| Title | : | How to estimate your personal income taxes |

| Lasting | : | 4.49 |

| Date of publication | : | |

| Views | : | 159 rb |

|

|

for the first time i made a yr is 40000 thats not alot for a year Comment from : @Graceology101 |

|

|

Why have we the people agreed to pay anything near 20-30 in taxes? After Britain DEFENDED us as colonies, we had a revolutionary war over their reparations of things like 3 tax ON TEA brbrWhy are people thankful for the smidgen of taxes we can fend off when we should not be paying this amount in the first place? I am just asking Comment from : @ironhalocorp |

|

|

I tried to find it at the moment this page is been working on, so it is not available 😔 Comment from : @SreysrosTakeo |

|

|

This is the best explanation on this topic that I’ve ever seen and heard 😊😊😊 Comment from : @TheGrahamFamily0524 |

|

|

If I file 1099 as well but I didn't really make much doing door dash or uber about 700-1k for each my question is do I need to file those 1099s this year or can I wait to do the 1099s until next year since what I made is very miniscule and I'm forsure going to make alot more this year doing widespread so it would make sense in my head to do it all together with next year ? Hopefully someone has an answer and id appreciate some clarification please Comment from : @jeremygonzalez94 |

|

|

Straight to the pointbrThank you sir Comment from : @kinsonMo |

|

|

How much of a percentage do you try to deduct from your home taxes? I am in Harris county, in Houston, Texas My appraised came to $229,037 How do I determine how much of a percentage I can lower when disputing the value? Comment from : @user-ms3es1wn2u |

|

|

We need a flat tax they tax us on everything Keep it simple Comment from : @TheMizpah2000 |

|

|

i just subcribed you Do you charge fee if i reach out to you and want to run estimate for me just to get an idea just want to make sure it get it right Comment from : @noy6184 |

|

|

Is this just for Federal taxes Comment from : @ricardodeasis4998 |

|

|

Actually trying to calculate how much my income is if im self employed Comment from : @ilovelearning2 |

|

|

you should explain next time who qualified for head of household & whom for single? thx! Comment from : @lizzetterivera2324 |

|

|

No, never wondered, never paying, never will Inland Revenue can suck my genitals, they've been told I'm a flash and blood human being NOT a corporation TAXATION is THEFT at EVERY LEVEL, especially when BANKS just PRINT money created out of FRESH AIR Comment from : @quanchyplimp |

|

|

is this just to calculate how much federal tax you owe for the year? or overall tax? Comment from : @xPancakes4lyf |

|

|

Does this include payroll taxes? Comment from : @mike-ej9hz |

|

|

ure not simply explaining this Comment from : @CheKelley |

|

|

This was very helpful🎉 Comment from : @tarabrown4105 |

|

|

so the tax table is what tells you how much fed income tax you will pay post the standard deductioncorrect? Comment from : @PBTKaizen |

|

|

Why is everyone concerned about taxes, PERIOD!! 26 CFR 10-1 paragraph (d) from the IRC OF 1954 clearly says TAXABLE YEARS began December 31 1953 and ENDED AUGUST 16 1954 passed into LAW by the 83rd Congress AS LAW and published AS Volume 68A in the United States Statutes at Large for anyone to look at AS LAW!!!!NOT some stupid IRS "rule" Any Subtitle F compliant enforcement provisions took effect the day AFTER the date of ENACTMENT which was August 17 1954 but on that day there was NO TAX TO ENFORCE AS the tax died expired the day before which was August 16 1954!! There HAS NOT been a lawful legal ENFORCEABLE INCOME TAX in this country for 70 YEARS!!!! Comment from : @dennishipsley8703 |

|

|

How much taxes should be held out per paycheck I have changed my W4 and still owe in taxes Comment from : @rosalynbrooks7195 |

|

|

Thank you so much! Comment from : @sonyafromtheh6225 |

|

|

The sad thing you're only talking about the paycheck you're not talking about every time you go to the grocery store and pay taxes on that and anytime you spend money you get taxed again on the same money they taxed from your paycheck and you pay property taxes come the end of the year the money that you brought home about a third of it is paid out in taxes Comment from : @johntatman8182 |

|

|

Is this the same calculation for employers to calculate employee’s Fed tax withholding? If so, do you take the estimated tax and decide by pay periods? Comment from : @daysirosales2731 |

|

|

Well you're going to have to update you know how to pay taxes if you owe on 1300 Comment from : @SamuelStone-b8v |

|

|

Excellent video, very quick and easy to understand 👏 Comment from : @jericodiaz |

