| Title | : | Build a Cash Flow Statement From Scratch Using a Balance Sheet and Income Statement |

| Lasting | : | 14.01 |

| Date of publication | : | |

| Views | : | 230 rb |

|

|

👉 Get 25 OFF Financial Edge using code KENJI25: bitly/3Lla95f Comment from : @KenjiExplains |

|

|

Excellent video, thanks! Comment from : @juanpablorodriguez1037 |

|

|

You have great explanation Sir, kindly guide how to create Lend and Borrow track record in appsheets app Comment from : @fazalraheem |

|

|

dude this is amazing, thanks so much! Can you explain deferred tax situation? Comment from : @kashmoney1 |

|

|

Yeah, but what good it does if, for example, Net income is not categorised? Also, income is booked when invoice is written Is there is income booked, it does not mean that money was received Comment from : @emilsa488 |

|

|

THANK YOU FROM PUERTO RICO Comment from : @ChristAlvarezBarreto |

|

|

When calculating Change in Working Capital, why calculating receivable, inventory and payables separately? what if, we first calculate the working capital of both years and takes the change of working capital? Comment from : @hammadhasan6953 |

|

|

Hi pls help me I need to figure it out why increase in inventory in company balance sheet will go in Cash Flow only but not under purchases in Trading and P&L account and reduce net/gross profit accordingly ? brExample company: Comment from : @anant0089 |

|

|

I have a question if you start from the net income for the cash flow statement, shouldn’t you take away interests? and is not correctly taking into account the operational taxes, isn’t it? Comment from : @juandiegoforero3805 |

|

|

kudos very well explained Comment from : @vinayaktiwari7702 |

|

|

Thank you sir!!! Comment from : @kayvanshah5216 |

|

|

Your voice forces my nerves to calm down and just listen This was so beneficial for me We are working on cash flow in my Finance class Thank you Comment from : @roseb5367 |

|

|

Thanks so much, Kenji Comment from : @alejandrojara2024 |

|

|

Noticed for the movement in PPE, this doesnt seem 100 correct because the movement may be due to a revaluation of properties So there would be a need to split out the fair valuation appreciation portion (not to be included) Right? Comment from : @justinseah4011 |

|

|

I am not from Finance, but wanted to learn about DCF which requires deriving FCF, thanks Comment from : @MellowMelodiesGoa |

|

|

I love the posibility to load the document and work with you! Thanks! Comment from : @tanjasahaidak1617 |

|

|

This was super helpful Thank you Kenji!! Comment from : @ethaneshelman5494 |

|

|

Could you let how to match balance sheet tallying in Excel Comment from : @himanshujoshi4927 |

|

|

Your soosmart and handsome Comment from : @HUMAN-VERSION4 |

|

|

dont you need to concern on payment of tax in cash You got net income after tax and interest and you didn't concern about the tax and interest payment in term of cash Comment from : @ruchikabandara4010 |

|

|

Hi Kenji Its really fabulous to see this video Request to show direct method with the same data Comment from : @reebazm5028 |

|

|

How do you set up the check thing at the end of the balance sheet? Comment from : @mrgk5 |

|

|

A question: why didn't we include accumulated depr in investing activies? Comment from : @sabazehrananji3406 |

|

|

it was very solid good explanation thank you Comment from : @artmusicworlds |

|

|

Hi Kenji, thank you for this video May I know if SG&A and other operating expenses should be included in Cash flow under Operating activities? Should I treat them the same as depreciation and not get the difference? Thanks Comment from : @jamlawas6924 |

|

|

Kenji you are great but very fast Man you need to slow down Comment from : @mohamedhabeshee5502 |

|

|

Thanks for explaining, Mr Kenji It makes me wanna know about you Hope you're always fine Can you tell me Which country do you come from? Comment from : @ramdanijim |

|

|

Sir if debenture is given in balance sheet how i understand that debenture or issued or redeem Comment from : @malikikram3643 |

|

|

Thank you for simplifying the Cash flow statement Comment from : @gehadsayed7157 |

|

|

The Total of Change in Cash from Cash Flow Is Wrong It is been equal to 8145 Comment from : @KHALIDLEMAR-t3z |

|

|

It does what it says on the tin; Kenji does, indeed, explain 👏 Comment from : @philevans906 |

|

|

What about the sale of an asset loss or gain don’t you have to adjust it in the operating activities part of the cash flow ? And the sale will be adjusted in the investing part Comment from : @xmen123ify |

|

|

Thank you very much for this very helpful video I am going to save this because I know it will definitely come in handy again! Comment from : @cuaumuz |

|

|

amazing docs and video Comment from : @dianehaen2407 |

|

|

download link doesn't work anymore :(( Comment from : @thesenate8268 |

|

|

But you're not teaching me how to make the template in the first placeT-T Comment from : @Fantatizee |

|

|

Simply superb You explained the toughest thing in a very simpler form Hats off Sir !! Comment from : @raihandawood987 |

