| Title | : | Your Ultimate Financial Plan in 10 minutes |

| Lasting | : | 12.41 |

| Date of publication | : | |

| Views | : | 409 rb |

|

|

Thank you for sharing Comment from : @ashleykipraseut9146 |

|

|

What about if you have no margin? 😔 Comment from : @continuousself-improvement1879 |

|

|

Humans aren’t meant to live like that Comment from : @JessicaHyde199 |

|

|

Girl you have fried my brain cells!!! Having watched a lot of your videos-as i need help-to learn0is so much hard work I am a adamant learner and always ready to learn Thank youso very nuch! Comment from : @SusanaDaCosta-v6q |

|

|

Focused on paying off my student loans debt and saving for a house Comment from : @NoraCastro-ol9ux |

|

|

💵💵💵💵💵💳 Comment from : @HasanRifino |

|

|

All these comments are wild… like investing is not hard… most of you should not be looking at single stocks and if you do 10 or less of your worth should be in single stocks You need t9 put your money in the S&P 500 and just let it sit The market will correct itself soon it’s over valued now but if you invest every month for 30 years you will have a shit ton of money Most of you missed the hot stocks the best time time to invest in Nvidia let’s say was 2 years ago you missed it apple a decade ago you missed it Tesla probably 5 years ago…brMost of you are not good investors including my self I have money in the S&P 500 mutual fund from vanguard and some small cap mid cap and large cap etfs and like 200 dollars in stocks I like that’s it…its not complicated have 3-6 months for an emergency fund have,if you, a set amount in your checking I have 5000 as a buffer between my paycheck and lifebrStop making everything complicated Comment from : @danasirkin5063 |

|

|

What am I focused on? I’m currently focused on getting out of debt as soon as possible and building up my Emergency Funds! Comment from : @bigb3d |

|

|

I do not really believe 50:30:20 rule - but really good content Comment from : @Itsmejabs |

|

|

Sure everybody has a spare 28K every month to put on savings!! Come on if I had that money spare every month I would not be watching this video dear Comment from : @cybersamurai99 |

|

|

Make me a happy millionaire Comment from : @appleztooranges |

|

|

For some reason i find this 50/50 but for me, you're saying work work work, save save save, there should be a better way in achieving financial stability faster This mindset is not for me Comment from : @brandondemixxmachine8137 |

|

|

Thank you for sharing! Check out my YouTube channel for videos on money, tips, and financial strategies! Comment from : @WeatlhTube |

|

|

Is this you on FB recommending Stock picks Thanks 🙏 Comment from : @amilaperera85 |

|

|

Sometimes Protecting your capital is much more important than making money Basically because if you lose your capital, making money is much harder ''Missing the train'' vs ''losing your money'' There are a lot of trains, but if your money is gone, it's over Comment from : @ArnisByrne |

|

|

Give me money, i will invest different places, i will become wealthier, rich in just a year😂 Comment from : @mdtalhamadni2758 |

|

|

£5700 take home a month means Alex is exactly on 100 grand a year before tax Alex is lucky as she belongs to the top 2 earners in the UK Most of them are based in and around London of course Comment from : @LadislavMaljar |

|

|

Despite my best attempts to save money, contribute to early retirement, and become financially independent, the economy has sucked out a large portion of my assets since the epidemic I want to know if I should continue to diversify my investments or if I should look into other industries during these erratic times Comment from : @DavidLucas-so8rr |

|

|

Azz,,,😊 Comment from : @naveennnair8499 |

|

|

Leaving this comment here so that when someone likes it I'll come back to remind myself of the power I have within Comment from : @mubashirali8353 |

|

|

What it you're 0 at step 1 😅 Comment from : @Gen_Vicious |

|

|

If I was taking home £5700 a month there’s no way I’d have any money worries These videos are good but not in the real world of the average workers wage Comment from : @tgwu64 |