|

|

Why can they just tell you they want like 25 of what you made ? Comment from : @anasmikail9276 |

|

|

Hi My tax preparer told me i qualify for 1700$ only in tax return cos i earned 13000$ Therefore as head of house hold with 2 dependents i do not get any refund on rhe dependents is this true? How do I get a bigger tax refund Comment from : @Abbycare-g4j |

|

|

This my first time Comment from : @PennyAreieta |

|

|

Hi Travis, could you please help show me how to calculate my incone Let say I got 60k and how to calculate it to know me net? Comment from : @PennyAreieta |

|

|

Ok butHOW DO I PAY IT? 😂 Like ware do I go the court house down the street? Comment from : @BenjiToJapan25 |

|

|

Hello, thank you for this video One question plz: I earned as an independent contractor $6,37588 from September 2023 to January 5, 2024 How much money do I owe the IRS as estimate tax? And when I am gonna pay, which tax year to mention? 2023 or 2024? Waiting for your response Thank you so much Comment from : @dailydreamer5639 |

|

|

I don’t understand why this isn’t taught in schools Comment from : @cheeseburger6001 |

|

|

Can anyone pls explain to me how did he get the number at $137000? I watched it twice and I’m shaking my head Comment from : @mytravls |

|

|

The 100,000 is after deductions, right? Comment from : @garybregel4606 |

|

|

Is this accurate for self-employed too? Comment from : @zachpeifer9535 |

|

|

Wtf I paid 15k in taxes last year and i made 57k that left me with 43k gross Smh that’s disgusting I have to pay the government 15k a year to live and I make less than 60k a year Comment from : @Shakedownsss |

|

|

This is so much easier to understand and insanely useful Thank you love Comment from : @singlemom1089 |

|

|

This was so helpful! Thank you! Comment from : @jeanayetts6665 |

|

|

But what if you have so much overtime work? Comment from : @ej3420 |

|

|

Thank you very much so much for this video Very instructive Comment from : @NinaLopez-ss3oj |

|

|

I see why people try and hide their money, jheeze! But great explanation Comment from : @rickyjames2508 |

|

|

2023 taxes so Joe Biden can send billions to Ukraine Comment from : @frlouiegoad4087 |

|

|

Is this for self employment? Comment from : @canocano5480 |

|

|

BIG Thank you for a nice and simple explanation 😊 Very helpful 👍 Comment from : @desireemosher2719 |

|

|

Man this was soooo helpful to me I used this and the business and personal extension filing You're awesome man! Keep up the good work Comment from : @joeyp9051 |

|

|

I dont want a refund by the end of the tax period, how can i figure this out? Comment from : @samanthaduarte8297 |

|

|

Thanks, had to go get my paystubs and bank statement from click_cybertech Was able to achieve that with no real stressbrThis taxes got me real stressed out Comment from : @Jackflynn611 |

|

|

Big thank you I could finally calculate an estimation 🎉 Comment from : @hanamirhaji8132 |

|

|

My question is how much is needed to be made to owe enough to buy a jet instead Comment from : @nesfinance |

|

|

With that example , let's say I have a capital loss of 10,000usd from my Bitcoin portfolio, I bought high and sell now , how to apply for tax harvesting? Thank You! Comment from : @darylbanquil-jg2pj |

|

|

I didn’t understand the math you did in 4:00 Could you please explain why it is 137 instead of 87k? Comment from : @joanaw1379 |

|

|

This tax shit is ridiculous They should abolish the IRS I don't feel sorry for anyone working for the irs either Comment from : @MikeSadala |

|

|

How much did you make last year? How much do you have left? Send it Comment from : @toycarpgmr |

|

|

So this is how you do your taxes for your job ? Comment from : @shaysfashionablejewelry9859 |

|

|

Wowmind blowing shit bro,!!! thx Comment from : @joewhiles9975 |

|

|

super insightful!! thank you! Comment from : @adamaponte8850 |

|

|

After it all, is this the number we owe for the year? Comment from : @tsoo6448 |

|

|

Does this apply to state taxes as well? Do we have to estimate state taxes? Comment from : @Caesar__99 |

|

|

Is this just for the federal, state, fica or all of the above? Comment from : @Mrpimble |

|

|

Hey, what about 17 year olds and under? I didnt file last year because i didnt know i had to I got told i get everything i pay in back But ive made over 14k income this year Could you please help me understand taxes for minors! <3 Comment from : @zombiekz7829 |

|

|

this was super simple what about state taxes? Comment from : @Kapitalk12 |

|

|

If I am renting a house, could the rent be subtracted from the tax? Comment from : @menaguirgues8182 |

