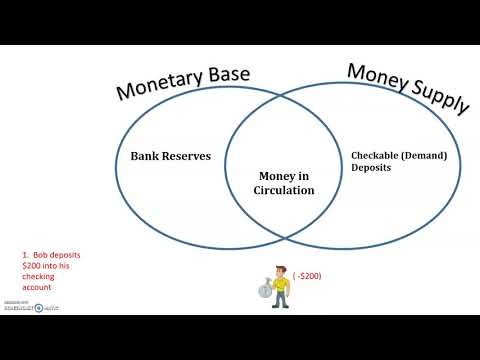

| Title | : | monetary base v money supply |

| Lasting | : | 5.05 |

| Date of publication | : | |

| Views | : | 23 rb |

|

|

3:41 Comment from : @SphereofTime |

|

|

Thank you so much mam for providing great knowledge ❤❤❤ Comment from : @yogeshaasare7575 |

|

|

Great video, thanks so much Comment from : @robin5453 |

|

|

This was so helpful I asked a question on stack exchange recently about how fed open market operations can possibly affect the money supply given that they only increase reserves and they also dont change the capitalization of commercial banks (since they just exchange one highly liquid asset for another) and therefore dont affect credit creation since credit creation is not restrained by reserve requirements but rather only capital requirements Do you agree with that? It seems crazy that what i was taught in macro about fed omo's controlling the money supply is just wrong Comment from : @BB-mr3vy |

|

|

#3, sounds like you're saying that banks lend out reserves Banks do not lend out Reserves, they create the credit/dollars they lend Comment from : @aatweed |

|

|

Amazing Comment from : @Abhinav-7 |

|

|

This really help me the diff And the common area!! Thank u so much Comment from : @Whitetysnowny |

|

|

That’s cleared up so many questions for me Thank you so much!! Comment from : @stevent3279 |

|

|

Bad explanation of M1 and M2 Also, acording to this explation there is always the same amount of money, it only moves from one category to the other Confuses things terribly by lack of information, a shame because the venn diagrams do help Comment from : @thefuecisla |

|

|

this is only increasing the money supply in the economy and that even is not backed my anything Comment from : @antifragile01 |

|

|

Wow this is such a great video! Thank you so much I really appreciate it I had a lot confusion about this concept as someone newly learning macroeconomics and this really clarified things Comment from : @davidlim5532 |

|

|

Thank you Tamra I graduated with a degree in econometrics and I was never taught this you students are lucky to have u as a teacher Comment from : @nuggetrouble1677 |

|

|

Banks buy stocks and other assets So I don't understand how giving money to banks doesn't affect the monetary supply Comment from : @Xerathiel |

|

|

Invest in bitcoin, gold, silver, buy stock, forex market, commodities just invest and save yourself Comment from : @richardmallow4022 |

|

|

Respected mambrFirst of thanks to youbrMam 1 questions was asked in Indian civil service examination 2020 directly from this videobrbrMam please continue this seriesbrBased on very applied economics or day to day economics Comment from : @rahulkumarsingh8684 |

|

|

Hello Tamra Carl, very good explanation, I liked your videos Can you tell me about the program which you use to make videos? Thanks Comment from : @elyordavlatov8689 |

|

|

Kind of confused on what Money in Circulation is supposed to represent Is it actual cash? Like the amount of actual cash notes the fed has put into or removed from the economy from day 1? From the last slide here, it looks like loans are the only way to increase Money in Circulation, but how is it actually calculated? Comment from : @suedunham1087 |

|

|

Not only banks but also the Treasury can increase the money supply with its fiscal policy iespending such as stimulus checks or PPP loans Comment from : @yurrwithme |

|

|

thanks! you made it clear for me to understand the relationship between them Comment from : @edwardchen0824 |

|

|

I like Comment from : @kushaagra098 |

|

|

what happens when the FED buy bonds not from a bank, but in the Open market? What happens when the FED buy stocks? Comment from : @alessandroagostini3568 |

|

|

Very good explanation! Most people that explain monetary base / money supply interchange one with the other and also usually begin with M0, M1 concept Before that, they should draw this out Comment from : @janpallai |

|

Money Supply Process: Control of Monetary Base | Monetary Economics | ECO604_Topic034 РѕС‚ : Virtual University of Pakistan Download Full Episodes | The Most Watched videos of all time |

|

Types of Money Supply with Examples M1, M2, M3, M4 | Monetary Base | Waht is Money РѕС‚ : COA Academy Download Full Episodes | The Most Watched videos of all time |

|

The Money Supply (Monetary Base, M1 and M2) Defined u0026 Explained in One Minute РѕС‚ : One Minute Economics Download Full Episodes | The Most Watched videos of all time |

|

Money Supply | Nominal Money Supply | What happens when Nominal Money Supply increases РѕС‚ : COA Academy Download Full Episodes | The Most Watched videos of all time |

|

? Abro 12 Sobres Base Set HEAVY 100% HOLO! ✅ Apertura Caja BASE SET! РѕС‚ : POKEMILLON Download Full Episodes | The Most Watched videos of all time |

|

Calls for a tight Monetary Policy and Liquidity Adjustments Ahead of 2025 Monetary Policy Statement. РѕС‚ : ZBC News Download Full Episodes | The Most Watched videos of all time |

|

Monetary and Non-monetary System РѕС‚ : ENF Lab Download Full Episodes | The Most Watched videos of all time |

|

Money Supply Response to Factors in Money Multiplier | Monetary Economics | ECO604_Topic045 РѕС‚ : Virtual University of Pakistan Download Full Episodes | The Most Watched videos of all time |

|

Money supply: M0, M1, and M2 | The monetary system | Macroeconomics | Khan Academy РѕС‚ : Khan Academy Download Full Episodes | The Most Watched videos of all time |

|

Y1 35) Monetary Policy - Interest Rates, Money Supply u0026 Exchange Rate РѕС‚ : EconplusDal Download Full Episodes | The Most Watched videos of all time |