|

|

Brilliantly presented Comment from : @mafingasichinga9572 |

|

|

Can you make a video for a couple with a common account?brbrI've been managing my money (expenses and income) for a long time My girlfriend and I are going to open a commont account, and we're going to put a certain amount into it for essential day-to-day expenses (rent, bills groceries etc)brbrBut I don't want to have to manage every single expense with the common account and impose her to manage money the way I do I just want to manage my remaining money How can I draw up a financial plan for this?brbrthanks a lot :) Comment from : @iamadrien460 |

|

|

There are plenty worse off but i cant retire early It only works if i keep going til 67 🛌 😮 Comment from : @SusanaXpeace2u |

|

|

£5700 is such an unrealistic figure I understand 'its the concept' but beyond that the average worker might get £2000 a month with the rise in rent, food etc sticking to 50/60 expenses is a lot tougher as theres less wiggle room its probably a lot higher 40/50 might be rent alone The £5700 figure is a lot easier to use as you have the flexibility to go down on expenses Just my thoughts I understand its more a video on the concept and thats all fine but just unrealistic for most people to stick to Comment from : @liamstubbins3000 |

|

|

beutiful video with a beautiful speaker 💘 Comment from : @old_money_channel |

|

|

Hi, what is your take on rebuilding a business you so believe in but debts is not helping How do i clear out the debts Comment from : @blessingjeje1026 |

|

|

Im enjoying your content Very relatable and easy to understand Comment from : @mattimuspearson |

|

|

I like video😊😊😊 Comment from : @InvierteHoy-y1l |

|

|

I am at the beginning of my "investment journey", planning to put 85K into dividend stocks so that I will be making up to 30 per year in dividend returns Any advice? Comment from : @tonysilke |

|

|

Can't take my eyes off you I am here to see you😊 Comment from : @CONFIDENCE596 |

|

|

How about to marry/to have a family or let all be single and get rich🤣 Comment from : @mingming |

|

|

I continue to be surprised by how often finance YouTubers struggle to understand how inflation affects future purchasing power Comment from : @astrahl |

|

|

A 25x rule doesn’t work for fire That’s rule only applies for a normal retirement age Comment from : @astrahl |

|

|

This is a great video Comment from : @anaissibly2950 |

|

|

Hi, thank you so much for the information I think I would benefit more if you were to slow down your pace, please Many thanks Comment from : @hkp7097 |

|

|

Biggest lesson i learnt in `2024 in the stock market is that nobody knows what is going to happen next so practice some humility and low a strategy with a long term edge Comment from : @AvelineOztas |

|

|

So this video is for the 3 that do not need this video 😂 30 years old going for a 500k home 😊 Retire in a couple of years 😊😊 O, and live life Youtubers selling dreams Comment from : @tomv7986 |

|

|

You are a genius Comment from : @peterboos930 |

|

|

This completely unrealistic brYou cannot live a life with rent, phone and groceries Especially when you have dependents and property Principles are ok, but this model is oversimplified and cannot be a basis for any real life budgeting Comment from : @AdamCiernicki |

|

|

The tutorial is easy to understand from all angles of the world , thanks dear Comment from : @KeuberJoel |

|

|

If she wants to retire at 40 instead of 50 she would need kore than 125 mn Comment from : @tobiasvalero |

|

|

I wish I could find more women like you in real life Smart, Beautiful, Financially savvy Hopefully this video is helping many ladies become more financially savvy I enjoy them, very easy to follow and to apply Have a blessed day! Comment from : @mikekujawagvsu |

|

|

Very Amazing ♥️💯brbrThank You So Much for Sharing Comment from : @noblesinghraina |

|

|

Excellent video Nischa, I like how you explain how to prioritise your financial goals and how, depending on what you choose will effect achievement of your other goals Comment from : @portiadane6020 |

|

|

Uuuh Not many people in Aus have a margin of 50 that is non-essential It's more like 10-20 Comment from : @jqryan |