|

|

I wanted to point out a couple of things I might be completely wrong Part of debt repaid is already subtracted in the income statement, so to account for that short-term debt repaid and portion of long-term debt repaid must be added back in CF from operations and subtracted back from financing activities to ensure there is no double substracting Moreover, shouldn't the change in other assets be added/substracted from investing activities? Comment from : @shrijapathak4829 |

|

|

Thank you very much, this helped me alot Comment from : @SaudS |

|

|

Hi Kenji Can you do a Seidman Financial Model 13 weeks cash flow tutorial? Comment from : @nicolearaujo5590 |

|

|

Thanks Kenji for sharing Your explanation is very detailed Comment from : @yudispace |

|

|

Working on my MS in Finance and I zero background working in accounting or finance(I work in insurance) this video is a great explanation for something that is difficult to understand from just reading the textbook Comment from : @ShawnWi |

|

|

Thank you for uploading such good content Comment from : @maurernicolas7829 |

|

|

Why to derivecan't you take an example as to how you arrived correctly!!!! Comment from : @ankit689 |

|

|

It's easy to do, just the non-cash movements, like provisions, allowance for doubtful debts, depreciation, financing costs on lease liability need to be considered Comment from : @0401412740 |

|

|

VERY USEFUL CONTENT MANY OF MY DOUBTS WERE CLEARED IN THIS VIDEO THANK YOU Comment from : @arunkumarilangovan1707 |

|

|

Great video, I just can't understand why you add in the depreciation to the operating cash flow? Cheers! Comment from : @andresfernandezdelvalle803 |

|

|

Thanks @KenjiExplains this is a very useful video on cash flow statement Comment from : @basantjangir1 |

|

|

Hi there Kenji , what could your recommend me (from your courses )… I’m civil engineer and for this 2023 year I would like to do like an investment for my company buying an excavator… so what could I do … like a project finance for the company trying to figure out my incomes and outcomes…? Thank you looking forward your reply Comment from : @pabloorellana6036 |

|

|

Hello Kenji I want to ask here Now all business were done in online which is all transaction were paid via bank Is it consider as cash flow? Comment from : @alexshah7277 |

|

|

Most helpful YouTube channel Comment from : @jackmedin6768 |

|

|

AMAZING VIDEO HONESTLY I DON´T HAVE WORDS Comment from : @mariab4010 |

|

|

hey i was analyzing a company's cash flow statement and the changes in current assets reported on cash flow statement does not correspond to the change in current assets on the balance sheet how to go about this thing? Comment from : @karanarora8027 |

|

|

Why we did not deduct Interest payment $289 in our Financing ? Subscribed, Thank you! Comment from : @godismyway7305 |

|

|

I very much enjoyed your videoI am creating a month to month forecast but do not know how to treat downpayment from customers and downpayments to vendors in the statement of cash flowsCan You advise? thanks Comment from : @ronaldpalmgren9478 |

|

|

Great video! It would be great if you made one on how to restructure financial statements, don’t you think? Comment from : @ettoremurano888 |

|

|

This is good I did my accounting class a year ago and already forgot some basics This reminded me a lot Thank you Comment from : @PraveenKumar-ei6qr |

|

|

This video is wonderful Comment from : @benwang7057 |

|

|

Amazing Thank you so much I have a horrible corporate finance professor and this channel is literally how I am getting through my masters course 🙌🏻 Comment from : @Jesstries13 |

|

|

thanks of nice Explanation Comment from : @qaniacademy2006 |

|

|

Thank you for the valuable content Comment from : @daniels5166 |

|

|

Hi Kenji I,m really enjoying watching ur videos, the link for the excel file is for a chart,not for building an income statment Comment from : @sujinseo9545 |

|

|

Question for You Kenji I noticed that you did not include the Net Income in your calculation for Change in Cash Is that an error? Comment from : @natesome |

|

|

The excel file is not the same used in the video Comment from : @Richardbassan |

|

|

Kenji, may I ask why you ignored Accounts payable, Taxes payable and Other Current liabilities? Comment from : @ruthenianthruth |

|

|

hi, kenji, how to make the Change in formula you make auto kinda to the right not in line the Change in Title thanks Comment from : @kriscahya |

|

|

Kenji, so do all cash flow statements show no original information? Everything in cash flow statement can be built from balance sheet and income statement? Comment from : @armitageshanks2499 |

|

|

your presentation is good Thank you Comment from : @indira6699 |

|

|

Hey kenji, you explain very clearly and your content is really goodbrbrI have theoretical knowledge about financial modelling and valuations (but I don't understand when it comes to practically making Models) can you suggest best Books to learn about financial modelling, Valuations(Basic to advance) and Finance (Investment Banking related) Comment from : @piyushsharma2829 |

|

|

Dear Kenji, Thank you for great lesson Comment from : @anv4614 |

|

|

🚨 Correction: short-term debt should not be accounted for under working capital It should go under financing activities Cheers! Comment from : @KenjiExplains |

