : KGW News Download Full Episodes | The Most Watched videos of all time |

|

How To Send Money To A Federal Inmate (How Can I Send Money To Federal Inmate) РѕС‚ : The Savvy Professor Download Full Episodes | The Most Watched videos of all time |

|

Navy Federal Money Market Savings Review (Pros u0026 Cons Of Navy Federal Money Market Savings) РѕС‚ : The Savvy Professor Download Full Episodes | The Most Watched videos of all time |

|

How Are Schools Actually Spending Federal Money? РѕС‚ : NBC Bay Area Download Full Episodes | The Most Watched videos of all time |

|

Lyn Alden: Can Anything Stop The Runaway Train Of Fiscal Deficits? РѕС‚ : Adam Taggart | Thoughtful Money® Download Full Episodes | The Most Watched videos of all time |

|

Stephanie Kelton: The big myth of government deficits | TED РѕС‚ : TED Download Full Episodes | The Most Watched videos of all time |

|

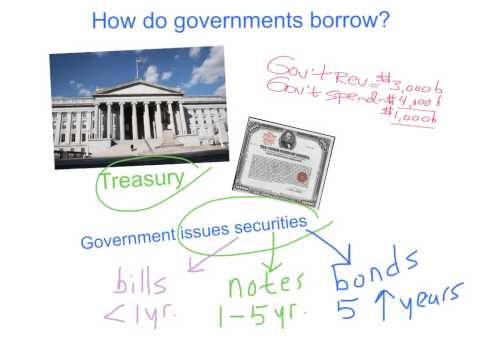

How do governments borrow money to finance their deficits? РѕС‚ : John Bouman Download Full Episodes | The Most Watched videos of all time |

|

Executive Functioning Skills For Kids | Executive Dysfunction–Executive Function Deficits-ADHD Kids РѕС‚ : Mental Health Center Kids Download Full Episodes | The Most Watched videos of all time |