|

|

Can you do a video about how people can retire early without getting killed on taxes, but retiring before they are 59½ (here in the US) or whatever it is in the UK?brbrBc it seems to me like the only options here are to work to 60, which isn't early, or get hammered on taxes in the meantime Unlock the code pls Comment from : @xote316 |

|

|

What do you do when you don’t know what your monthly income is because you rely on clients as a business owner? Comment from : @spiritworks_elizabethwright |

|

|

Is there an app to help create and keep track of my financial planning? I need to calculate how to allocate my resources to reach my goals, such as early retirement, buying house, etc Comment from : @MusicSlaveAlien |

|

|

No one ever adds margins for economic fluctuations She is talking about 5-20 year timeframes, that 2900 a month is going to shrink monthly Comment from : @Birdmam2021 |

|

|

Hello Nischa, can you please make a contextualised video for a third world country ? Comment from : @sidoniaachanngoralich9968 |

|

|

Amazing content! I have been following your videos for sometime now, consistently kicking down Wall Street doors for two years now, I have over $320k in stocks Currently, my portfolio is down by 15 Wondering if they're any short term opportunities I can invest in Comment from : @NikitaMcLauren |

|

|

Hi Nischa, brIn this planning strategy, I am assuming you are using net monthly income, not gross? Comment from : @blairekabernagel5422 |

|

|

And here we come with house costing 500k now and in 5 years it will cost 1mln just because of modern economy state and all your plans are down the toilet Comment from : @andreybiryulin7207 |

|

|

Subbed Thank you for sharing your experience Best wishes Comment from : @rob4263 |

|

|

I mean I value all the information you share but 5700 pounds/€ is unrealistic for most of people nowadays and actually, if I earn that amount of money Im mostly sure I wouldn't be looking for this kind of information What about to do something more adjusted to the majority of the people in EU earnings? 🙏🙏 Comment from : @muchoguillo |

|

|

Thank you for your coherent and concise presentation of these financial tips It really helps Comment from : @harinda |

|

|

i wish Nischa was my older sister i would have been doing so well now Comment from : @vtecminileon |

|

|

iiibre Comment from : @HasanRifino |

|

|

💏👪👈 Comment from : @HasanRifino |

|

|

💋🌷🕴💏 Comment from : @HasanRifino |

|

|

💏⚘🌏 Comment from : @HasanRifino |

|

|

$1000000 Comment from : @HasanRifino |

|

|

What a regular person can do is just move from London, and work remotely Comment from : @jakewelford |

|

|

5700 after tax isn't that like 100k to 150k a year or something quite high ?brbrWhen one's earning that much it's piss easy to reach goals Comment from : @jakewelford |

|

|

She is totally out of touch with reality- concept sound right but many people listening to this can’t just do what she is saying Comment from : @Lokdhxnskam |

|

|

so good to hear something like your content I would like to start saving much earlier but sometimes it isn't easy Comment from : @patrikvida3134 |

|

|

ого круто однгако Comment from : @artisnearbybtc |

|

|

amazing video Nischa , a hybrid of both Ramit Sethi and budgetnista <3 I love it Comment from : @FouadBallan |

|

|

Sound advice, though most people don't have that much disposable income every month The less disposable income you have, the harder it gets to figure out what to do with it Comment from : @stefandemerov8423 |

|

|

Figuring out what to do with 50 of your monthly income (after the mandatory taxes and bills), which amounts to £3K is a literal first world rich person problem You'd have to be an utter idiot to fail at life with that much available money Comment from : @stefandemerov8423 |

|

|

I’d love to buy my own home, it’s definitely going to take over 8 years for that Comment from : @cakie_0933 |

|

|

captain obvious here nothing new under the sun Comment from : @9-and-3 |

|

|

Hi Nischa, i am focused on my youtube channel, its about finance books and personal development in romanian for now, any advise? i just started, do you remember any tips from when you started? thanks Comment from : @CarteInMinute |