|

|

Short-term debt is not a working capital item, net working capital refers to non - cash and non-debt items Comment from : @edsonmachel7516 |

|

|

Did you reduce form the balance statement and income statement? Comment from : @hieuieu9194 |

|

|

Hi Kenji I always watch your videos, thanks for explain really good I'd like to know why you add short term debt in operating cash flow, I understood it was part of financing cash flow Why it could be?brthanks so much Comment from : @ronaldroldancavero |

|

|

When you take the difference between share capital won’t be the divided paid be counted ? Why took it separately again as well ? Comment from : @TheSivaroshan |

|

|

Hi Kenji, I love your content as it provides exact information about finance and its working Just wanted to ask any videos on DCF modelling from scratch ? Comment from : @soumyajain7863 |

|

|

Interview? I have to build this for a job interview? Comment from : @ChasingMyLiberty |

|

|

Jedi Master Kenji teaches another lesson in the ways of the Force Comment from : @ChasingMyLiberty |

|

|

Amazing Comment from : @solomonbhandari-young4154 |

|

|

Congrats Kenji ! The quality of your videos is amazing ! Comment from : @lucabenattar7365 |

|

|

You're such a king honestly Thanks a lot Comment from : @abdallahlakkis449 |

|

|

short term debt is not a working capital item Comment from : @jonnyfavela1011 |

|

|

We were deserving this type of video! Thanks professor Kenji! Comment from : @andymarci6766 |

|

|

Thank you my friend! Keep doing this interesting videos!😁 Comment from : @andreugiro2807 |

|

|

Really easy to understand thanks!! Comment from : @camlex6310 |

|

|

Kenji Explains, also known as every business student's best friend! 😁😃 Truly appreciate the endless value you keep providing! Comment from : @danielmwabila8064 |

|

|

Sir what is the monthly salary of investment banker Comment from : @user-hq2lg5sh3x |

|

|

First! Comment from : @willzinner8813 |

|

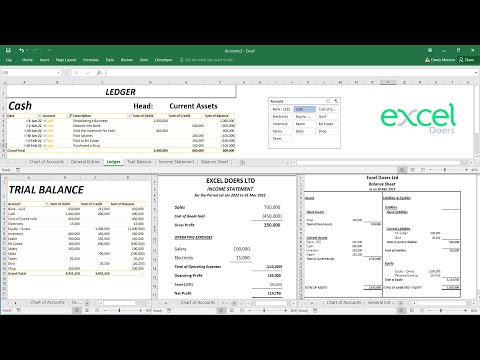

How to automate Accounting Ledger, Trial Balance, Income Statement, Balance Sheet in Excel | English РѕС‚ : EXCEL DOERS Download Full Episodes | The Most Watched videos of all time |

|

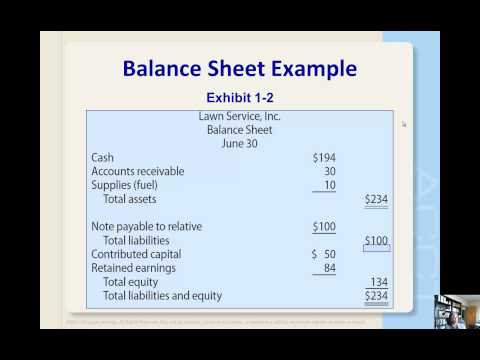

Balance Sheet and Statement of Retained Earnings РѕС‚ : srauterkus Download Full Episodes | The Most Watched videos of all time |

|

Preparing Statement of Retained Earnings and Balance Sheet (basic) - Gate City Pool Service РѕС‚ : Ed Kaplan Download Full Episodes | The Most Watched videos of all time |

|

Determining (Calculating) Retained Earnings and Net Income Using Only the Balance Sheet РѕС‚ : Jeff Fisher, CPA Download Full Episodes | The Most Watched videos of all time |

|

Transform a Trial Balance into a Balance Sheet ⚖️ РѕС‚ : The Financial Controller Download Full Episodes | The Most Watched videos of all time |

|

Grade 12 accounting Term 1 | Ordinary share capital u0026 Retained income Notes | Balance sheet РѕС‚ : Accounting Solution SA Download Full Episodes | The Most Watched videos of all time |

|

Balance Sheet Equity Section Closing Net Income 5 QuickBooks Online 2025 РѕС‚ : Accounting Instruction, Help, u0026 How To (Financ Download Full Episodes | The Most Watched videos of all time |

|

test sheet | driving licence form 3 |how to download test sheet for driving licence|learning licence РѕС‚ : E-KERALAM ONLINE SERVICE Download Full Episodes | The Most Watched videos of all time |

|

NIOS mark sheet is accepted in Germany/ Europe/ Apply with National Open Schooling mark sheet РѕС‚ : Rcare Overseas Education Download Full Episodes | The Most Watched videos of all time |

|

The CASH FLOW STATEMENT for BEGINNERS РѕС‚ : Accounting Stuff Download Full Episodes | The Most Watched videos of all time |