|

|

Thank you Travis for this great video Comment from : @menaguirgues8182 |

|

|

Does this include state taxes as well? Comment from : @mikefasho8492 |

|

|

OMG why has it taken me weeks to find someone who can explain this simply?!! Thanks 👍 Comment from : @lisaboston9162 |

|

|

Hi how about allowances? Comment from : @MarcP5267 |

|

|

Finally! Someone who explained it without talking to hear themselves speak Comment from : @patg555 |

|

|

The best info!!! Thank you so much!!! Comment from : @linakabell |

|

|

Let's say I'm retired and not paying social security or medicare taxes, would this 15 taxes only cover Federal tax, if so, what percentage would go to state tax? Comment from : @JerryLL |

|

|

Would also like to see the example with the 401k taken into account Comment from : @WideSpectrum |

|

|

TmarTn?? Comment from : @wadupdox3519 |

|

|

If you haven’t been dealing with Darklurd on telegram y’all missing a lot he’s the greatest of all time 💯 Comment from : @charlesfrederick4243 |

|

|

Thank God I made the right decisions for trusting Darklurd on telegram Comment from : @LlVILARGE04-On-TELE |

|

|

Is this for a 1099 self employed??? Comment from : @koolkid6773 |

|

|

Good job! You labeled the video properly and addressed the topic ( That should be what most videos do, but they do not) Comment from : @rockfish6766 |

|

Personal Service Contracts and Caregiver Income Taxes РѕС‚ : Elder Needs Law, PLLC Download Full Episodes | The Most Watched videos of all time |

|

Self Employed Income Taxes - How Much Self Employed Income is Required to File a Tax Return? РѕС‚ : Ginny Silver - Business Coach for Creatives Download Full Episodes | The Most Watched videos of all time |

|

How to Estimate - ALL - Your Trim Carpentry and Construction Jobs! РѕС‚ : Production Trim Carpenter Download Full Episodes | The Most Watched videos of all time |

|

Pawn Stars: Rare Double Eagle Coin Exceeds Estimate (S22) РѕС‚ : Pawn Stars Download Full Episodes | The Most Watched videos of all time |

|

1/12 anna of George v coin review with estimate value ??? РѕС‚ : coin tuber Download Full Episodes | The Most Watched videos of all time |

|

1945, King George VI, Silver 1/4 Rupee, Bombay Mint, Large "5", Estimate Value ₹35,000+ РѕС‚ : iconic India Download Full Episodes | The Most Watched videos of all time |

|

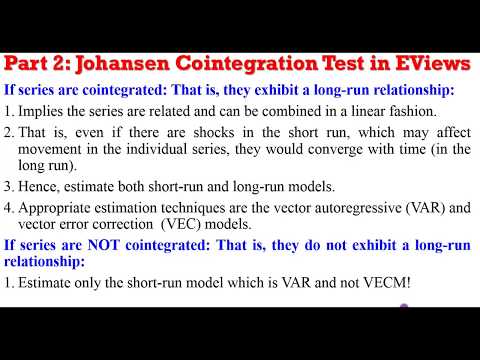

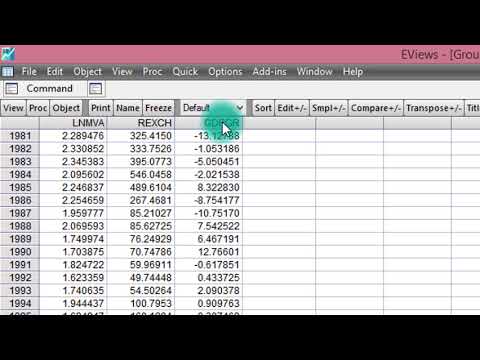

(EViews10):Estimate Johansen Cointegration Test #var #vecm #Johansen #cointegration РѕС‚ : CrunchEconometrix Download Full Episodes | The Most Watched videos of all time |

|

(EViews10):Estimate Bounds Cointegration Test #ardl #ecm #boundstest #cointegration РѕС‚ : CrunchEconometrix Download Full Episodes | The Most Watched videos of all time |

|

EViews: How to Estimate ARDL Bounds Test Approach to Cointegration (Estimation and Interpretation) РѕС‚ : Obezip Academy Download Full Episodes | The Most Watched videos of all time |

|

1964 Lincoln Pennies That Coin Grading Experts Pay Big Money For - $13,500 Estimate!! РѕС‚ : BlueRidgeSilverhound Download Full Episodes | The Most Watched videos of all time |