|

|

I will be forever grateful to you, you changed my whole life and I will continue to preach on your behalf for the whole world to hear you saved me from huge financial debt with just a small investment, thank you Elena Stein Comment from : @Deji-p3m |

|

|

Bottom line: this video is made NOT for 35k incomes 🤷♂️ so no early retire for this group Comment from : @tomnuytens925 |

|

|

By the way, the Road to Wealth cheat sheet link isn't working Comment from : @AlfaMJalo |

|

|

Most ppl in the comments are focused on the "unrealistic" salary mentioned rather than the message itself She has given us the formula, now implement it using using your own realistic salary 😅 Comment from : @AlfaMJalo |

|

|

Yes appears still living in her investment banker world Comment from : @simonellis7775 |

|

|

Best video Comment from : @littlebluefishy |

|

|

If you wanna be successful, you most take responsibility for your emotions, not place the blame on others In addition to make you feel more guilty about your faults, pointing the finger at others will only serve to increase your sense of personal accountability There's always a risk in every investment, yet people still invest and succeed You must look outward if you wanna be successful in life Comment from : @Joegolberg1 |

|

SBI life ewealth plan complete details | sbi life ewealth plan | sbi life e wealth plan | ulip plan РѕС‚ : YouTheReal Download Full Episodes | The Most Watched videos of all time |

|

SBI life insurance smart elite plan | sbi life smart elite plan | sbi smart elite plan | Hindi РѕС‚ : YouTheReal Download Full Episodes | The Most Watched videos of all time |

|

SBI life smart champ insurance plan | sbi life smart champ plan benefit | sbi life smart champ plan РѕС‚ : YouTheReal Download Full Episodes | The Most Watched videos of all time |

|

LIC Jeevan Labh Plan 936 10 Years LIC Plan Example | LIC New जीवन लाभ 936 | LIC short term Plan РѕС‚ : Aakash Garg Download Full Episodes | The Most Watched videos of all time |

|

LIC SIIP Plan No 852 | LIC Sip Plan Details | LIC ULIP SIIP Plan | Best Sip Plans for 2022 РѕС‚ : Insurance Clinic Download Full Episodes | The Most Watched videos of all time |

|

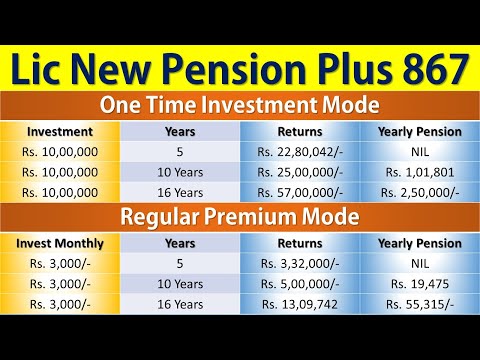

Lic New Pension Plan 867 | Lic Pension Plan 2022 | Lic New Pension Plus Plan | नई पेंशन प्लस योजना РѕС‚ : Insurance Clinic Download Full Episodes | The Most Watched videos of all time |

|

LIC Nivesh Plus Plan Vs LIC Index Fund Return calculator, LIC New plan 2024, Best SiP plan 2024 РѕС‚ : Insurance Pathshala -Ankesh sahu Download Full Episodes | The Most Watched videos of all time |

|

How to lesson plan effectively: tips of how to structure and plan your lessons | Teacher advice | РѕС‚ : broken chalk Download Full Episodes | The Most Watched videos of all time |

|

PhD Research Project Plan | How to plan your PhD Timeline, stay organized and productive! РѕС‚ : Hira Javaid | TheOxfordPhD Download Full Episodes | The Most Watched videos of all time |

|

Investment Calculator Ignites Your Personal Financial Plan РѕС‚ : Retire Certain Download Full Episodes | The Most Watched videos of all time |